DIpil Das

On May 19, 2021, Deborah Weinswig, CEO and Founder of Coresight Research presented at the Bucharest Tech Week event, Romania’s largest networking and learning event for tech enthusiasts and thought leaders. Kicking off on May 18, 2021, more than 19,000 tech enthusiasts attended to hear from speakers spearheading the tech sector.

As part of the event’s Business Summit conferences, Weinswig’s virtual presentation focused on how brands and retailers can learn from and capitalize on the tech innovations that Coresight Research has identified as drivers in China’s e-commerce market.

In this report, we present insights from Weinswig’s presentation, covering China’s e-commerce market growth and Coresight Research’s 10 key e-commerce trends for 2021.

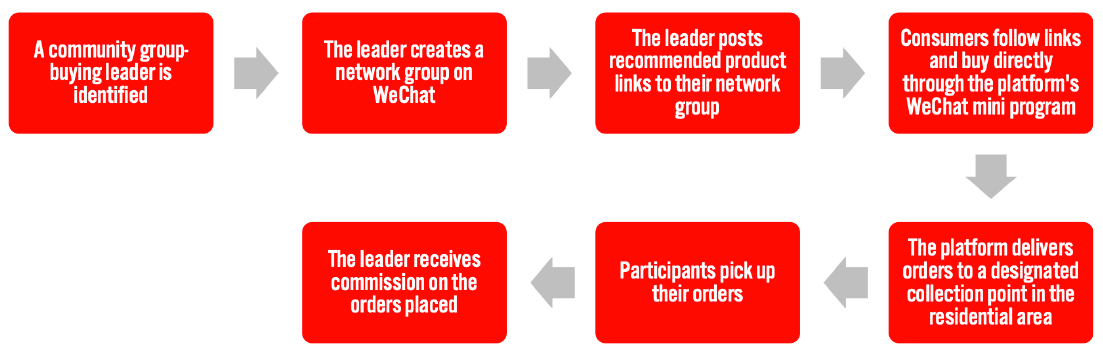

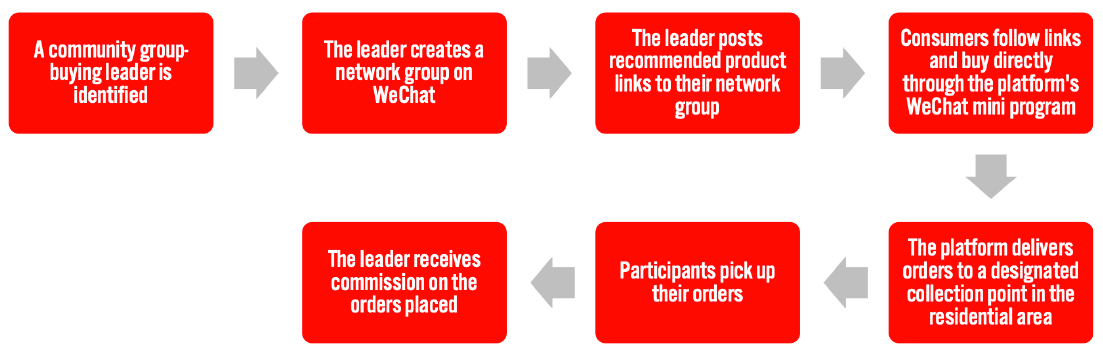

Figure 1. Community Group Buying via WeChat in China: The Consumer Journey [caption id="attachment_128255" align="aligncenter" width="725"] Source: Coresight Research[/caption]

Many Internet giants launched a community group-buying platform to gain market share in 2020. For instance:

Source: Coresight Research[/caption]

Many Internet giants launched a community group-buying platform to gain market share in 2020. For instance:

Bucharest Tech Week: In Detail

China’s E-Commerce Market Growth The total China e-commerce market has grown significantly over the past few years and is set to reach $1.7 trillion in 2021, we estimate from National Bureau of Statistics of China data. While China saw strong sales and increasing e-commerce penetration amid the coronavirus pandemic in 2020, market growth is also being driven by changes in consumer preferences and the introduction of innovative retail technologies adopted by the country’s major e-commerce players. China is ahead of the US in terms of advanced retail technologies and innovation, giving US retailers a lot to learn from China’s e-commerce market as key technology trends begin to move from east to west. Although China’s online sales have seen double-digit year-over-year growth over the past five years, growth has declined since 2017—reflecting the continued significance of physical stores in China. Weinswig discussed the online-offline retail relationship in China, referencing e-commerce giant Alibaba. Having opened its first physical grocery store (Freshippo) in China in 2015, the company leverages its physical grocery presence in customer acquisition—whereby converting brick-and-mortar grocery shippers into online shoppers reduces costs compared to acquiring new online customers through extensive marketing efforts. Below, we explore 10 key e-commerce trends in China, as identified by Coresight Research and discussed in Weinswig’s presentation. 10 Trends in China’s E-Commerce Market 1. Livestreaming Will Continue To Be an Effective Sales Channel The livestreaming market has grown significantly over the past few years. We expect livestreaming to become a valuable marketing tool for more brands following the coronavirus pandemic, helping their businesses become more agile and resilient. Coresight Research estimates that livestreaming e-commerce sales in China are set to reach approximately $300 billion in 2021 while livestreaming e-commerce sales in the US will reach approximately $11 billion this year. Going forward, we expect to see more Chinese retailers and brands hosting their livestreaming sessions, rather than working with KOLs (key opinion leaders) who use their influence to convince consumers to purchase products during a livestreaming session. With the shift to brands and retailers running their own sessions, we will see longer livestreams and hosts with more in-depth product knowledge to answer consumer questions in more detail than KOLs. Additionally, moving away from working with KOLs enables brands or retailers to save on the cost of commission paid to the KOL based on the livestream sales performance Going forward, we expect this greater flexibility to host to more frequent livestream sessions to give brands and retailers a better hand in their own product exposure. 2. Short-Video Platforms Will Capture Greater E-Commerce Market Share We believe that short video platforms such as Douyin and Kuaishou will capture a greater e-commerce market share going forward by enabling sales. Short-video platforms include user-generated content with shopping. Consumers are turning toward short video platforms for entertainment and fun, with many short-video apps recording a rising number of active users in China in 2020:- In September 2020, thenumber of monthly active users of Douyin reached 524 million, a year-over-year increase of 8.5%.

- The number of monthly active users on Kuaishou reached 408 million in the same month, a year-over-year increase of 20.4%.

Figure 1. Community Group Buying via WeChat in China: The Consumer Journey [caption id="attachment_128255" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Many Internet giants launched a community group-buying platform to gain market share in 2020. For instance:

Source: Coresight Research[/caption]

Many Internet giants launched a community group-buying platform to gain market share in 2020. For instance:

- Didi Chuxing, China’s largest ride-hailing platform, launched its community-group buying platform Chengxin Youxuan in June 2020.

- Pinduoduo launched its community group-buying service, Duo Maicai, in August 2020.

- Read Coresight Research’s Think Tank on community group buying.

- Suning.com established a New Retail unit, Yunwangwandian, in November 2020, aiming to provide its physical stores with a digital upgrade—including stores that will be able to use big data to plan inventory. The company also wants to attract merchants to join the initiative, to enhance and extend its supply chain system.

- On November 13, 2020, Skechers announced its cooperation with Alibaba Cloud. Alibaba Cloud will help the footwear retailer integrate sales and warehousing data from online and offline channels, and intelligently allocate goods to keep inventory in a dynamic balance.