DIpil Das

What’s the Story?

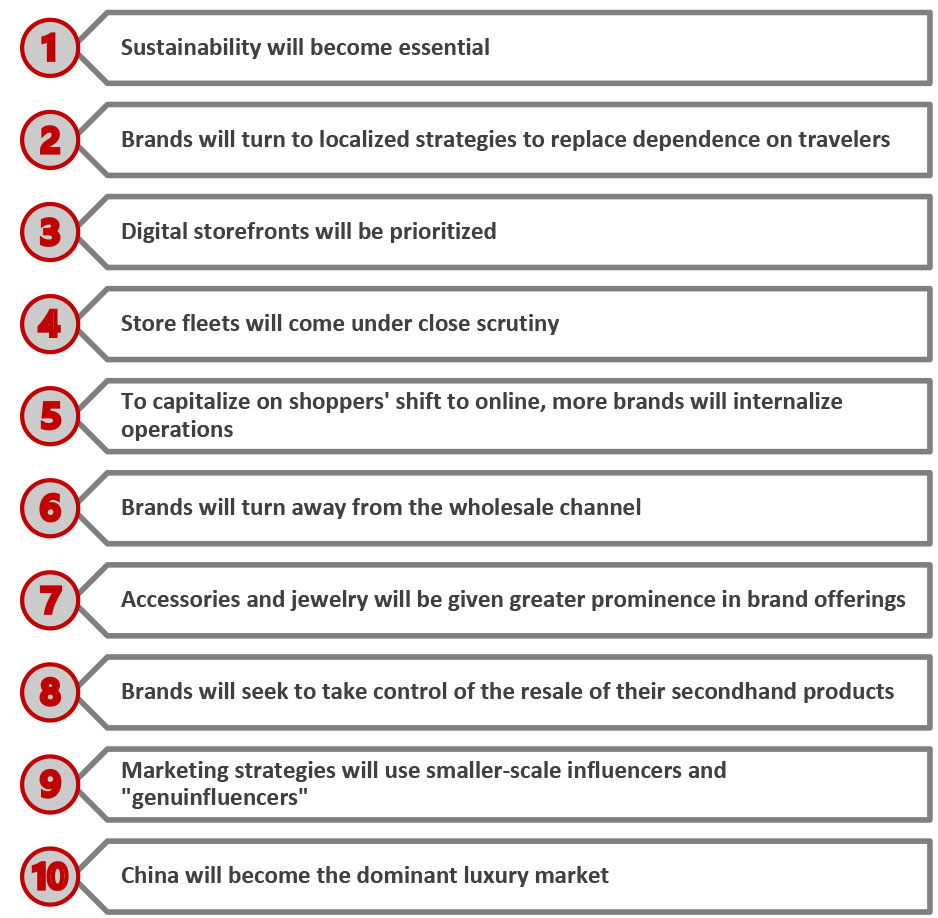

We present 10 trends that are impacting the global luxury sector and identify strategies for luxury brands and retailers to best capitalize on momentum in each area. Our trend coverage includes preeminent multiyear trends, such as sustainability and the increasing importance of the Chinese consumer, as well as burgeoning new trends such as localization and the use of “genuinfluencers.”Why It Matters

Luxury, like many other sectors, was deeply impacted by the repercussions of the pandemic in 2020, but has seen a strong rebound through 2021. 2021 has seen several companies repositioning their strategies to adapt to the new, post-pandemic luxury shopper: a consumer that likes to shop consciously and locally, and places great emphasis on quality.10 Trends in Global Luxury: Coresight Research Analysis

Coresight Research has identified 10 key trends for luxury retail, as shown in Figure 1.Figure 1. 10 Trends in the Global Luxury Sector [caption id="attachment_136064" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

1. Sustainability Will Take Center Stage

The theme of sustainability has been growing in importance in recent years and the pandemic heightened many consumers’ awareness of environmental issues and conscious consumption options.

A Coresight Research survey of US consumers and the impact of the pandemic on their shopping habits undertaken in July 2021 found that:

Source: Coresight Research[/caption]

1. Sustainability Will Take Center Stage

The theme of sustainability has been growing in importance in recent years and the pandemic heightened many consumers’ awareness of environmental issues and conscious consumption options.

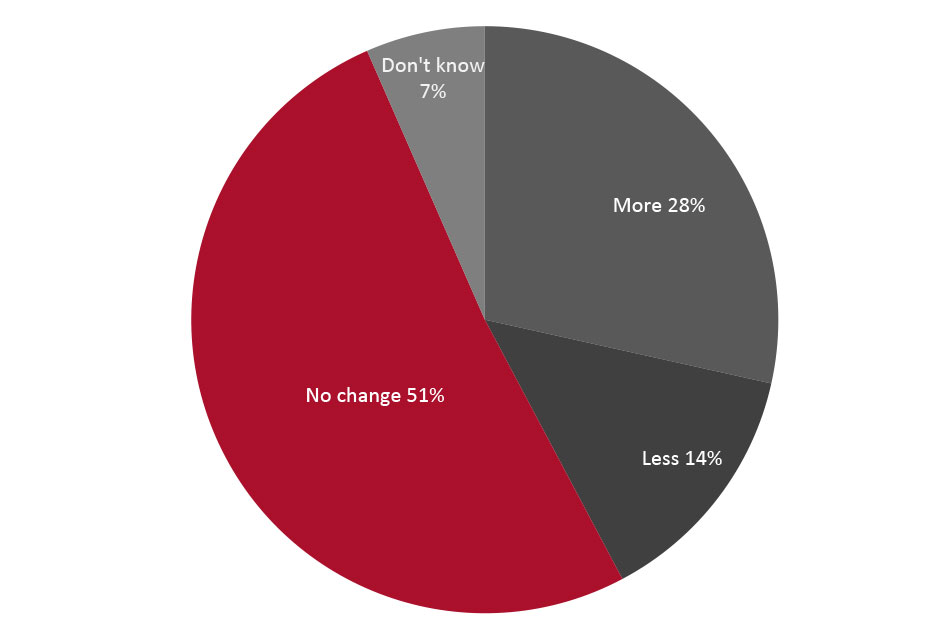

A Coresight Research survey of US consumers and the impact of the pandemic on their shopping habits undertaken in July 2021 found that:

- Almost three in 10 consumers consider sustainability more of a factor when shopping than they did before the Covid-19 crisis. Only 14% of consumers, by contrast, said sustainability is now less of a factor for them when shopping.

- Greater awareness of global risks and the way the pandemic has shown the immediate impact of changed behavior were the two main reasons cited by respondents who consider sustainability more of a factor when shopping.

- Prioritizing avoiding the virus and saving money were the two main reasons cited by respondents who consider sustainability less of a factor when shopping.

Figure 2. US Respondents: Whether the Covid-19 Pandemic Has Made Environmental Sustainability More or Less of a Factor (% of Respondents) [caption id="attachment_136065" align="aligncenter" width="725"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] Sustainability is an important focus for global luxury consumers as well. A November 2020 survey of over 26,000 consumers by Vogue Business found that over half of luxury consumers across all age groups consider sustainability important when buying luxury fashion. A greater proportion of millennial consumers are concerned about sustainability than Gen Zers and older consumers, the survey found. A number of luxury brands have announced further sustainability initiatives as environmental consciousness becomes deeply embedded in consumer shopping habits:

- Luxury reseller The RealReal launched an upcycling program in April 2021 in partnership with eight brands, including Balenciaga and Stella McCartney. The program, called ReCollection, will repair damaged pieces from the brands and resell them via its platform, giving a new life to items that would have otherwise been discarded. Its first collection features 50 pieces donated by the brands priced between $195 and $2,450.

- Outwear brand Canada Goose announced in June 2021 that it plans to become completely fur-free: it will stop fur purchases by the end of 2021 and stop manufacturing with fur by the end of 2022. It has also been making several innovations to its products and introduced a sustainable parka and jackets in 2021 that generate less carbon, use less water in their production and use recycled materials.

[caption id="attachment_136066" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

In recent earnings notes, several brands noted the impacts of reduced travel on their sales and explained the localization strategies they have implemented.

Source: Company reports/Coresight Research[/caption]

In recent earnings notes, several brands noted the impacts of reduced travel on their sales and explained the localization strategies they have implemented.

- Kering noted that over 65% of its sales in Western Europe in the second quarter of 2019 were to tourists, and as travel has not yet returned to normal, sales in the region were down 40% on a two-year basis (despite rising 71% year over year) in its second quarter, ended June 2021. Likewise, as tourism flows had not fully resumed, over 90% of total retail sales were to locals in some Asia-Pacific countries, including Japan, and in Western Europe. The group remarked that local initiatives helped drive “exceptional results” for Balenciaga, particularly in North America.

- In July 2021, Prada remarked on its first-half earnings call that it saw strong local growth in China, the Middle East, Russia and the US during the period. It too has been creating localized campaigns: for example, a campaign in China for the Qixi Festival in July 2021, which centered on the concept of gift-giving. The campaign included a short film starring its brand ambassador, Chinese pop star Cai Xukun, carrying pieces from the collection for the festival. Xukun also created the film’s soundtrack and invited his followers to co-create movies on Chinese short-video platform Douyin.

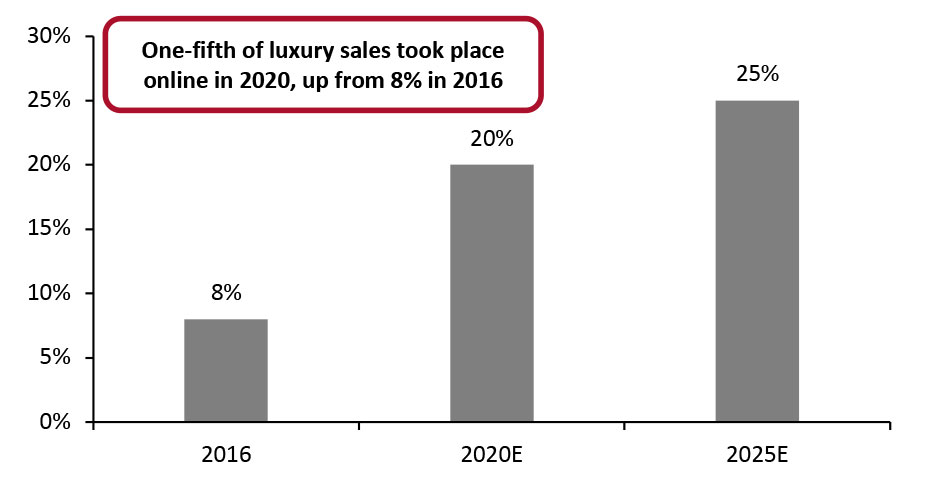

Figure 4. Global Luxury E-Commerce Sales by Year (% of Total Sales) [caption id="attachment_136067" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Many luxury brands and retailers are still building out their digital storefronts:

Source: Company reports/Coresight Research[/caption]

Many luxury brands and retailers are still building out their digital storefronts:

- As well as offering its own luxury e-commerce marketplace platform, online luxury retailer Farfetch provides enterprise software solutions to help brands build and manage digital storefronts. In November 2020, it announced a partnership with Alibaba Group and Richemont “to accelerate the digitalization of the luxury industry.” Farfetch launched its store on Tmall Luxury Pavilion in March 2021 and had 250,000 followers by the following August. Farfetch offers about 3,200 brands on its Tmall storefront, of which about 90% are exclusive to Farfetch on the platform. Brands can use this as a digital DTC channel to reach consumers in China.

- Capri Holdings told analysts during its investor day in June 2021 that it expects to increase its e-commerce revenues from its current 26% of retail revenue to 33% by fiscal year 2023. It has allocated around 25% of its capital expenditure to building its digital capabilities and e-commerce platforms.

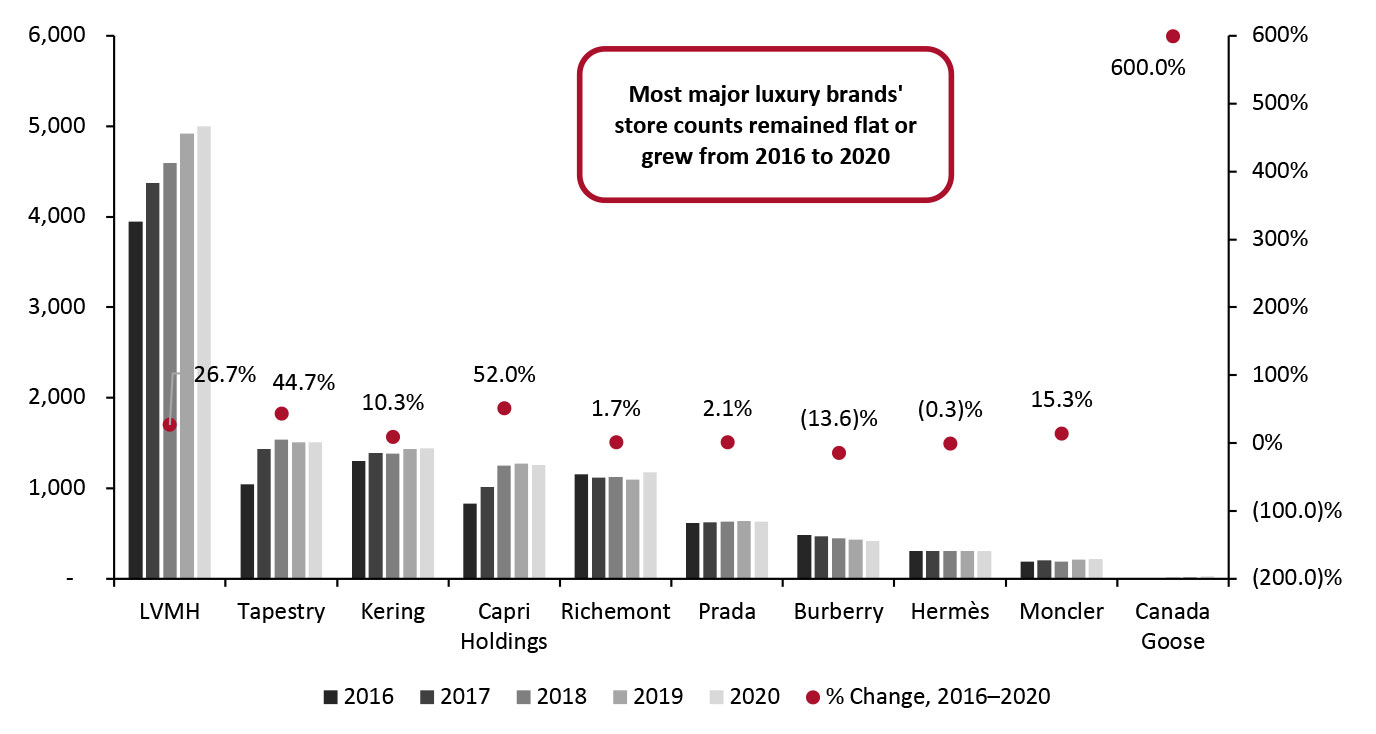

Figure 5. Directly Operated Stores of Selected Luxury Brands/Brand Owners (Left Axis) and % Change 2016–2020 (Right Axis) [caption id="attachment_136068" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Despite temporary store closures, some luxury brands have announced plans to expand their store fleets:

Source: Company reports/Coresight Research[/caption]

Despite temporary store closures, some luxury brands have announced plans to expand their store fleets:

- Capri Holdings plans to increase its global retail store count for Versace from 210 to 300 stores, and for Jimmy Choo from 227 to 300, in the near term (it did not provide a specific year). It also plans to close 170 group retail stores by the end of fiscal year 2022 (ending March 28), as part of a two-year store optimization plan.

- Tapestry closed a net 59 stores in its fiscal year 2021 (ended July 3). Over the last year, it focused capital expenditure on areas such as digital projects and reduced investments in new stores. In the current year, it has allocated around 40% of its capital expenditure to store development, particularly in China, while the remainder will be used to build out its digital capabilities.

- Kering has been working to manage its own e-commerce platforms since 2018, originally through its joint venture with Yoox Net-A-Porter. Kering internalized the e-commerce platforms for Alexander McQueen and Saint Laurent in 2020, and Balenciaga’s platform in 2021.

- Moncler internalized its US e-commerce operations in September 2020. On its first-half earnings call in July 2021, the brand said that it had internalized its e-commerce operations for some 30 countries in Europe, the Middle East and Africa in May, followed by its Japanese operations in July. The company reported that it saw its general and admin expense margin grow slightly due to these investments, but it prioritized having its e-commerce system in-house to take full advantage of the consumer shift to online.

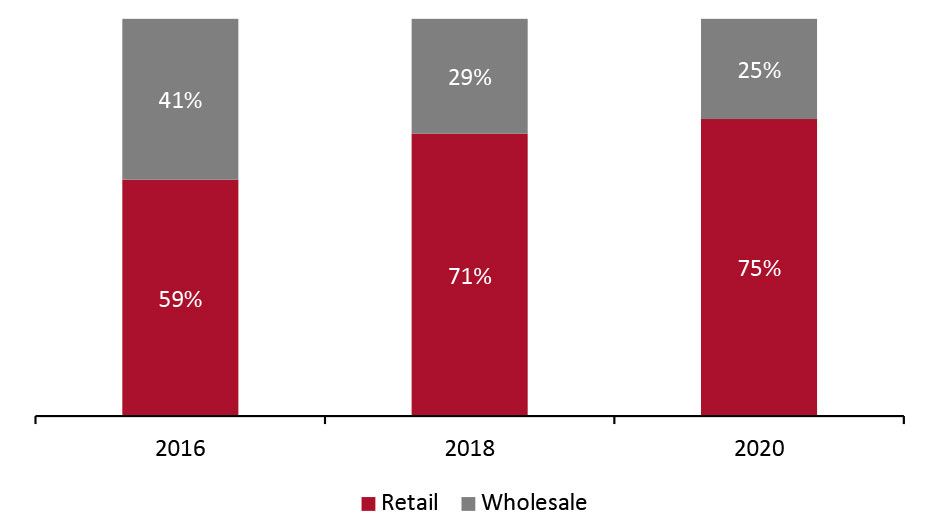

Figure 6. Selected Major Luxury Brands’ Retail and Wholesale Revenue Split [caption id="attachment_136069" align="aligncenter" width="726"]

Source: Company reports/Coresight Research[/caption]

A major advantage of the DTC model for the luxury sector is the control it allows brands over their exclusivity and customer service—two key distinguishing features of luxury brands. Moving away from wholesale and toward DTC also gives brands the ownership of more customer data to inform their marketing and product development.

7. Brands Will Refresh Their Assortments with Accessories and Jewelry

Travel restrictions and limited social events continue to dictate the kinds of products that consumers are purchasing. With little opportunity to flaunt the latest fashion, consumers are currently turning to products with timeless appeal—jewelry and accessories are benefiting, particularly as spending on formal clothing continues to diminish.

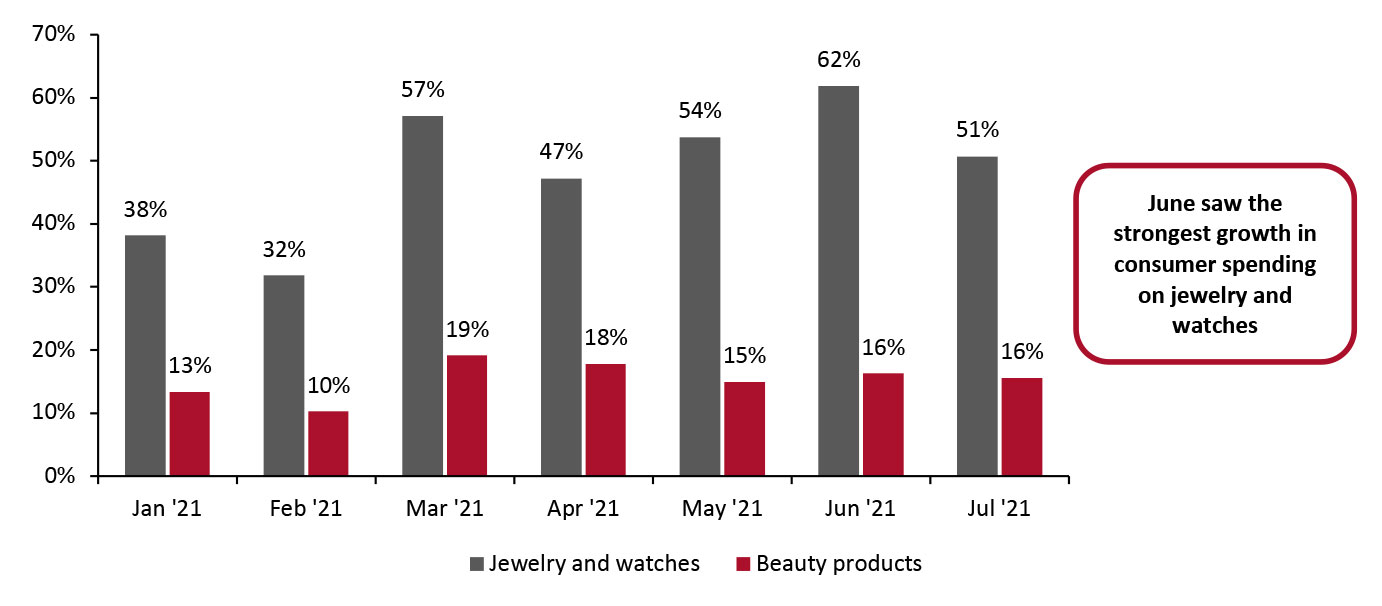

In the US, consumer spending on jewelry and watches has been strong—since March 2021, it has grown by 47% or higher on a two-year basis, according to data from the Bureau for Economic Analysis (BEA). Spending on beauty products has also been solid, with two-year growth of 10% or more in every month as of July 2021.

Source: Company reports/Coresight Research[/caption]

A major advantage of the DTC model for the luxury sector is the control it allows brands over their exclusivity and customer service—two key distinguishing features of luxury brands. Moving away from wholesale and toward DTC also gives brands the ownership of more customer data to inform their marketing and product development.

7. Brands Will Refresh Their Assortments with Accessories and Jewelry

Travel restrictions and limited social events continue to dictate the kinds of products that consumers are purchasing. With little opportunity to flaunt the latest fashion, consumers are currently turning to products with timeless appeal—jewelry and accessories are benefiting, particularly as spending on formal clothing continues to diminish.

In the US, consumer spending on jewelry and watches has been strong—since March 2021, it has grown by 47% or higher on a two-year basis, according to data from the Bureau for Economic Analysis (BEA). Spending on beauty products has also been solid, with two-year growth of 10% or more in every month as of July 2021.

Figure 7. Two-Year % Growth in US Consumer Spending on Jewelry and Watches and Beauty Products by Month [caption id="attachment_136070" align="aligncenter" width="725"]

Source: BEA/Coresight Research[/caption]

Some brands are already looking to capitalize on this trend by revamping their offerings to include more jewelry, accessories and beauty products.

Source: BEA/Coresight Research[/caption]

Some brands are already looking to capitalize on this trend by revamping their offerings to include more jewelry, accessories and beauty products.

- This fiscal year, Capri Holdings plans to expand its Jimmy Choo beauty range, first launched in 2020, and launch a jewelry collection in 2022. It also plans to expand Versace’s accessories business from its current $200 million to $1 billion (and 50% of brand revenue) in the long term.

- Hermès, known for its handbags and leather accessories, entered the beauty category for the first time in 2020 with the launch of its lipstick collection. It subsequently launched blush powder and nail polish lines in 2021, and plans to expand its makeup offering further with hand and eye products.

Figure 8. Average Engagement Rates of Global Influencers by Social Media Platform [wpdatatable id=1445 table_view=regular]

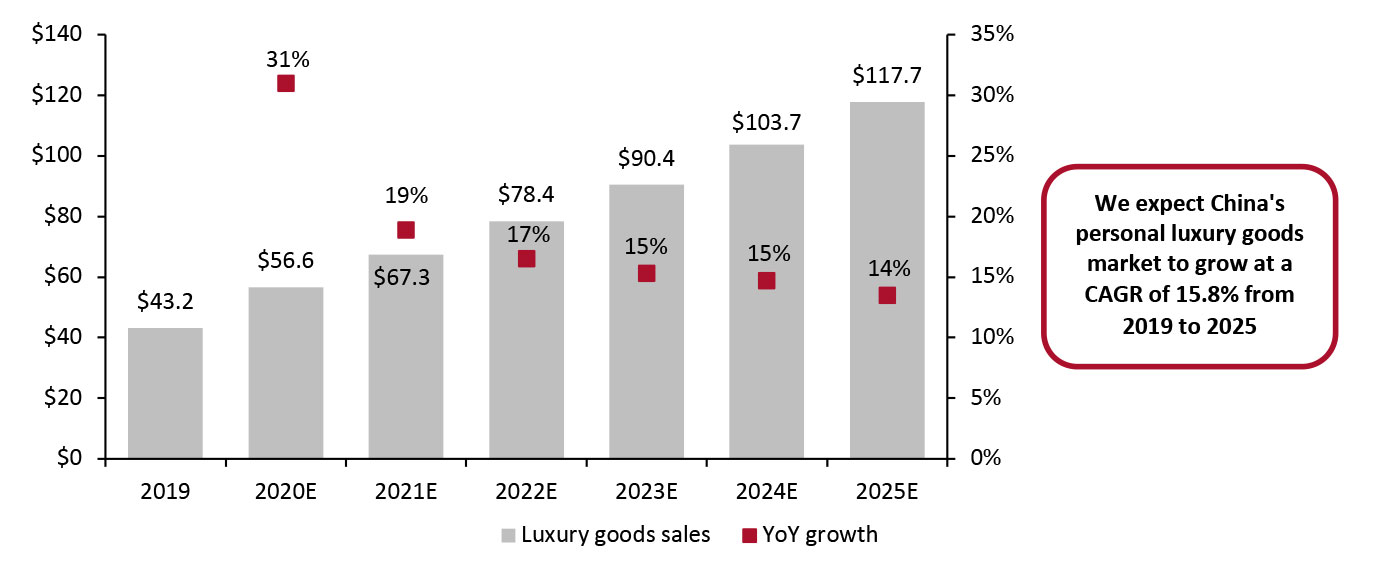

Source: Influencer Marketing Platform/Upfluence We expect luxury brands to increasingly work with micro-influencers and “genuinfluencers” to increase engagement with untapped segments of the market, generate a better return on their marketing spending and connect with audiences that care about social and economic issues. 10. Sales in China Will Continue To Rise Of the major global markets, the US has historically been the biggest consumer of luxury. China, however, with its large population of young, working consumers, looks poised to become the biggest consumer of luxury by 2025. The following data points indicate that brands and retailers should be paying attention to the Chinese luxury consumer:

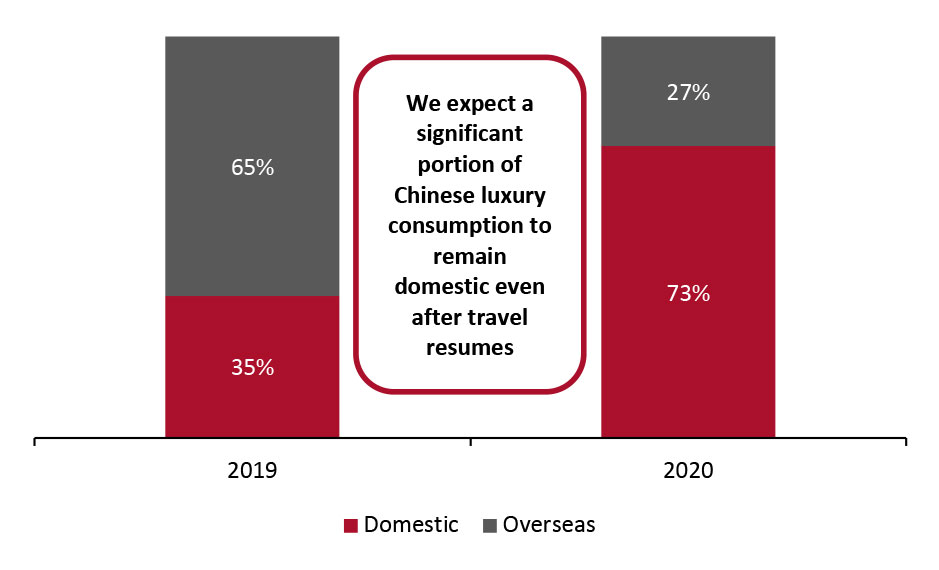

- China’s domestic personal luxury market accounted for 18.2% of the global luxury market in 2020, up from 12.4% in 2019, according to Coresight Research estimates.

- We estimate that domestic personal luxury goods sales in China reached $56.6 billion in 2020, up 31.0% from $43.2 billion in 2019, primarily due to the repatriation of Chinese consumers’ luxury spending because of travel restrictions. We expect the market to grow at a CAGR of 15.8%, reaching $117.7 billion and accounting for 25.0% of the global luxury goods market by 2025.

Figure 9. China: Personal Luxury Goods Sales (USD Bil., Left Axis) and Year-over-Year Growth (%, Right Axis) [caption id="attachment_136071" align="aligncenter" width="724"]

Source: Company reports/Coresight Research[/caption]

We believe four key factors will drive the rise of China as a luxury market: the repatriation of Chinese luxury consumption; increasingly sophisticated e-commerce offerings that make international brands more easily accessible; a high luxury purchase appetite; and growing numbers of discerning, young luxury shoppers that prize quality and authenticity.

Source: Company reports/Coresight Research[/caption]

We believe four key factors will drive the rise of China as a luxury market: the repatriation of Chinese luxury consumption; increasingly sophisticated e-commerce offerings that make international brands more easily accessible; a high luxury purchase appetite; and growing numbers of discerning, young luxury shoppers that prize quality and authenticity.

What We Think

The luxury sector is undergoing a drastic transformation with the adoption of digital touchpoints as consumers increasingly seek to shop online. Simultaneously, the types of products they are buying and the voices they are influenced by are being shaped by changes brought on by the pandemic. Implications for Brands/Retailers- As more consumers seek to shop consciously, brands and retailers must meet these needs with their product assortment and brand storytelling. Along with an emphasis on product quality, younger consumers are increasingly seeking the story behind the product and brands must find means to deliver this.

- Brands are accustomed to using social media platforms as a megaphone for announcements but must now learn how to use them as a medium for close conversations with increasingly aware and vocal consumers. Brands should focus on the means through which they can engage closely with their customers, particularly as part of a shift toward DTC models.

- As brands seek to revamp their store fleets, real estate firms may find themselves without tenants if luxury companies decide to downsize.

- Real estate firms must use this opportunity to identify prime property in neighborhoods that have a low concentration of luxury shops but have potential in terms of the residents’ appetite for luxury.

- As luxury companies look to localize their offer and marketing, they will seek spaces where they can engage meaningfully with local audiences.

- As luxury firms continue to digitalize, technology vendors that are able to provide exclusivity in their offerings and retain the premium nature of the brands will be in demand.

- Technology vendors should tailor their offerings for luxury businesses, as Reflaunt did with its offer for Harvey Nichols, to help companies in the sector distinguish their digital offerings from those of the mass market.