albert Chan

2019 Set to See a More Dynamic China E-Commerce Market

We expect a dynamic year for e-commerce in China in 2019 following new regulations, new and growing forms of e-commerce, and escalating competition among giants.

Over the following pages, we outline our 10 trends in Chinese e-commerce and discuss how brands can capitalize on the changes we expect to see in 2019.

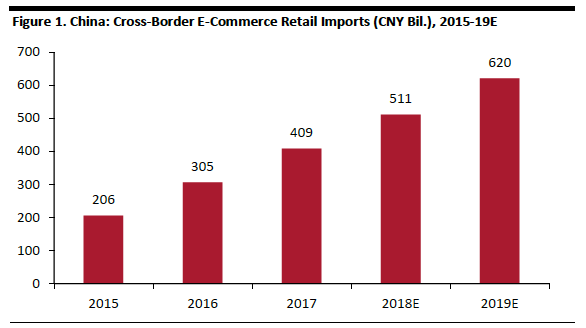

1. Demand for Quality Imported E-Commerce Goods Will Increase

China’s new e-commerce law, which came into effect January 1, 2019, raises the tax exemption limits for cross-border e-commerce purchases by Chinese consumers. Consumers in China can now spend up to ¥5,000 ($720) on a single transaction and pay no import tax, up from ¥2,000 ($288). Annual purchase limits rose to ¥26,000 ($3,780) from ¥20,000 ($2,900). Buying imported goods over e-commerce platforms is just as convenient as before since it is still regarded as for personal use, so no import licenses or registrations are required.

Under the new law, e-commerce platforms will also be liable if they sell counterfeit goods, along with the original sellers. We expect heightened supervision to guarantee the authenticity and quality of goods on online marketplaces.

Implications for Brands: We expect to see greater demand for imported goods through online channels, especially for luxury brands and big-ticket items as consumers take advantage of the higher purchase limits. Brands can diversify their assortment with more quality products to justify the price premium people pay for imported products. It also adds momentum to luxury brands’ ongoing expansion into e-commerce as more stringent rules on product authenticity will enhance consumers’ confidence in purchasing luxury goods online.

[caption id="attachment_67111" align="aligncenter" width="586"] Source: CBNData/China Internet Watch/Coresight Research[/caption]

Source: CBNData/China Internet Watch/Coresight Research[/caption]

2. Daigou Will Decline in the Face of the New E-Commerce Law

The new e-commerce law requires individuals or organizations selling goods or providing services on the Internet or other information networks to obtain business licenses and file tax returns. This means daigou agents (who buy goods overseas and bring them back for sale in China) will have to deal with more red tape and associated costs.

We expect the combination of life getting more difficult for daigou and it being easier for consumers to buy imported goods online will shrink the total daigou business.

Implications for Brands: As consumers increasingly buy through regulated channels, price differences for identical products in different channels will shrink. And, brands will be able to exercise greater influence over pricing, for example, offering discounts more often or tailoring specific campaigns to price-sensitive consumers.

[caption id="attachment_67110" align="aligncenter" width="584"] Australia’s pharmacy chain Chemist Warehouse

Australia’s pharmacy chain Chemist WarehouseSource: iStock[/caption]

3. Non-Tier-1 Cities Will Drive E-Commerce Growth

China’s non-tier-1 cities will be the key drivers for e-commerce growth as disposable income and Internet use rise outside the traditional centers of wealth. Consulting firm Mckinsey estimates that the proportion of the middle class residing in tier-1 cities will shrink from 40% in 2002 to just 16% in 2022. Tier-3 cities’ share will more than double from 15% to 31% during the same period.

Consumers in non-tier-1 cities are also potential targets for luxury brands. According to a joint study by Boston Consulting Group and Tencent in 2018, over half of luxury consumers in China live in less developed regions, outside the top 15 cities. Yet, there are relatively few brick-and-mortar luxury stores in non-tier-1 cities, which is dampening growth.

Implications for Brands: China’s non-tier-1 cities represent a growing opportunity. Group-buying e-commerce platform Pinduoduo has been successful by relying on more price-sensitive consumers in non-tier-1 cities, but consumers there still want — and are increasingly able to buy — premium goods. As the cost of living is lower in those cities, so rising incomes will deliver even more disposable income power. However, as many of these cities lack brick and mortar infrastructure from major brands, consumers are more likely to buy online. Understanding where and how they shop online is crucial for brands to tap into this emerging market.

[caption id="attachment_67109" align="aligncenter" width="574"] Sino-Ocean Taikoo Li shopping complex in Chengdu

Sino-Ocean Taikoo Li shopping complex in ChengduSource: Swire Properties[/caption]

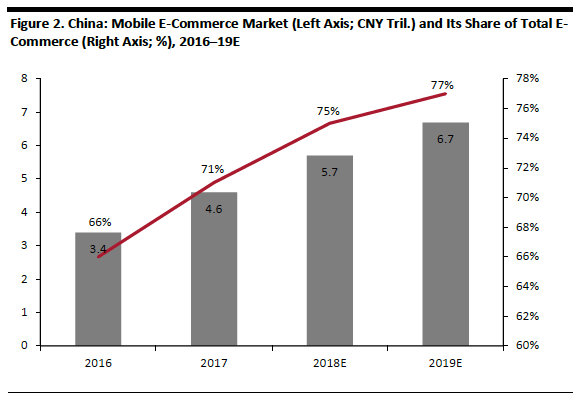

4. Shopping on Mobile Will Continue to Prevail

China’s consumers are more used to shopping on mobile phones than their global counterparts. According to consultancy PwC’s Total Retail 2017 survey, around 52% of respondents in China said they shop weekly on mobile phones, more than three times the only 14% of all respondents globally. Mobile Internet data services company iiMedia Research has estimated that China’s mobile e-commerce market will be worth ¥6.7 trillion this year, representing around 77% of the total e-commerce market.

Mobile accounted for 93.6% of total sales on all e-commerce platforms during the Singles’ Day 2018 online shopping festival, the largest annual online shopping festival in China, according to China-based data services company Syntun.

[caption id="attachment_67108" align="aligncenter" width="584"] Source: iiMedia Research/Coresight Research[/caption]

Source: iiMedia Research/Coresight Research[/caption]

Implications for Brands: A good user experience on mobile is increasingly important as consumers shop more on mobile. As consumers continue to shop on the go, they buy faster and more frequently. Brands should look at omni-channel opportunities to draw sales into physical stores from the online traffic or the other way around.

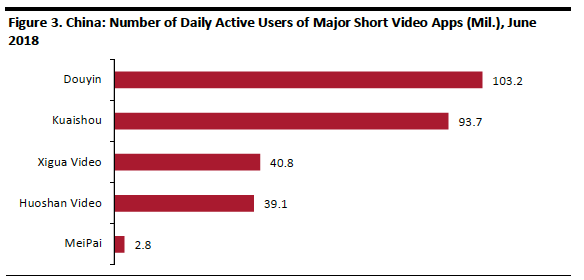

5. Short Video Apps Will Push Content E-Commerce

Content e-commerce refers to the combination of user-generated content and online purchase by monetizing high traffic from popular posts, articles or videos. Short video apps have become the major driver of content e-commerce in China. According to consulting firm iResearch, China’s short video app market will be worth ¥30 billion ($4.78 billion) by 2020.

Douyin, known as TikTok overseas, is the most widely used short video app both at home and abroad. TikTok surpassed Facebook, Instagram and YouTube to become the most downloaded non-game app in iOS App Store at 45.8 million times in the first quarter of 2018, according to app analytics firm Sensor Tower. As of June 2018, Douyin had the largest number of daily active users at 103.2 million amongst all domestic short video apps, according to the Miaozhen Douyin Report 2018.

[caption id="attachment_67107" align="aligncenter" width="584"] Source: Miaozhen Douyin Report 2018/WalkTheChat Analysis/Coresight Research[/caption]

Source: Miaozhen Douyin Report 2018/WalkTheChat Analysis/Coresight Research[/caption]

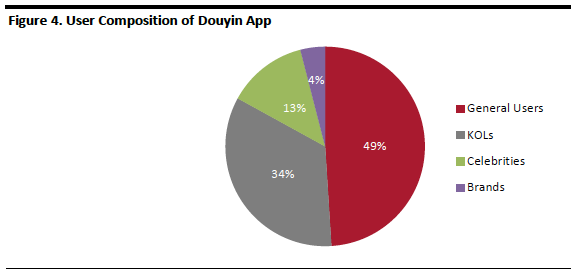

The general public and key opinion leaders (KOL) are the major users of the Douyin app. However, some brands have started using it for marketing campaigns. Michael Kors was the first luxury brand to partner with Douyin, leveraging KOLs to attract 30,000 Douyin users to post their own 15-second Michael Kors Catwalk videos. Since March 2018, Douyin has incorporated external links onto the accounts of content publishers with over one million followers to Alibaba’s Taobao marketplace, allowing users to purchase products featured in the short videos. We expect that this in-app purchase feature will become more prevalent.

[caption id="attachment_67106" align="aligncenter" width="576"] Source: Miaozhen Douyin Report 2018/WalkTheChat Analysis/Coresight Research[/caption]

Source: Miaozhen Douyin Report 2018/WalkTheChat Analysis/Coresight Research[/caption]

Implications for Brands: Short video apps are useful in targeting young consumers as the users and audience are mainly the post-90s and 00s generation. The video formats are convenient in grabbing audiences’ attention for new products and creating marketing buzz. Brands should identify target customer segments and understand which KOLs or celebrities reach them.

[caption id="attachment_67105" align="aligncenter" width="598"] Source: Douyin[/caption]

Source: Douyin[/caption]

6. WeChat Mini Programs Will Become More Popular as a Cost-Efficient Tool for Social Commerce

WeChat mini programs are mini applications that operate within Tencent’s social media app WeChat. Users can perform similar functions without having to download a separate app. WeChat mini programs have become more sophisticated over the last two years, and its lower production costs have attracted brands and third-party developers. As of June 2018, there were a million WeChat mini programs, according to WeChat parent company Tencent. Daily active users reached around 260 million, according to Aldzs.com, a WeChat mini programs research firm.

WeChat mini programs are light in capacity but still able to perform similar functions of native apps. For example, McDonald’s and KFC launched WeChat mini programs that allow customers to pay in-store, request delivery and accumulate loyalty points to redeem meals.

Brands can capitalize on WeChat’s over one billion active users to drive social commerce. For example, users of Starbucks’s mini program can purchase and send gift cards to their contacts on WeChat, which helps drive store traffic as recipients redeem the cards.

[caption id="attachment_67104" align="aligncenter" width="592"] Starbucks’s mini program

Starbucks’s mini programSource: Coresight Research[/caption] Implications for Brands: WeChat mini programs offer a new channel for brands to interact with customers, are less expensive and come packed with a variety of social media features a stand-alone app can hardly attain.

7. New Retail Will Increase with Greater Online-Offline Integration

New Retail, a concept created by Alibaba Executive Chairman Jack Ma, refers to the model of online-offline integration that involves mobile payments and a digitalized supply chain. We believe New Retail will increase, with greater offline-online integration in 2019. E-commerce platforms will continue to quicken the online-offline integration process. The e-commerce giants have extended the arena to setting up offline cross-border e-commerce smart stores:

- Alibaba set up its first offline Tmall Global store in Hangzhou in April 2018 featuring a range of imported goods. Shoppers living within five kilometers of the store can request same-day delivery after they shop in-store.

- JD.com set up its first cross-border e-commerce experiential center in November 2018 in Chongqing, the economic hub of China’s southwestern region. The experiential center features retailtainment with different zones including a playground for kids.

LingShouTong, Alibaba’s B2B intelligence services platform to help small businesses digitalize, announced in September 2018 that over one million mom-and-pop stores in China, around 10% of the total, have used its services.

[caption id="attachment_67103" align="aligncenter" width="588"] Store upgraded with LingShouTong’s services

Store upgraded with LingShouTong’s servicesSource: AlibabaNews.com[/caption]

Alibaba’s A100 partnership program, announced in January 2019, offers participating partners a one-stop solution to accelerate digital transformation by tapping into the entire Alibaba ecosystem. Some companies already participating include Starbucks, Nestlé, L'Oréal, P&G and Easyhome.

Implications for Brands: Online-offline retail integration will become increasingly commonplace in China. Brands must stand ready to serve customers wherever they choose to buy — and we think this will prompt more brands to seek collaborations with platforms and retailers to serve customers across channels.

8. Parcel Delivery Will be Faster. Brands Need to Adapt.

Chinese e-commerce platforms are expanding warehouse capacity to accommodate future demand for imported goods. Cainiao Network, Alibaba’s logistics subsidiary, announced its goal of having a total of 20 bonded warehouses and 10 overseas warehouses within three years.

Greater bonded warehouse capacity means e-commerce platforms and brands will be able to stock more imported goods locally, speeding delivery of online orders.

The Singles’ Day online shopping festival, which drove daily parcel volume to record highs, showed the system can handle volume – and do it even faster. Cainiao Network says it delivered the first 100 million parcels in just 2.6 days during Singles’ Day 2018, compared to 9 days for the same volume in 2013.

Implications for Brands: Parcel delivery will be faster in China with upgraded logistics infrastructure and increasing capacity at bonded warehouses. Same-day delivery will be possible for a broader range of products, which could prompt consumers to buy more frequently online. Companies can use data analytics to plan inventory with more predictable demand forecasts, can keep more inventory locally to deliver more quickly — but will face increasing consumer expectations for speedy delivery.

[caption id="attachment_67102" align="aligncenter" width="590"] Alibaba’s robotic warehouse

Alibaba’s robotic warehouseSource: Alizila.com[/caption]

9. Fresh-Food E-Commerce Will Gain Traction

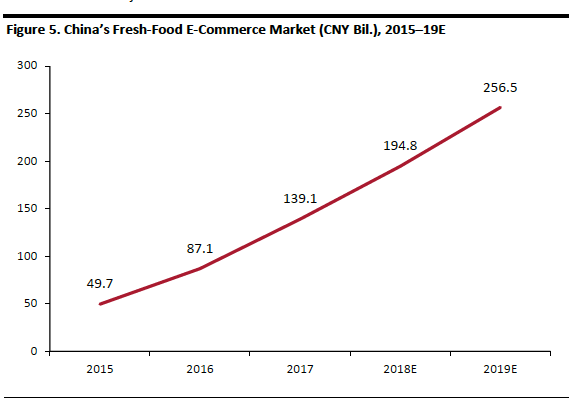

Fresh-food e-commerce in China developed rapidly in recent years. According to consulting firm iResearch, China’s fresh-food e-commerce market grew 180% to ¥139.1 billion in 2017, from ¥49.7 billion in 2015. The market is expected to reach ¥256.5 billion in 2019.

Traditional e-commerce players Alibaba and JD.com have opened their own fresh food supermarkets, Hema and 7Fresh respectively. Both can deliver fresh products to nearby customers within 30 minutes for customers within three kilometers. JD.com’s investment in cold chain logistics has enabled it to deliver imported fresh food within 48 hours.

Some fresh-food e-commerce specialists are growing, adding further competition. Miss Fresh, an e-commerce startup founded in 2014 that delivers fresh produce to 20 Chinese cities, raised $450 million in September 2018. Tencent was a major investor.

Implications for Brands: The fresh-food e-commerce market looks bright in China. High logistics costs will likely confine the fresh food delivery business to tier-1 and tier-2 cities which are more densely populated — and by people with busy lifestyles and income that lets them pay a premium for convenience.

10. Alibaba and JD.com Will Compete More Intensely in Luxury E-Commerce

China’s luxury e-commerce market will see increasing competition between Alibaba-backed Yoox Net-a-Porter and JD.com-invested Farfetch. Both are international luxury e-commerce platforms eager to establish a foothold in the China market.

Alibaba formed a strategic partnership with Swiss luxury group Richemont, parent of Yoox Net-A-Porter, in October 2018 to further tap into China’s luxury e-commerce market by launching localized mobile apps. Net-A-Porter and Mr Porter will also launch online stores on Alibaba’s Tmall Luxury Pavilion, a designated marketplace for luxury brands, under the partnership.

This poses a direct threat to Farfetch, in which JD.com invested to step up its high-end apparel business. Farfetch acquired Chinese digital marketing agency CuriosityChina in 2018 to launch WeChat stores with fashion brands. Tencent’s strategic partnership with JD.com will see the three players interconnected over the luxury front.

Farfetch listed on the New York Stock Exchange in September 2018, creating a boon in capital that strengthened the company’s ability to compete against Yoox Net-a-Porter.

Implications for Brands: Two blocs have come into shape in the fight over China’s luxury e-commerce market, with Alibaba pitted against JD.com and Tencent. Luxury brands are increasingly drawn to Chinese tech giants due to their huge customer base and stepped up control over product authenticity. Brands need to differentiate the roles of their own shopping sites and online stores on e-commerce platforms to prioritize resources.

Top Takeaways

The new e-commerce law in China will push up the demand for quality cross-border e-commerce goods and drive consumers to buy through official regulated channels. New forms of e-commerce are emerging, thriving on mobile, video formats and social networks. China’s e-commerce has deviated from a linear B2C model and become multidimensional. Investments, partnerships and upgraded technology will continue to drive e-commerce to wider geographies and sectors in China under the philosophy of New Retail.