DIpil Das

Introduction

What’s the Story?We present 10 trends that are impacting the global beauty market and identify strategies for beauty brands and retailers to best capitalize on momentum in each area.

Our trend coverage spans pre-eminent multiyear trends such as premiumization and sustainability to nascent trends such as the expanding metaverse.

Why It MattersBeauty, like many other sectors, was deeply impacted by the repercussions of the Covid-19 pandemic, with the definition of “beauty” being redefined in the mind of the consumer to cover wellness, sustainability practices and more. Consumer expectations around beauty products and brands continue to evolve, and the sector must keep pace to capitalize on new opportunities—particularly in channels such as livestreaming and the metaverse.

10 Trends in Global Beauty: Coresight Research Analysis

We have identified 10 key trends for the global beauty market, as shown in Figure 1.

Figure 1. 10 Trends in the Global Beauty Market [caption id="attachment_151792" align="aligncenter" width="701"]

Source: Coresight Research[/caption]

1. Beauty and Wellness

Source: Coresight Research[/caption]

1. Beauty and Wellness

Similar to the body positivity movement in apparel, consumers increasingly expect new benefits from beauty products—self-confidence, serenity and good looks. The definition of beauty has evolved into a state of mind and being: beauty from the inside out. The pandemic amplified the shift in consumer priorities toward health, wellness and wellbeing, and drove an increased awareness and acknowledgment of the mind/body continuum. In response, the beauty industry is adjusting to consumer’s broader expectations by incorporating wellness concepts and messaging into their products, categories and marketing.

David Kimball, CEO at Ulta Beauty, told CNBC on June 8, 2022, that beauty is about self-expression; consumers have an emotional relationship with the category. Based on its research, Ulta Beauty believes that two-thirds of consumers link beauty to overall self-care and wellness. As such, the brand has added and expanded the wellness sections in its stores. Kimball emphasized that beauty is resilient: it plays an important role in consumers’ lives and is not purely discretionary.

We see three key categories gaining traction in the beauty and wellness space:

- Pharmaceuticals or medicinal skincare. Skincare brands founded by doctors, aestheticians and cosmetic surgeons populate cosmetic stores with claims that their products alleviate stress, repair the skin barrier, provide deep hydration and brighten the skin.

- Ingestibles or beauty supplements. These are frequently vitamin formulations that are developed and/or recommended by doctors, with ingredients to solve specific beauty concerns, such as brittle or soft nails, hair loss, or fine lines and wrinkles.

- Beauty experiences. Consumers look for the feel-good factor when it comes to experiences; they can view beauty experiences as an indulgence and a way of taking care of oneself. During Ulta Beauty’s conference call for the first quarter, held in May 2022, management said that the salon business was booming while digital sales were essentially flat, underpinning consumers’ eagerness for experiences.

Refillable lipstick in different shades from Dries Van Noten

Refillable lipstick in different shades from Dries Van Noten Source: Company website [/caption]

In addition to cosmetics, liquid soap, shower gel, shampoo and haircare brands are creating refillable products too. For example, L’Oréal’s Keratase reduces plastic waste compared to a typical shampoo bottle: its refillable shampoo bottles are made from 100% recycled aluminum, and the shampoo refill pouches are made with 82% less plastic, according to the company.

[caption id="attachment_151775" align="aligncenter" width="699"] L’Oréal’s Keratase refillable shampoo products

L’Oréal’s Keratase refillable shampoo products Source: Company website [/caption]

In addition to refillables and recyclables, Aveda is piloting a Returnable Shipping Program in partnership with solutions provider Returnity, where the boxes used to ship certain auto-replenishment orders to customers are returned to Aveda for reuse. Mike Newman, CEO at Returnity, told Coresight Research that the company is working on expanding the program and turning Aveda into “another $1 million client.” Discussing the challenges of reuse, Newman said, “Reuse is an operational logistics challenge. Trouble is, it is a designer-led initiative, and reuse, regardless of the product, requires systems support and consistency in reuse; otherwise, innovative packaging is a waste.”

In Figure 2, we present selected circular, refillable packaging initiatives by beauty brands over the past few years.

- Read more Coresight Research coverage of sustainability in retail.

Figure 2. Recent Circular, Refillable Packaging Initiatives by Beauty Brands [wpdatatable id=2129 table_view=regular]

Source: Company reports/Coresight Research 3. Beauty Retail Partnerships

Beauty’s retail channels are in flux. Looking at physical store sales, department stores lost 4.0 percentage points of US beauty market share between 2011 and 2021, dropping to 10.6%, according to Euromonitor International data. Beauty specialists, on the other hand, gained 4.4 percentage points of market share in the same time frame, to 18.3%.

The share of e-commerce (including online sales by department stores, mass merchants and beauty specialty retailers) in the US beauty market has seen a huge increase of more than 20 percentage points, from 7.2% in 2011 to 27.7% in 2021—with the pandemic boosting this share significantly in 2020 (see Figure 3).

Figure 3. Selected US Retail Channels: Share of US Beauty Market [wpdatatable id=2130 table_view=regular]

*Physical stores only Coresight Research defines the beauty market as color cosmetics, fragrance, haircare and skincare Source: Euromonitor International Limited 2022 © All rights reserved/Coresight Research

To stem the loss of market share and bring excitement and newness to consumers, department store Kohl’s and mass merchandisers Target and Walmart have joined forces with beauty specialty retailers.

- In its March 7, 2022, investor meeting, Kohl’s confirmed that it had opened 200 Sephora shops inside its stores, with plans to open a total 850 shop-in-shop locations through 2023 and grow its Sephora business to $2 billion. According to Kohl’s, adding Sephora’s prestige products enables the department store to offer an elevated experience, attract a new and younger customer and drive a “halo effect” to the entire business. The first 200 stores provided a mid-single-digit sales lift, with 25% of Sephora customers new to Kohl’s and 50% of customers cross-shopping, according to the company. In addition, Sephora and Kohl’s are trialing a service to enable orders placed on Sephora’s e-commerce site to be collected at a Kohl’s store; Sephora has a significant online business, so offering this option is positive for Kohl’s in terms of driving additional store traffic.

- Target’s partnership with Ulta Beauty, through its Ulta at Target shop-in-shops, is seeing positive gains for the company. During its first-quarter conference call on May 18, 2022, Target reported that it “benefited from double-digit comp growth in beauty, reflecting our ongoing work to enhance presentation, assortment and service, including our new and expanding partnership with Ulta Beauty. The result of this partnership have exceeded our initial expectations, driving higher productivity and sales in both beauty and adjacent categories in the stores where we have added an Ulta Beauty experience.”

- · During its first-quarter conference call on May 26, 2022, Ulta Beauty discussed expanding the Ulta at Target partnership to more doors as part of a long-term strategy to build brand loyalty and engagement. The brand sees existing Ultamate Rewards members taking advantage of shopping at Target, while the shop-in-shops also leverage Target’s store traffic to introduce Ulta Beauty to new potential customers. There were 127 Ulta at Target shops at the end of the first quarter, and the companies are on track to reach 250 shops this year, with 37.7 million active members in the Ultamate Rewards loyalty program (up 17% year over year), according to Ulta Beauty.

- Walmart partnered with UK beauty brand SpaceNK in March 2022 to create the BeautySpaceNK collaboration, bringing prestige beauty products to Walmart.com and nearly 250 Walmart stores this summer. SpaceNK, founded in 1991, is known for its curated prestige beauty assortment and operates 72 stores, including 29 in the US, as of June 2022.

Source: Walmart.com[/caption]

4. Beauty and the Metaverse

Source: Walmart.com[/caption]

4. Beauty and the Metaverse

Although still in its nascent stages, the metaverse is changing how people interact and transact online. A Coresight Research survey of US consumers (aged 13+) conducted in March 2022 found that among users of metaverse platforms, 34% are shopping and 16% are buying/trading NFTs (non-fungible tokens).

The beauty category is a natural fit for the metaverse. Beauty products transform how users feel and think about themselves as they change one’s appearance, allowing the user to be transported to a new self—a more beautiful and confident self. This can translate into the virtual world of avatars. The capabilities of Web 3.0 and the metaverse enhance the beauty industry’s intrinsic creativity and provide an alternative reality to interact with brands and like-minded consumers.

In Figure 4, we present a timeline of entry into the metaverse by selected beauty brands and retailers over the past two years.

- Read more Coresight Research coverage of the retail metaverse.

Figure 4. A Timeline of Entry into the Metaverse by Selected Beauty Brands and Retailers Since 2020 [wpdatatable id=2131 table_view=regular]

Source: Company reports 5. Beauty and Livestreaming

Livestreaming e-commerce is a unique way for beauty brands and retailers to interact with shoppers, drive sales, enhance loyalty and increase customer lifetime value (CLV).

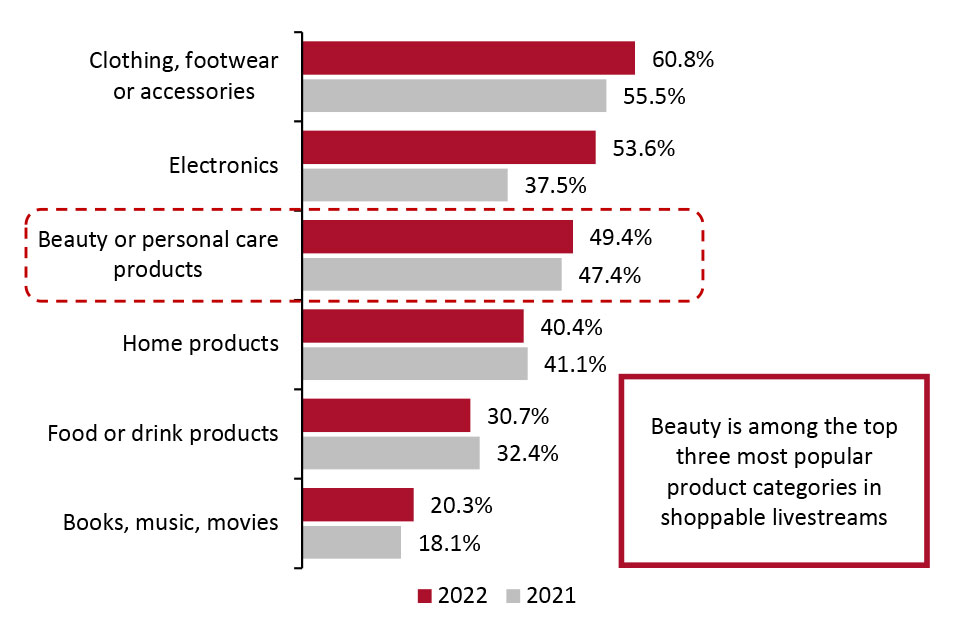

Beauty is a popular product category for livestreaming. According to Coresight Research’s US livestreaming survey, conducted in February 2022, nearly half (49.4%) of all US consumers who have watched a shoppable livestream reported that they watch live content focused on beauty/personal care—up 2.0 percentage points from 2021 and ranking the third-most-popular category among livestream viewers (see Figure 5).

Figure 5. US Livestream Viewers: Select Product Categories They Watch via Livestreaming (% of Respondents) [caption id="attachment_151777" align="aligncenter" width="700"]

Base: US respondents aged 18+ who have watched a shoppable livestream—502 surveyed in February 2022; 515 surveyed in March 2021

Base: US respondents aged 18+ who have watched a shoppable livestream—502 surveyed in February 2022; 515 surveyed in March 2021 Source: Coresight Research [/caption]

Many beauty brands and retailers are now tapping the livestreaming channel (see Figure 6), by holding their own live events as well as participating in events hosted on third-party platforms.

- Clinique hosts livestreaming sessions on its owned website, enabling shoppers to take classes, watch how-to videos, and shop.

- L’Oréal saw 50% of product purchases through livestream shopping events come from new customers in June 2021.

Figure 6. Notable Beauty Brands Engaging in Livestreaming [caption id="attachment_151778" align="aligncenter" width="700"]

Source: Company websites[/caption]

Source: Company websites[/caption]

Coresight Research has identified livestreaming e-commerce as a key trend to watch in retail. In the fall of 2021, the second annual 10.10 Shopping Festival, powered by Coresight Research, had a livestreaming focus. More than 160,000 consumers participated in the event, and 28 brands and retailers hosted livestreaming sessions during the festival—many of which were beauty brands. Elizabeth Arden, for example, hosted a livestreaming session that gained 21,205 unique views and featured 17 products, including eye cream, sunscreen and toilette spray.

We believe that livestreaming will continue to gain traction in the beauty space globally, driven by China and expanding to the West—as the category is a highly visual one, with shoppers valuing product demonstrations and expert advice.

- Read more Coresight Research coverage of livestreaming e-commerce.

The US male beauty market (fragrance, haircare and skincare), totaled nearly $4 billion in 2021, according to Euromonitor International—up 21.9% year over year. In the fragrance category specifically, 2021 was extremely strong, growing 35.2% year over year and accounting for 60.2% of men’s beauty spending in the US—comprising more than $500 million in sales.

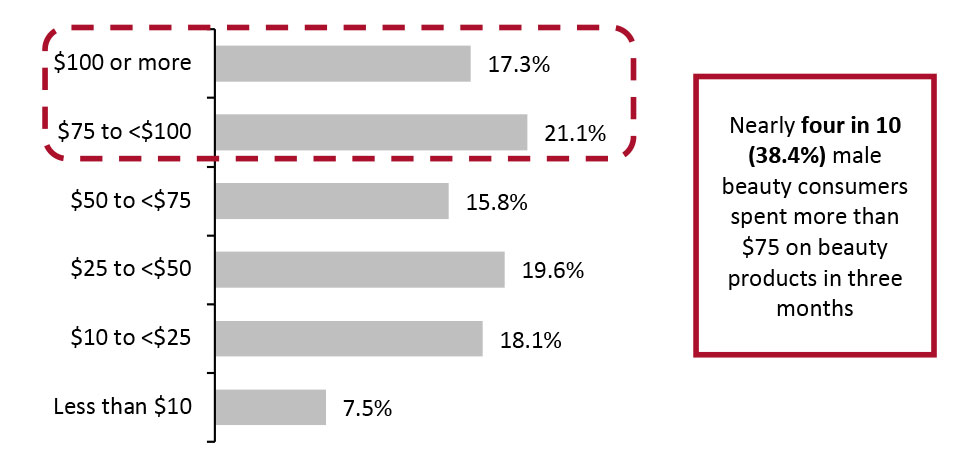

A Coresight Research survey of male beauty shoppers in the US, conducted in March 2022, found that more than half (54.2%) spent $50 or more in the prior three-month period (see Figure 7).

Figure 7. US: How Much Men Spent on Beauty Products in the Last Three Months, as of March 2022 (% of Respondents) [caption id="attachment_151779" align="aligncenter" width="700"]

Base: 133 US male respondents aged 18+ who had bought beauty products in the past three months, surveyed in March 2022

Base: 133 US male respondents aged 18+ who had bought beauty products in the past three months, surveyed in March 2022 Source: Coresight Research [/caption]

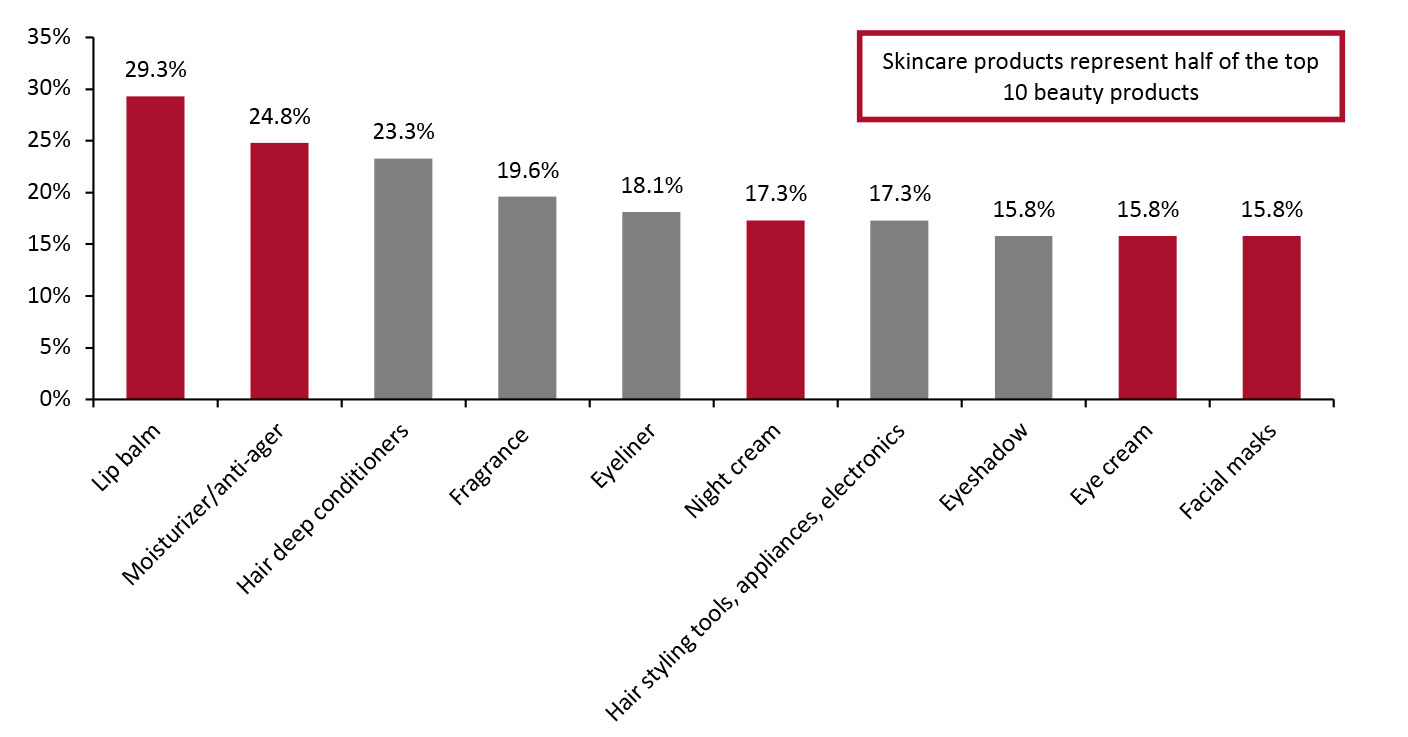

Among the 10 most popular beauty products among male beauty shoppers in the US, five are skincare products (including lip balm) and two are color cosmetics, according to our survey (see Figure 8), indicating that male consumers are diversifying their beauty interests outside of traditional products and into categories that had previously been targeted at female consumers. This presents huge opportunity for beauty brands and retailers to expand their customer base.

Figure 8. US: Top 10 Beauty Products Purchased by Men (% of Respondents) [caption id="attachment_151780" align="aligncenter" width="700"]

Base: US male respondents aged 18+ who had bought beauty products in the past three months, surveyed in March 2022

Base: US male respondents aged 18+ who had bought beauty products in the past three months, surveyed in March 2022 Source: Coresight Research [/caption]

We think that the rise of video conferencing amid the pandemic has prompted men to use products that enhance their appearance as well as products that perform. Looking forward, we see continued growth in all male beauty.

- Read our separate report on the rise of male cosmetics.

The beauty business, like the fashion industry, thrives on newness to drive discovery, excitement and product trial. In addition to launching new products and extending categories, large beauty companies are strategically investing in small indie brands that delight beauty enthusiasts and often create the next “must-have” beauty product.

Estée Lauder

Minority and majority investments are frequently made by Estée Lauder as part of a build-or-buy strategy: smaller entrepreneurs can address niche markets and larger mature companies have the corporate knowhow and systems to grow a business. For instance, in February 2022, Estée Lauder made a minority investment in Haeckels, a UK-based beauty brand that sells haircare, skincare and fragrance products made from natural and locally sourced ingredients, including botanicals and seaweed.

Estée Lauder has also set up its venture arm, New Incubation Ventures (NIV), to invest in smaller niche and trending beauty companies. At the WWD Beauty CEO Summit in December 2021, Tracy Travis, CFO at Estée Lauder, said that the company set up NIV to invest in small, entrepreneurial businesses. “It’s a small group internally focused on finding those kernels of ideas that are really new and differentiated, providing some seed money to those entrepreneurs, and learning from them,” Travis said. She stated that the company is interested in “organic, clean, better-for-you products.”

L'Oréal

In December 2018, L'Oréal launched BOLD (Business Opportunities for L'Oréal Development), a corporate venture capital fund to take minority stakes in innovative startups with high growth potential. The fund will invest in new business models in marketing, R&I (research and innovation), digital, retail, communication, supply chain and packaging—and support the startups with L'Oréal’s expertise, networking and mentorship.

In May 2022, L’Oreal created BOLD Female Founders to invest in startups launched by women entrepreneurs, with an initial allocation of €25 million ($25.6 million).

Ulta Beauty

During the company’s first-quarter conference call, Kimball discussed the two virtual try-on tools that Ulta Beauty has launched—each powered by technology developed by companies it invested in through Ulta Beauty’s Digital Innovation Fund.

- GLAMlab Skin Advisor 2.0 is powered by global AI startup pot.ai. The skin-analysis technology enables Ulta Beauty to “provide guests with more accurate skin diagnosis.”

- GLAMlab hairstyle try-on is powered by Restyle, a beauty tech startup that uses AI and machine learning to enable virtual try-on of more than 50 different hair styles, including options by gender and texture, according to Ulta Beauty.

Walmart

Walmart launched its beauty brand accelerator program, Walmart Start, in early 2022. According to the company, the program is aimed at finding “the next big names in beauty—more specifically, five up-and-comers its customers can really get excited about.”

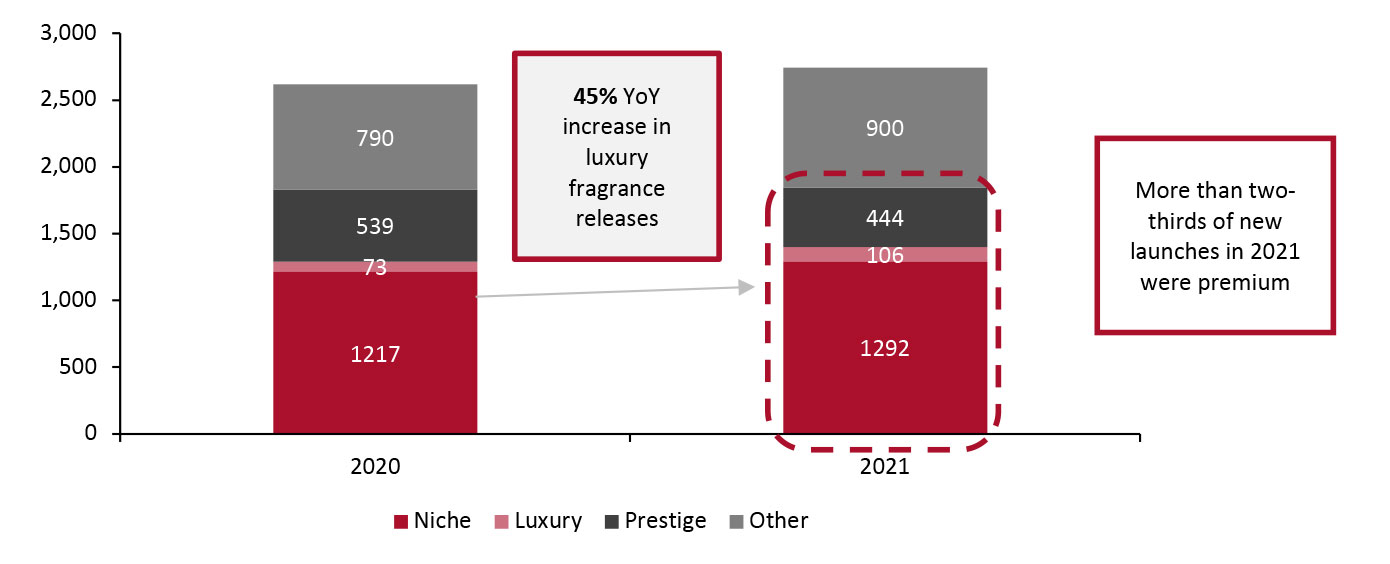

8. Premiumization in FragranceBetween 2016 and 2021, premium fragrance captured a growing share of the world’s fragrance market, growing from 60.3% of industry sales to 66.9%, according to Euromonitor International data. Coresight Research expects this trend to continue in the next five years, albeit at a slower pace, based on global demand for premium, luxury and niche fragrances and the market’s eagerness to meet this need with new fragrances and brand extensions.

Fragrance has become more meaningful to individuals’ lifestyles as a result of the pandemic, with many discovering the health, wellness and self-caring aspects of scent via fragrance products, including potpourri, candles and oils, as well as fragrance that is worn.

According to Fragrances of the World, fragrance launches in 2019 (pre-pandemic) numbered 3,727, dropping 29.7% to 2,619 in 2020. While launches were up 5.4% year over year in 2021 to 2,742, the total was still 985 launches short of 2019’s total. Still, more than two-thirds (67.2%) of new launches in 2021 were premium.

Figure 9. Global: Fragrance Launches, by Type [caption id="attachment_151781" align="aligncenter" width="700"]

Source: Fragrances of the World Quarterly Insights, April 2022 issue[/caption]

Source: Fragrances of the World Quarterly Insights, April 2022 issue[/caption]

We project that the premiumization of fragrance, new fragrance launches and increased penetration and usage will drive industry growth for the next five years, with premium fragrance brands outpacing mass fragrance brands and capturing a growing portion of the global fragrance market. As a result of increased demand for premium fragrances, new designers, brands and retailers will also be attracted to the category, further strengthening the market share of premium fragrances.

- For more on fragrance premiumization, read our separate report.

Technology is driving change in the beauty industry. From allowing brands to go DTC (direct to consumer) with e-commerce platforms and thus accessing a wealth of consumer data, to new products and services.

At Ulta Beauty, both online and in the app, virtual try-on enables shoppers to try thousands of products virtually, including mixing and matching multiple brands. AI and AR support customers as they search for the perfect foundation, using computer vision and face-scanning technology. Ulta Beauty also uses AI to power product replenishment recommendations for Ultamate Loyalty members and to personalize product recommendations. On the company’s first-quarter 2022 conference call, Kimball commented, “We introduced innovative AR and virtual reality experiences to support our launch of Fenty Beauty and r.e.m. Beauty.”

HydraFacial, part of The Beauty Health Company, uses patented technology to cleanse, extract and hydrate in a non-invasive manner. BeautyHealth is a business-to-business company, with 60% of its business selling to the medical community, and the remaining 40% to spas and retailers including Equinox, Nordstrom, Saks Fifth Avenue and Sephora.

HydraFacial has 20 patents, according to the company. It is a technical treatment to provide glowing skin; it is well positioned for the new definition of beauty discussed above. The minimum cost of the cleansing is $150 and with added serums and treatments, the total cost can easily approach $350 to $500, and the average usage is around four times per year, according to the company. Sephora offers a lower-cost Perk by HydraFacial at $60 that is designed for a younger client to drive early adoption.

On May 11, 2022, HydraFacial signed a partnership with JLo Beauty: HydraFacial’s President and CEO Andrew Stanleick told Coresight Research that the partnership boosts aided brand awareness by 9% and unaided brand awareness by 2%.

[caption id="attachment_151782" align="aligncenter" width="333"] The HydraFacial machine

The HydraFacial machine Source: CleanBeauty [/caption] 10. The Evolving Role of Celebrities and KOLs

By using celebrities as part of their marketing campaigns, brands can address a mass market and an engaged follower base. However, celebrity endorsement can seem shallow and self-serving, and today’s consumer demands authenticity.

A more authentic iteration of celebrity in beauty is with owned brands, where passion for the category resulted in the development of a product line/collection. Sarah Jessica Parker is an example of a fragrance lover who took her passion to Coty and developed a fragrance, Lovely, with the company in 2005. There are many other celebrity brands in beauty and wellness, including Gwyneth Paltrow with Goop, Michelle Pfeiffer with Henry Rose Fragrances, Jennifer Lopez with JLo Beauty, Kylie Jenner with Kylie Cosmetics, Rihanna with Fenty Cosmetics.

Social media influencers have also launched beauty and fashion brands. Examples include beauty influencers Huda Kattan’s launch of Huda Beauty and Camila Coelho’s launch of Elaluz. In China, where the role of KOLs (key opinion leaders) drive significant sales volumes for brands featured in livestreams, some KOLs are developing their own brands.

Again highlighting the emergence of virtual worlds and the metaverse, the latest iteration of influencers in beauty was launched by Olaplex, a technology-driven prestige haircare company, in May 2022. The company’s AI-inspired gender-neutral virtual team member and KOL is a composite of the 200-plus employee team on the basis of looks, personality and voice, according to Olaplex.

[caption id="attachment_151783" align="aligncenter" width="448"] Olaplex genderless virtual team member

Olaplex genderless virtual team member Source: CEW [/caption]

We expect the role of influencers in beauty to continue to evolve alongside the livestreaming channel and the metaverse, as consumers shift their lives online. Effectively using celebrities, influencers and virtual idols will be a key brand differentiator in the competitive online landscape moving forward.

What We Think

Consumers’ evolving relationship with beauty has deepened the connection to health and wellbeing, grounding beauty products in the concept of self. Brands need to understand and meet these new expectations to remain competitive and tap expanding consumer bases. We expect a focus on sustainability to also benefit brands and retailers in attracting environmentally minded shoppers.

Implications for Brands/Retailers

- Beauty brands and retailers should prepare for the next generation of beauty users and start exploring, testing and learning in the metaverse.

- Premiumization is a real trend in beauty; we see it in fragrance, skincare and haircare. Beauty brands should look to upscale their product offerings in line with this trend, presenting real opportunities to drive revenue through higher-ticket products.

Implications for Real Estate Firms

- With the expected growth of beauty experiences/services, including spa services such as HydraFacial, mall operators can provide space in shopping centers for a new beauty destination.

Implications for Technology Vendors

- Technology vendors should provide solutions for beauty brands to go DTC digitally.

- There is opportunity for technology providers to support shoppable livestreaming on beauty brands’ owned websites, such as by facilitating seamless payment options.

- Technology vendors can work with beauty brands to help them enter the metaverse, and create and implement a personalized metaverse brand strategy.

Source for all Euromonitor data: Euromonitor International Limited 2022 © All rights reserved