What’s the Story?

In this report, we present 10 key retail trends in India and discuss how brands and retailers can capitalize on the changes we expect to see through the remainder of 2021 and beyond.

We see 2021 as a potential inflection point for existing trends to find new relevance and gain momentum in retail.

Why It Matters

The Indian retail sector is one of the fastest-growing in the world. According to the India Brand Equity Foundation (IBEF), India is the fifth-largest retail destination for investment globally. India’s retail sector is undergoing rapid growth, with major retail developments in cities of all sizes: metros (India’s eight largest cities by population), Tier 1 cities (over 1 million inhabitants), Tier 2 cities (500,000–1 million inhabitants) and Tier 3 cities (those with fewer than 500,000 inhabitants).

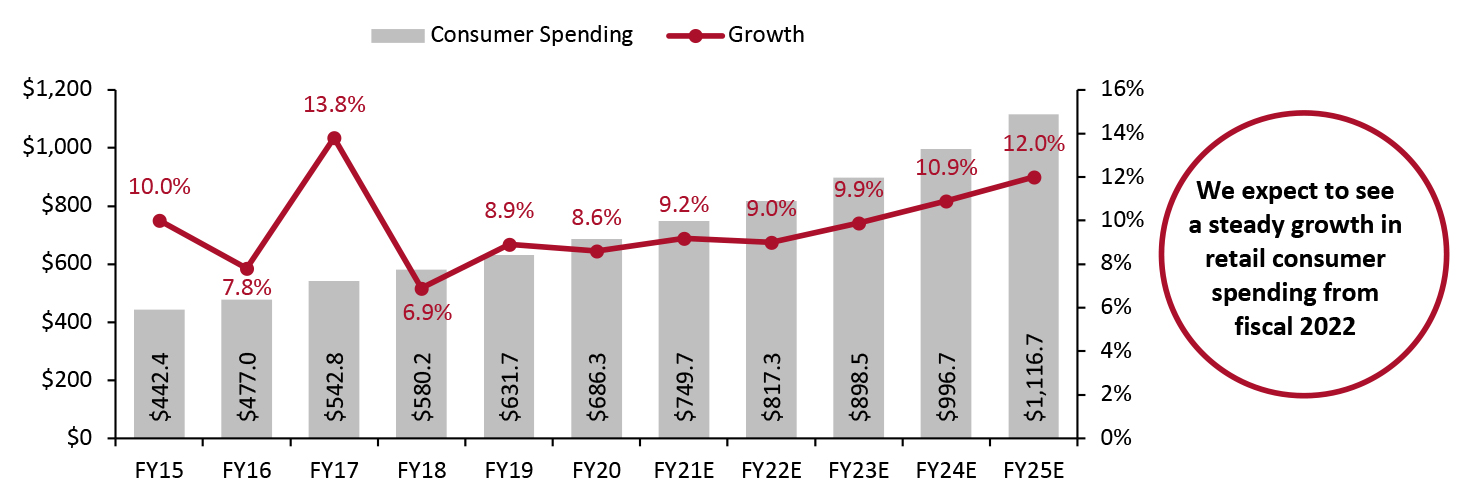

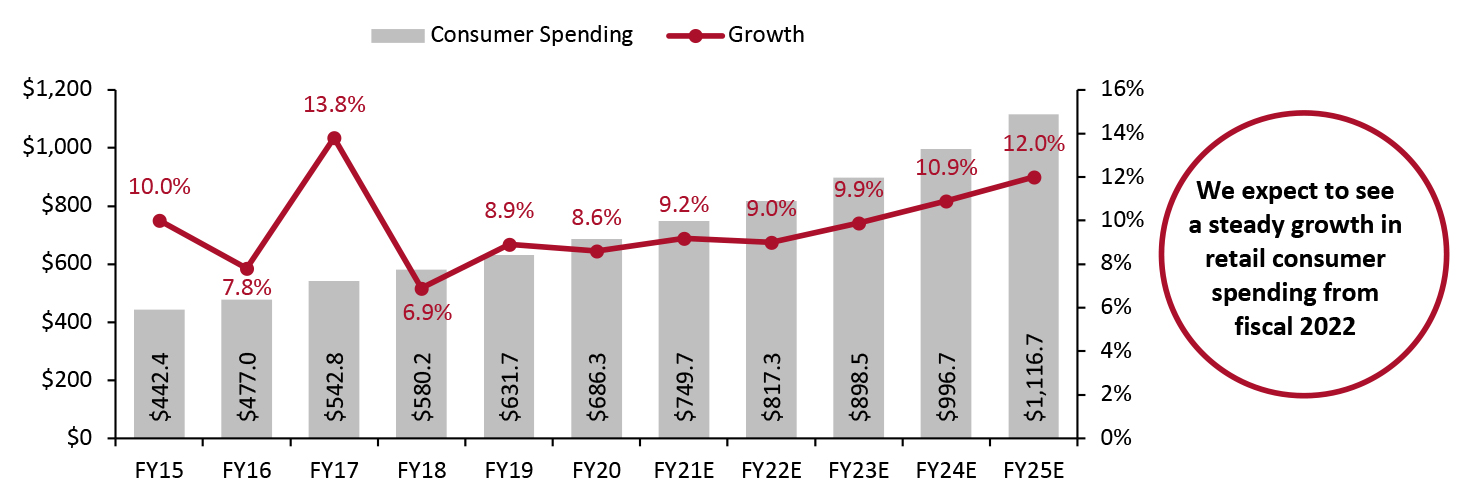

According to our estimates, India’s total consumer spending on core retail categories (food and non-alcoholic beverages; alcoholic beverages, tobacco and narcotics; clothing and footwear; furnishing, household equipment and routine household maintenance; recreation and culture; and personal effects) has increased by around 9.2% year over year in fiscal 2021, driven by an increase in the spending food and non-alcoholic beverages category, reaching $749.7 billion—slightly above the 8.6% growth in fiscal 2020—based on data from the Ministry of Statistics and Programme Implementation (MOSPI). (All conversions to dollar figures are at constant 2020 exchange rates.) We expect to see a steady growth in retail consumer spending from fiscal 2022.

Figure 1. India Consumer Spending on Retail Categories (Left Axis; USD Bil.) and YoY % Change (Right Axis)

[caption id="attachment_133200" align="aligncenter" width="724"]

Fiscal years end March 31

Fiscal years end March 31

Conversions to USD are at constant 2020 exchange rates

Source: MOSPI/Coresight Research [/caption]

10 Trends in India Retail: A Deep Dive

Coresight Research has identified 10 key trends for retail in India, as shown in Figure 1.

Figure 2. 10 Trends in India Retail

[caption id="attachment_133201" align="aligncenter" width="724"]

Source: Coresight Research

Source: Coresight Research[/caption]

1. Omnichannel Shows No Signs of Slowing Down

Growing internet penetration and smartphone usage in India have given rise to digital-savvy consumers and transformed their purchase behavior. Their needs and expectations are constantly evolving: With the Covid-19 pandemic having led consumers to prioritize safety and convenience, they expect brands and retailers to provide a smooth purchase journey across online and offline channels. Demand for “anytime, anywhere access” and the need for a personalized and differentiated shopping experience are driving brands and retailers to adopt an omnichannel strategy, using a combination of online and offline digital touchpoints to provide a highly personalized, consistent and holistic consumer experience.

While the pandemic has accelerated the shift to e-commerce, consumer appetite remains for the experiential and tangible elements that physical stores offer. Brands and retailers are therefore breaking down the barriers between virtual and physical storefronts—integrating in-store and online shopping experiences to create a consistent omnichannel strategy that improves consumers’ experiences and interactions with the brand, increases brand visibility and improves retention and loyalty. With a shift in focus from the company to the customer, we believe that omnichannel will be the preferred retail model in the future.

According to a

Harvard Business Review study in 2017, omnichannel customers spend 4% more when shopping in-store and 10% more online than single-channel customers. According to the Festive Shopping Index 2020 by the Retailers Association of India (RAI) and LitmusWorld, 75% of Indian consumers reported that they were shopping online for the holidays last year, while 66% were also considering shopping at standalone stores. It will be interesting to see which channels consumers use for shopping in the 2021 festive season; we expect omnichannel to remain prevalent.

Many brands are increasingly adopting omnichannel strategies to create a unified experience across multiple touchpoints, including mobile, websites and brick-and-mortar stores. The table below shows some of the omnichannel initiatives by Indian brands Pepperfry and Van Heusen.

Figure 3. Successful Omnichannel Strategies by Selected Renowned Brands and Retailers in India

[wpdatatable id=1289 table_view=regular]

Source: Company reports

Implications for Brands/Retailers

- Consumers prefer to shop through multiple channels for convenience. Brands and retailers must adopt an omnichannel strategy and ensure consistency of the brand experience across all channels. Brands should also identify the right channels through which their customers shop and offer optimum solutions such as in-store digital initiatives.

- Last-mile fulfillment is also a key consideration for omnichannel strategies. According to the Shopify “Future of Commerce 2021” report, 69% of Indian consumers use BOPIS (buy online, pick up in store) or curbside-pickup options more frequently than before the pandemic. Demand for these services is likely to remain heightened moving forward, as consumers expect an easy and frictionless shopping journey. Brands and retailers should launch and enhance BOPIS and curbside-pickup services to improve convenience for online shoppers.

2. Online Stores Will Be Eyeing Offline Spaces for Operational Expansion

Building on the omnichannel consumer trend, flagship stores are an essential strategic element for e-commerce players and digital natives seeking to make a strong brick-and-mortar statement. However, large square footage will not be a prerequisite for the flagship store in the future; instead, the focus will be on smaller spaces that can have an outsized impact and demonstrate omnichannel capabilities through advanced technologies.

We are seeing international players expand into the India market:

- Apple’s retail partner, Unicorn, will open four to six new flagship and premium stores in India by the end of 2022. Unicorn, operating under the brand name Uni, has 29 Apple stores across the country. The company plans to open two flagship stores in the first half of the coming financial year and the rest in the second half.

Increased consumer demand coupled with a surplus of idle retail space will drive the spread of micro-fulfillment centers in urban areas, in order to reduce delivery times. Many retailers will be able to reallocate existing retail spaces as e-commerce distribution centers—perhaps as they rely more on BOPIS. This will also lead to the development of BOPIS.

- Walmart-owned e-commerce firm Flipkart announced plans on September 15, 2021, to bolster its grocery supply chain infrastructure to provide a seamless ordering and delivery experience to its customers. The company will expand its supply chain network across India with the addition of 66 new fulfillment and sortation facilities, covering 10 million square feet and with around 20 million cubic feet of storage space. Flipkart has also hired 23,000 people, including delivery executives, to strengthen the supply chain and meet growing demand for e-commerce services across the country.

Online players are also planning to expand their footprint to Tier 2 and 3 cities, following a shift in consumption patterns due to increased discretionary spending and higher purchasing power. According to a March 2021 Kearney report, the share of luxury retail spending grew from 9% in 2013 to 55%–60% in 2018 in non-metro cities. The report also states that retailers are looking beyond the top 100 cities for expansion, as consumers’ appetite for branded goods, access to quality retail infrastructure, and improved back-end processes have driven growth in these emerging markets.

Implications for Brands/Retailers

- Offline presence remains important, especially for e-commerce and digital natives, as consumers still favor in-store shopping in particular categories for its experiential and tangible elements—and this may revive further as the impacts of the pandemic fade. Moreover, with wide consumer choice and increasing consumer awareness of brands, products and services, brands must prioritize effectively communicating their brand story to their consumers.

- There has been increased demand for prompt delivery as more consumers shift to online shopping and expect faster deliveries. Brands and retailers should focus on adding more fulfillment centers to bridge delivery gaps and improve their last-mile delivery systems.

3. Tech-Enabled Kiranas Will Offer Stiff Competition to E-Commerce

Indian retail is predominantly unorganized, comprising traditional low-cost retailing formats such as family-owned general and grocery stores, and regional corner shops with no standardization—rather than organized, which comprises privately owned large retail businesses and corporate-backed hypermarkets, supermarkets and retail chains. Coresight Research estimates that the unorganized retail sector will comprise around 77% of India’s total retail market in fiscal 2022.

The pandemic has made many kiranas (small, traditional neighborhood stores) realize that technology adoption is no longer optional. According to a July 2020 report by EY India—covering owners of small and large kiranas across 12 cities in India—20% of survey respondents said that they had started using online platforms to organize their supply chain and deliveries during the lockdown in April and May 2020. Many kiranas started their digitalization at this time, some using the WhatsApp Business app to accept orders, list inventory and receive payments.

Technology adoption enables kiranas to capitalize on their existing strengths—such as personal relationships with local customers, customized offerings and flexibility—even as more consumers switch to shopping online. Kirana stores deliver anything from a loaf of bread to a monthly grocery list at speeds e-commerce companies cannot match. The EY report states that the pandemic has led to a renewed trust in the local kiranas, with 79% of store owners in metros and 50% of store owners in non-metros reporting a surge in new consumers visiting the stores post the lockdown period.

Kiranas are increasingly partnering with tech startups for their digital switchover. A report by tech startup Snapbizz reveals that around 75% of kiranas are inclined to establish an online presence. The figure presents some of the tech startups that have supported the tech initiatives of kiranas amid the pandemic.

Figure 4. Tech Startups That Are Powering Digital Initiatives by Kiranas

|

Near.Store helps kiranas to create a website in their name. The company provides store owners a dongle to plug into their point-of-sale (POS) machine, uploading all products they sell to the website, enabling them to quickly and easily establish an online presence. |

| Khatabook digitalizes store owners’ accounts. The system records day-to-day cash dealings, keeps track of credit dues and sends reminders to customers to settle these dues. The company thus mitigates kiranas’ cash-flow challenges—one of their biggest pain points. |

|

|

SnapBizz offers solutions ranging from creating an app for the store to providing digital merchandising tools for displaying products, offers, promotions and ads in-store to smart billing solutions for kirana owners through billing systems and POS machines. SnapBizz onboarded around 1,800 merchants within the 60 days following the first lockdown in 2020, and has around 8,000 merchants on board as of June 2021. |

Source: Company reports

Implications for Brands/Retailers

- With kiranas going digital and winning consumer trust, it is critical for online brands and e-commerce players to revamp their existing product offerings by adding more local variants and customized SKUs (stock-keeping units) along with faster deliveries and strong discounts.

- Thousands of kiranas in Tier 2 and 3 cities are gearing up to go digital. This presents opportunities for big-box retailers to forge strategic partnerships to provide inventory solutions to these shops and at the same time utilize them for last-mile deliveries.

4. Super Apps Will Become a One-Stop Solution for Consumers

With millennials and Gen Zers constituting over one-half of the Indian population and Internet and smartphone penetration on the rise, super apps (platforms offering a portfolio of services under one umbrella) are finding greater acceptance for their utility in developing economies like India. According to a June 2021 report in

The Indian Express, many consumers in India are experiencing the Internet for the first time via their mobile phones. Similarly, a 2019 report by the Internet and Mobile Association of India (IAMAI) and market research firm Nielsen found that the vast majority of Indian Internet users access the Internet through mobile phones.

According to a January 2021 report by InMobi, a mobile advertising technology company, India accounted for around 14% of global app installs in 2020, and the growth rate of app downloads in India in 2020 was 28% year over year—four times higher than the global average of 7% year over year for the same period. This is one of the main reasons that Indian companies should focus on building super apps.

The super app concept first emerged in China and Southeast Asia, where Internet companies such as WeChat, GoJek and Grab leveraged the customer traffic on their social and communication platforms to offer additional services for increased revenue generation. The super app usually has a high-frequency core offering within the platform and leverages this to provide other services to engage customers with the least amount of friction; China’s WeChat, for example, started as a messaging app before expanding into payments, taxi booking, shopping and food ordering, becoming a super app.

In India, Reliance Industries, under its Jio umbrella, offers services such as shopping, content streaming, groceries, payments, cloud storage services and ticket bookings. Paytm, an Indian digital payments startup in which Alibaba has invested, has also brought together services including payments, ticket bookings, games, online shopping, banking and consumer finance into one app. Tata Group plans to launch an all-in-one “super app” by early 2022, bringing together all its consumer-facing businesses under one digital umbrella.

Global players such as Amazon, Google and WhatsApp have tweaked their offerings and launched new services in India. The figure below summarizes their service offerings.

Figure 5. Service Overview of Global Players’ Indian Super App Offerings

[wpdatatable id=1290 table_view=regular]

Source: YourStory/company reports/Coresight Research

In addition to increased revenue generation due to the consolidation of services under one umbrella, super apps also provide companies with large volumes of data, allowing them to learn more about consumers and their buying behavior.

Implications for Brands/Retailers

- Brands and retailers having a slew of products and services should consolidate these offerings into a super app to cater to all needs.

5. The Online DTC Model Promises To Be Lucrative

With the pandemic having caused a rise in first-time online shoppers, brands and retailers are assessing a range of options for their online presence. According to

The Bain-Price Consumer Survey, undertaken between April 1 and May 6, 2020, online shopping in India gained popularity during the lockdown, and consumers purchased from new product categories as well as buying more from their existing categories.

Figure 6. Online Shopper Behavior in India, April–May 2020 (% of Respondents)

[caption id="attachment_133206" align="aligncenter" width="724"]

Source: Bain & Company/Coresight Research

Source: Bain & Company/Coresight Research[/caption]

A faster take-to-market, better control over brand communication, direct interaction with consumers, consumers’ shift to online shopping during the pandemic and a rise in digital payment adoption have resulted in a trend toward DTC among Indian brands. There are currently over 600 DTC brands, including prominent names such as Licious, Mamaearth, MyGlamm, The Moms Co. and Wakefit.

According to a February 2021 report by cloud-based e-commerce solutions provider Unicommerce, in association with global management consulting firm Kearney, there was a 66% year-over-year increase in brands developing their own websites in the fourth quarter of 2020. Platforms such as Magento, Shopify and WooCommerce are helping brands to easily build their online stores with a range of plug-and-play tools for better marketing without the need for a significant investment.

The fashion and accessories category saw 92% year-over-year growth in DTC websites, compared to a much lower rate of 9% growth on marketplaces during 2020, according to the Unicommerce-Kearney report. According to a June 2021 report in The Economic Times, fashion brand websites have reported 66% order volume growth against 45% in marketplaces, and 77% GMV growth against 33% on marketplaces in FY2021—which strongly implies that fashion brands are succeeding with a stronger DTC presence.

The popularity of the DTC model is growing because it is seen as a win-win for both customers and brands. For brands, it can drive increased sales and revenue at much lower operating costs, due to the absence of third-party wholesalers, distributors and intermediaries. On the other hand, consumers get a wide variety of personalized and tailored products as DTC companies understand their requirements and shopping habits better.

DTC is a novel and steadily growing niche that promises to be the next big thing in the market. According to a 2020 report by Avendus Capital, the DTC segment could have a $100 billion addressable market by 2025. We expect the success of digital-first DTC brands in 2020 and 2021 will provide further growth avenues for brands and categories for their DTC switch.

Implications for Brands/Retailers

- With DTC gaining popularity, large e-commerce brands and offline-only brands should also launch their DTC arms for better growth prospects. This will offer a direct connection with their consumers, better understanding of their shopping behavior and habits, and the ability to customize product offerings to consumer preferences.

6. Brand Partnerships Will Elevate Retailers To Meet Changing Customer Expectations

Brands and retailers need to keep pace with ever-changing consumer expectations and shopping needs. Rather than building an effective multi-channel ecosystem, which can require significant time and investment, retail partnerships are an attractive and rewarding alternative that will help to meet consumers’ changing expectations. In addition, partnerships are an efficient way to add new brands, categories, products and consumers.

Offline retail partnerships will help e-commerce and digital natives to reap the benefits of a brick-and-mortar presence.

- Indian DTC watch brand Noise partnered with Vijay Sales, India’s leading electronics store chain, in December 2020 to enable consumers to buy Noise products from Vijay Sales’ online platform and its 50 brick-and-mortar stores across cities. While the partnership allows Vijay Sales to offer Noise products to its online and offline customers at competitive prices, Noise can use Vijay Sales’ wide network across India to expand its reach and widen its customer base. The brand has a 28.5% market share based on unit shipment as of 2020, as stated in a December 2020 report in The Economic Times.

Partnerships will also facilitate faster digital transformation and integrate tech-driven systems and processes into offline businesses.

- British footwear brand Clarks partnered with Indian e-commerce company Fynd in November 2020 to expand its omnichannel presence. Fynd’s technology helped Clarks digitally expand its brick-and-mortar stores, fulfill customer orders across India, solve its inventory challenges and improve warehouse efficiency.

During the nationwide lockdown in 2020, when most businesses shut and revenues were affected, certain brands and retailers partnered with other retailers classified as “essential”—largely big-box and grocery stores—to boost sales and maintain a physical connection with their customers.

- Walmart-owned Flipkart partnered with retail store chain Vishal Mega Mart during the nationwide lockdown in May 2020 to offer home delivery of essential items in 26 cities in India. Under the partnership, a “Vishal Mega Mart Essentials” store was created on Flipkart’s platform. Consumers could order products through this from over 365 Vishal Mega Mart stores for delivery by Flipkart.

Implications for Brands/Retailers

- To deliver on consumers’ ever-evolving needs without compromising quality, cost and service delivery, brands and retailers can look at partnerships as a mutually beneficial alternative for expansion, technological advancement and operational efficiencies.

7. Social Commerce Will Gain Prominence Over E-Commerce

Increased smartphone adoption and social media penetration are changing Indian shopping behavior and driving

a surge in social commerce—with many consumers bypassing e-commerce.

As social media penetration increases, both big and small sellers are increasingly adopting social commerce to drive sales; a robust social commerce strategy is vital for today’s businesses. A December 2020 report in

The Hindu Business Line stated that social commerce in India will reach a GMV of $50 billion by 2025. China first leveraged the power of combining e-commerce and social media; now social commerce accounts for nearly 12% of all online retail sales in China, and the country has created four unicorns over the last five years, as reported by

The Economic Times in

January 2021.

In India, a rise in Internet users, increased smartphone adoption and growing DTC channels are some of the factors driving social commerce. Social commerce is also an affordable way for small and medium-sized businesses to build an online presence. According to a February 2021 EY report, the social commerce format that is gaining the most momentum in India is social reselling, via platforms such as Bulbul, GlowRoad, Meesho, Shop 101 and SimSim, catering to product categories including apparel, footwear, electronics and home utilities. The ability to offer convenience and personalization to customers, while building trust, is driving the growth of these platforms.

For millennials and Gen Zers, social media influencers can play a prominent role in guiding their shopping choices. Therefore, brands should integrate influencers with their marketing strategy and provide promotional content to share on their social channels that resonate with this audience to generate revenue.

Visual experience drives social media, and features such as Instagram Reels, live streaming and immersive campaigns will help brands reach a broader audience and promote products and services in an engaging format. User-generated content such as product reviews and shopping experiences on social media can also prove beneficial for brands and retailers—another factor driving the growth of social commerce over e-commerce.

Implications for Brands/Retailers

- Brands and retailers must embrace social commerce and create social features for their products to reach out to social media-savvy consumers.

8. Consumers Are Prioritizing Health and Wellness

The pandemic has made Indians more health-conscious, and there is a

widespread trend toward healthier lifestyles. Many have become more focused on healthy eating and exercise—affecting their shopping decisions. This is fueling

a boom in health and wellness retail in India. According to a report by Research and Markets published in February 2021, 45% of Indian millennials aspire to maintain a healthy lifestyle and are willing to spend a premium to ensure good health.

A Facebook–BCG survey between April 30 and May 3, 2020, published by

The Indian Express in June 2020, revealed a spike of almost 120% in online searches on topics relating to health and immunity in India. Fueled by the pandemic, the demand for dietary or nutritional supplements among consumers is rising. The survey also revealed that 40% of the consumers intended to buy more vitamins, herbs and supplements in the future. We expect brands offering nutritional and vitamin supplements to continue to experience the surge.

A more sedentary lifestyle, due to lockdowns and working from home, has also heightened health concerns among consumers. With gyms and fitness centers shut, many are turning to app-based fitness programs. A related consumer trend is a new appetite for freshly prepared and healthy food options, which has led to the growth of nutrition and health-tech companies, such as CureFit, in the personal wellness space. The Facebook–BCG survey also found that 44% of consumers plan to increase their online spend on fresh food.

Consumers’ mental health has also been affected, leading to the rise of many online health and wellness platforms. Companies such as HopeQure, Better Help, Trijog, Tick Talk To and TalkSpace offer online counseling, corporate wellness program, webinars, offline counseling and health and educational well-being support.

Implications for Brands/Retailers

- Consumer interest in health and wellness is not going to die down in the aftermath of the pandemic, and health and wellness brands can capitalize on changed consumer attitudes.

- With consumers willing to spend more on health and wellness, there is ample scope for players to enter this sector.

9. Businesses Will Diversify for Expansion or Entry into New Markets

The first and second waves of the Covid-19 pandemic and associated lockdowns adversely affected most businesses other than those selling essentials such as groceries. While most brands and retailers suffered, some of them considered this an opportunity to diversify their operations into related sectors to generate sales and revenue, support their employees and manage financial pressures.

- Food delivery platform Swiggy partnered with companies including Dabur, Godrej, Hindustan Unilever, ITC and P&G to enter the grocery delivery market soon after its business was affected during the nationwide lockdown in April and May 2020. Swiggy also announced the home delivery of alcohol during the same period. This diversification helped Swiggy bring in additional revenue during what would otherwise have been a lean period.

- Like Swiggy, food-delivery platform Zomato also expanded its business into grocery and alcohol delivery. Zomato Market, Zomato’s grocery delivery wing, partnered with FMCG and Vishal Mega Mart, meeting consumers’ grocery requirements in more than 80 cities in India by accepting orders through the Zomato app. While e-grocers BigBasket, and Grofers lead the online grocery market, what gives Zomato a competitive edge is its swift two-hour delivery service.

The pivoting of Zomato and Swiggy into new domains that are not their primary business sets an example of how even large businesses’ diversification to multiple ventures helps their survival during challenging times. Swiggy and Zomato registered year-over-year revenue growth of 129% and 98% respectively in fiscal 2020, with revenues for each retailer exceeding $300 million.

While the above examples were forced shifts amid the pandemic, companies also enter new fields to reduce their dependency on single businesses, as their presence in other verticals can lend stability to their earnings and sustain growth across business cycles.

- Nykaa, an online beauty and wellness retailer, entered the fashion sector in 2019, just seven years after its founding in 2012. Nykaa Fashion offers predominantly premium products and private brands in the apparel, lingerie, athleisure and accessories categories. Today, Nykaa Fashion has over 500 labels and 75,000 styles, and it plans to achieve total sales of $68 million in fiscal 2021.

E-commerce players are also diversifying by expanding their reach to Tier 2 and Tier 3 cities as smaller Indian cities increasingly account for a bigger volume of e-commerce sales. A report by Flipkart states that the company witnessed a 35% increase in sellers onboarding in 2020 compared to the same period last year, mainly from Tier 2 and Tier 3 cities. Such cities now account for nearly half of all shoppers and contribute to three out of every five orders on leading e-commerce platforms, indicating promising growth prospects for e-commerce in these smaller cities.

Implications for Brands/Retailers

- Brands and retailers should look at appropriate diversification strategies to related sectors by expanding their products or services to achieve greater profitability.

- By expanding their reach and appeal to new markets, brands and retailers can explore new avenues for sales and the potential to increase their profits.

10. Last-Mile Deliveries Will Be Reimagined

With consumers’ shift to online and growing expectations of faster deliveries, e-commerce and online businesses are looking to adopt new technologies and processes to expedite deliveries and improve last-mile fulfillment. According to business consultancy firm RedSeer, India’s last-mile delivery market will be worth $6–7 billion by 2024. Optimizing last-mile deliveries gained prominence during the pandemic in 2020, fueled by reduced staffing levels and increasing demand from online consumers for faster deliveries; we expect this to become a necessity as we move into 2022.

E-commerce giants Amazon and Flipkart, with their same-day and next-day delivery options, have set a standard in the eyes of consumers: They now expect all online players to do the same. In 2021, we expect businesses to pay more attention to their delivery models and last-mile operations.

To facilitate quick deliveries, businesses will focus on establishing urban fulfillment centers. This model would be best suited for metro cities. This would save considerable time and effort while ensuring order fulfillment during peak times.

Deliveries using drones for medicines and other essentials might gain momentum in 2022, as this can enhance last-mile delivery operations in rural areas by minimizing dependency on human resources.

- India’s first official beyond-visual-line-of-sight medical drone delivery experiment began in June 2021 in the rural parts of Bengaluru, with the participation of a consortium of firms: Throttle Aerospace Systems and Involi-Swiss providing unmanned traffic management systems and Honeywell Aerospace as a safety expert. The consortium used two variants of drone that can carry up to four pounds in load; the technology is not at this stage viable for the larger loads seen in retail delivery.

Companies can also adopt a hybrid fleet model to manage last-mile deliveries using both in-house delivery vehicles and third-party logistics partners. Streamlining of in-house logistics by e-commerce retailers and increased third-party logistics partnerships help to expand operations even to remote corners of the country and scale last-mile operations flexibly when required.

Last-mile technological solutions will gain popularity: GPS, RFID (radio-frequency identification) tags and other technologies can track shipments and sensors installed in consignments can monitor their temperature to prevent damage.

Implications for Brands/Retailers

- To meet consumer demand for faster deliveries, brands and retailers must focus on tech adoption and enter into strategic partnerships with logistics service providers to optimize their last-mile delivery capabilities.

What We Think

Omnichannel will play a bigger role in retail as consumers expect safety and convenience for their shopping and want brands and retailers to offer a smooth purchase journey across online and offline channels. More online brands will adopt a DTC strategy as it enables a faster take-to-market, better connection with their consumers, and a higher ROI. E-commerce players and digital natives will also utilize offline spaces for their operational expansion, whether through experiential stores or fulfillment centers. We expect technology adoption and third-party logistics partnerships to witness increased traction among e-commerce and online players to expedite deliveries and optimize their last-mile fulfillment.

The informal retail sector will embrace technology in 2021, and kiranas’ digitalization will heat up competition with online grocery players. Brands and retailers with a broad range of services will aim for consolidation of their product and service offering through super apps.

Retail partnerships will become crucial for expansion plans and technology adoption without compromising service quality and costs. Moreover, brands and retailers will explore options for diversification into related sectors to generate additional revenue and guard against the challenges that can arise out of a single business.

Increased smartphone adoption and social media penetration among the large millennial and Gen Z cohort will help social commerce flourish over e-commerce. Consumers’ increased focus on health and wellness will persist even once the pandemic fades, and consumers’ willingness to spend more on health and wellness will fuel the growth of this segment.

Fiscal years end March 31

Fiscal years end March 31  Source: Coresight Research[/caption]

1. Omnichannel Shows No Signs of Slowing Down

Growing internet penetration and smartphone usage in India have given rise to digital-savvy consumers and transformed their purchase behavior. Their needs and expectations are constantly evolving: With the Covid-19 pandemic having led consumers to prioritize safety and convenience, they expect brands and retailers to provide a smooth purchase journey across online and offline channels. Demand for “anytime, anywhere access” and the need for a personalized and differentiated shopping experience are driving brands and retailers to adopt an omnichannel strategy, using a combination of online and offline digital touchpoints to provide a highly personalized, consistent and holistic consumer experience.

While the pandemic has accelerated the shift to e-commerce, consumer appetite remains for the experiential and tangible elements that physical stores offer. Brands and retailers are therefore breaking down the barriers between virtual and physical storefronts—integrating in-store and online shopping experiences to create a consistent omnichannel strategy that improves consumers’ experiences and interactions with the brand, increases brand visibility and improves retention and loyalty. With a shift in focus from the company to the customer, we believe that omnichannel will be the preferred retail model in the future.

According to a Harvard Business Review study in 2017, omnichannel customers spend 4% more when shopping in-store and 10% more online than single-channel customers. According to the Festive Shopping Index 2020 by the Retailers Association of India (RAI) and LitmusWorld, 75% of Indian consumers reported that they were shopping online for the holidays last year, while 66% were also considering shopping at standalone stores. It will be interesting to see which channels consumers use for shopping in the 2021 festive season; we expect omnichannel to remain prevalent.

Many brands are increasingly adopting omnichannel strategies to create a unified experience across multiple touchpoints, including mobile, websites and brick-and-mortar stores. The table below shows some of the omnichannel initiatives by Indian brands Pepperfry and Van Heusen.

Source: Coresight Research[/caption]

1. Omnichannel Shows No Signs of Slowing Down

Growing internet penetration and smartphone usage in India have given rise to digital-savvy consumers and transformed their purchase behavior. Their needs and expectations are constantly evolving: With the Covid-19 pandemic having led consumers to prioritize safety and convenience, they expect brands and retailers to provide a smooth purchase journey across online and offline channels. Demand for “anytime, anywhere access” and the need for a personalized and differentiated shopping experience are driving brands and retailers to adopt an omnichannel strategy, using a combination of online and offline digital touchpoints to provide a highly personalized, consistent and holistic consumer experience.

While the pandemic has accelerated the shift to e-commerce, consumer appetite remains for the experiential and tangible elements that physical stores offer. Brands and retailers are therefore breaking down the barriers between virtual and physical storefronts—integrating in-store and online shopping experiences to create a consistent omnichannel strategy that improves consumers’ experiences and interactions with the brand, increases brand visibility and improves retention and loyalty. With a shift in focus from the company to the customer, we believe that omnichannel will be the preferred retail model in the future.

According to a Harvard Business Review study in 2017, omnichannel customers spend 4% more when shopping in-store and 10% more online than single-channel customers. According to the Festive Shopping Index 2020 by the Retailers Association of India (RAI) and LitmusWorld, 75% of Indian consumers reported that they were shopping online for the holidays last year, while 66% were also considering shopping at standalone stores. It will be interesting to see which channels consumers use for shopping in the 2021 festive season; we expect omnichannel to remain prevalent.

Many brands are increasingly adopting omnichannel strategies to create a unified experience across multiple touchpoints, including mobile, websites and brick-and-mortar stores. The table below shows some of the omnichannel initiatives by Indian brands Pepperfry and Van Heusen.

Source: Bain & Company/Coresight Research[/caption]

A faster take-to-market, better control over brand communication, direct interaction with consumers, consumers’ shift to online shopping during the pandemic and a rise in digital payment adoption have resulted in a trend toward DTC among Indian brands. There are currently over 600 DTC brands, including prominent names such as Licious, Mamaearth, MyGlamm, The Moms Co. and Wakefit.

According to a February 2021 report by cloud-based e-commerce solutions provider Unicommerce, in association with global management consulting firm Kearney, there was a 66% year-over-year increase in brands developing their own websites in the fourth quarter of 2020. Platforms such as Magento, Shopify and WooCommerce are helping brands to easily build their online stores with a range of plug-and-play tools for better marketing without the need for a significant investment.

The fashion and accessories category saw 92% year-over-year growth in DTC websites, compared to a much lower rate of 9% growth on marketplaces during 2020, according to the Unicommerce-Kearney report. According to a June 2021 report in The Economic Times, fashion brand websites have reported 66% order volume growth against 45% in marketplaces, and 77% GMV growth against 33% on marketplaces in FY2021—which strongly implies that fashion brands are succeeding with a stronger DTC presence.

The popularity of the DTC model is growing because it is seen as a win-win for both customers and brands. For brands, it can drive increased sales and revenue at much lower operating costs, due to the absence of third-party wholesalers, distributors and intermediaries. On the other hand, consumers get a wide variety of personalized and tailored products as DTC companies understand their requirements and shopping habits better.

DTC is a novel and steadily growing niche that promises to be the next big thing in the market. According to a 2020 report by Avendus Capital, the DTC segment could have a $100 billion addressable market by 2025. We expect the success of digital-first DTC brands in 2020 and 2021 will provide further growth avenues for brands and categories for their DTC switch.

Implications for Brands/Retailers

Source: Bain & Company/Coresight Research[/caption]

A faster take-to-market, better control over brand communication, direct interaction with consumers, consumers’ shift to online shopping during the pandemic and a rise in digital payment adoption have resulted in a trend toward DTC among Indian brands. There are currently over 600 DTC brands, including prominent names such as Licious, Mamaearth, MyGlamm, The Moms Co. and Wakefit.

According to a February 2021 report by cloud-based e-commerce solutions provider Unicommerce, in association with global management consulting firm Kearney, there was a 66% year-over-year increase in brands developing their own websites in the fourth quarter of 2020. Platforms such as Magento, Shopify and WooCommerce are helping brands to easily build their online stores with a range of plug-and-play tools for better marketing without the need for a significant investment.

The fashion and accessories category saw 92% year-over-year growth in DTC websites, compared to a much lower rate of 9% growth on marketplaces during 2020, according to the Unicommerce-Kearney report. According to a June 2021 report in The Economic Times, fashion brand websites have reported 66% order volume growth against 45% in marketplaces, and 77% GMV growth against 33% on marketplaces in FY2021—which strongly implies that fashion brands are succeeding with a stronger DTC presence.

The popularity of the DTC model is growing because it is seen as a win-win for both customers and brands. For brands, it can drive increased sales and revenue at much lower operating costs, due to the absence of third-party wholesalers, distributors and intermediaries. On the other hand, consumers get a wide variety of personalized and tailored products as DTC companies understand their requirements and shopping habits better.

DTC is a novel and steadily growing niche that promises to be the next big thing in the market. According to a 2020 report by Avendus Capital, the DTC segment could have a $100 billion addressable market by 2025. We expect the success of digital-first DTC brands in 2020 and 2021 will provide further growth avenues for brands and categories for their DTC switch.

Implications for Brands/Retailers