albert Chan

2019: Prepare for Another Year of Retail Transformation

The retail industry has undergone a significant transformation over the past decade, and continues to evolve quickly. In 2019, the market will be defined by emerging technologies that change the way consumers interact with brands, by new engagement formats and channels, as retailers look to collaboration more with startups to future-proof their businesses.

By the end of 2019, we expect to see more data-driven personalized e-commerce and in-store experiences, smarter supply chains and further maturity of voice shopping, and augmented reality (AR) and virtual reality (VR) experiences.

Large companies are increasingly recognizing the enormous potential startup tech offers. We expect large retailers to continue to seek acquisition and partnerships with startup companies in 2019. Companies across multiple sectors have launched collaborative efforts to gather disruptive new ideas, harness new technologies and achieve competitive edge.

We’ve identified the top 10 tech trends for 2019 that we believe will drive and enable retail to become stronger and better equipped to serve evolving consumer demand, to understand consumer behavior and create increasingly customized offerings.

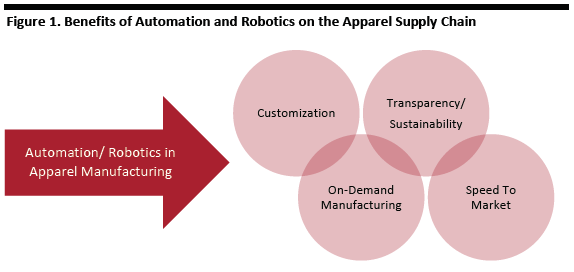

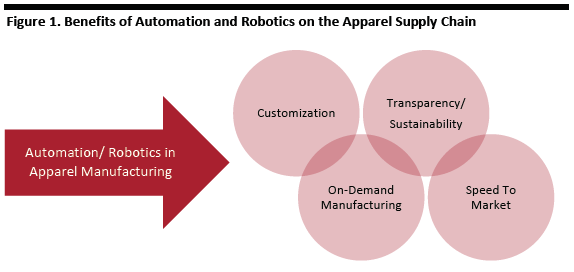

1. Tech, brands and retailers will work together to automate apparel manufacturing

Automation and the application of robotics in apparel manufacturing will accelerate in 2019, and collaboration between tech companies and brands and retailers will intensify. Some companies to watch include:

Source: Coresight Research[/caption]

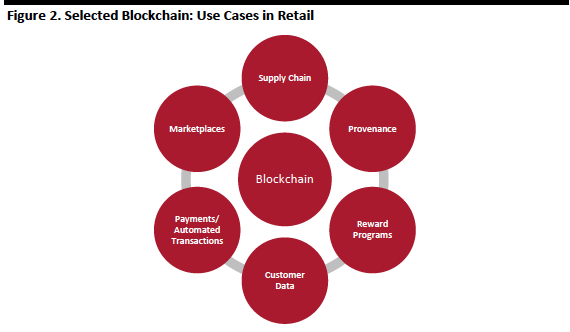

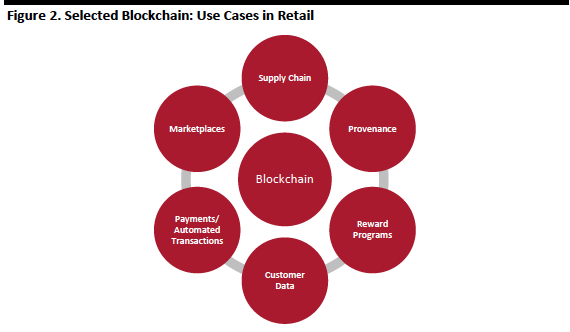

2. We’ll see an increase in blockchain in supply chain, e-commerce and CRM

In 2019, we expect blockchain technology to have a real impact on retailers’ operations, including supply chain and logistics, product provenance, e-commerce operations, payments, loyalty programs and customer data management. Retailers are already working on blockchain platforms, often in collaboration with technology firms. Some examples to watch include:

Source: Coresight Research[/caption]

2. We’ll see an increase in blockchain in supply chain, e-commerce and CRM

In 2019, we expect blockchain technology to have a real impact on retailers’ operations, including supply chain and logistics, product provenance, e-commerce operations, payments, loyalty programs and customer data management. Retailers are already working on blockchain platforms, often in collaboration with technology firms. Some examples to watch include:

Source: Coresight Research[/caption]

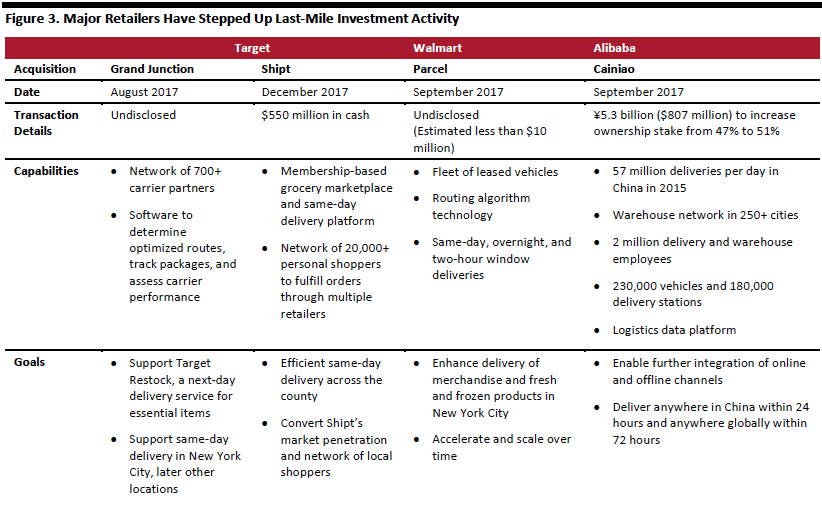

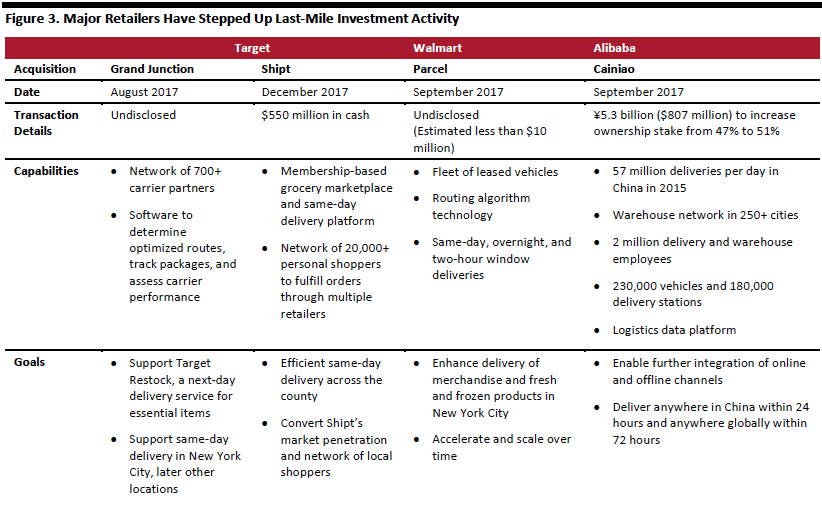

3. Last-mile delivery will proliferate as consumer expectations rise

Consumers have come to expect rapid and convenient service, and shipping costs and delivery times are an important factor in purchasing decisions. Retailers and logistics providers, vying for market share and looking to minimize costs, have responded by investing in last-mile innovation and infrastructure.

In 2019, we expect big retailers and brands to continue acquisitions, developing new technology in-house, while startups continue entering the space looking for partnerships. New models for flexible workers and advances in automation, particularly drone and robotics technology, are shaping the future of last-mile delivery.

Amazon, for example, reported shipping costs as a percentage of net sales increased from 10.7% in 2015 to 12.2% in 2017, and have grown significantly on an absolute basis as the company has scaled from $11.5 billion in 2015 to $21.7 billion in 2017. Much of these costs can be attributed to last mile delivery. The company aims to innovate at the tail end of the supply chain, in part by experimenting with bringing last-mile logistics in-house.

Source: Coresight Research[/caption]

3. Last-mile delivery will proliferate as consumer expectations rise

Consumers have come to expect rapid and convenient service, and shipping costs and delivery times are an important factor in purchasing decisions. Retailers and logistics providers, vying for market share and looking to minimize costs, have responded by investing in last-mile innovation and infrastructure.

In 2019, we expect big retailers and brands to continue acquisitions, developing new technology in-house, while startups continue entering the space looking for partnerships. New models for flexible workers and advances in automation, particularly drone and robotics technology, are shaping the future of last-mile delivery.

Amazon, for example, reported shipping costs as a percentage of net sales increased from 10.7% in 2015 to 12.2% in 2017, and have grown significantly on an absolute basis as the company has scaled from $11.5 billion in 2015 to $21.7 billion in 2017. Much of these costs can be attributed to last mile delivery. The company aims to innovate at the tail end of the supply chain, in part by experimenting with bringing last-mile logistics in-house.

Source: Company reports/Coresight Research[/caption]

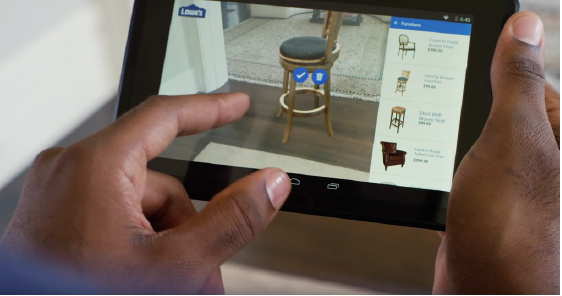

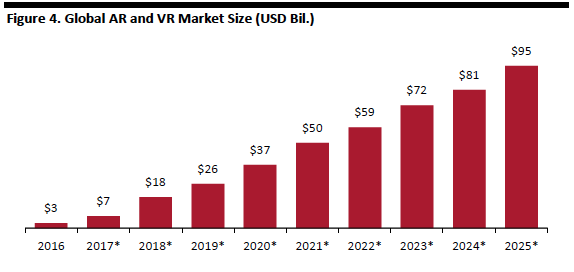

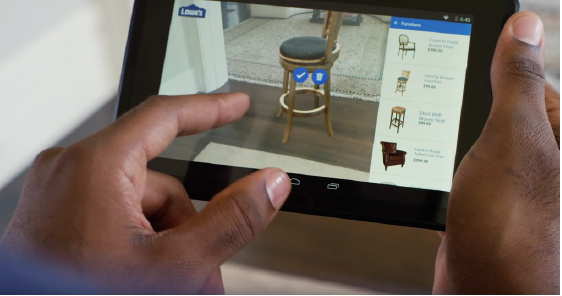

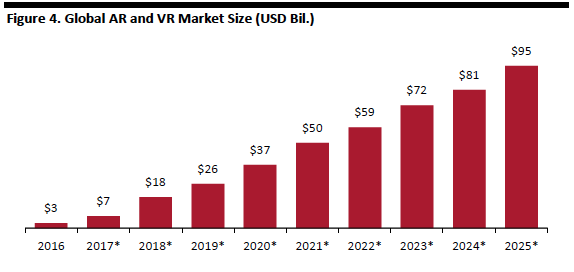

4. Reality technology will become more commonplace — and a disruptor

In 2019, XR-reality technology will change the way consumers interact with their favorite brands. The three types of reality technology are used to digitally simulate the user’s environment. AR enhances physical objects with digital content, VR simulates a completely virtual 3D environment, while MR combines the two by creating a VR environment in which physical objects are a part.

AR, VR and 3D technology will help both in-store and online retailers to enrich the research and discovery process in a consumer’s shopping journey. By partnering with the right technology providers, retailers can create innovative and immersive shopping experiences that will increase traffic as well as appeal to the digital-first millennial shopper.

We saw collaborations between tech companies and brands and retailers, and we expect this to intensify in 2019:

Source: Company reports/Coresight Research[/caption]

4. Reality technology will become more commonplace — and a disruptor

In 2019, XR-reality technology will change the way consumers interact with their favorite brands. The three types of reality technology are used to digitally simulate the user’s environment. AR enhances physical objects with digital content, VR simulates a completely virtual 3D environment, while MR combines the two by creating a VR environment in which physical objects are a part.

AR, VR and 3D technology will help both in-store and online retailers to enrich the research and discovery process in a consumer’s shopping journey. By partnering with the right technology providers, retailers can create innovative and immersive shopping experiences that will increase traffic as well as appeal to the digital-first millennial shopper.

We saw collaborations between tech companies and brands and retailers, and we expect this to intensify in 2019:

Lowe's Vision app

Lowe's Vision app

Source: Lowe’s YouTube channel[/caption] Startups will continue to disrupt the industry with innovative approaches to retail operations, including: Note: *Estimated

Note: *Estimated

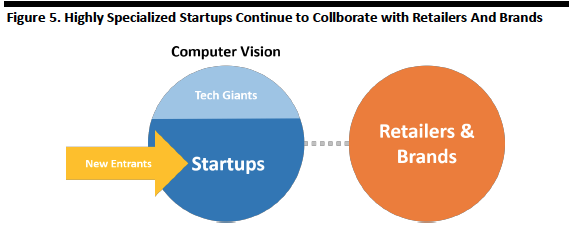

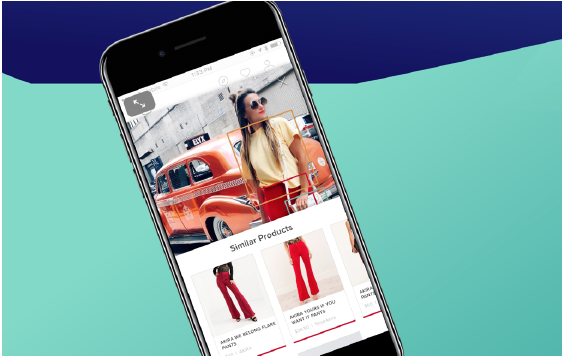

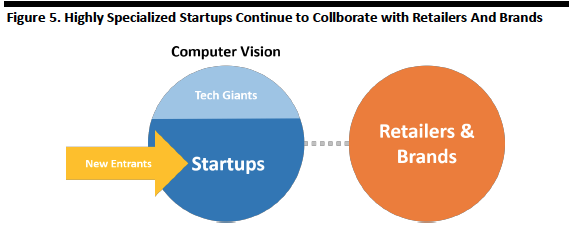

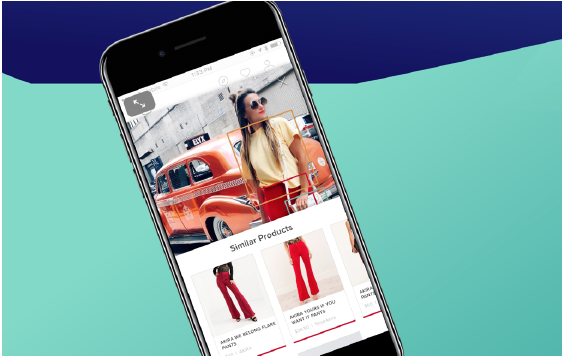

Source: World Economic Forum/Gartner[/caption] 5. Computer vision will be used more to improve e-commerce Computer vision has seen rapid growth in the last few years while AI is emerging as the preeminent new technology in retail. We expect to see more startups focus on computer vision in 2019, which can boost retail’s e-commerce business. Computer vision technology enables the faster identification of similar items that are in stock on a retailer’s website.This eliminates many of the problems inherent in keyword searches and offers results that are six times more accurate than Google text searches. It also lets retailers organize products better than they can by manually tagging with keywords. Since the products surfaced are directly related to the actual images searched, the items shown are more likely to interest shoppers. Tech giants such as Google, Microsoft and Amazon are already leveraging the power of computer vision technology in their services. Source: Coresight Research[/caption]

In 2019, we expect to see more retailers and brands adopt computer vision through collaborations with startups. Some companies to watch include:

Source: Coresight Research[/caption]

In 2019, we expect to see more retailers and brands adopt computer vision through collaborations with startups. Some companies to watch include:

Source: Markable.ai[/caption]

6. Retailers will use more data-driven models to increase personalization

Retailers and brands will be able to deliver a more personalized omnichannel shopping experiences for consumers using data on areas such as demographics, brand engagement, category trends and purchase spending. In 2019, we expect to see a growing number of startups focusing on data collection and data analytics on each stage of customer’s shopping journey.

For brick-and-mortar retailers, many have found that working with a start up is more cost-effective.

Source: Markable.ai[/caption]

6. Retailers will use more data-driven models to increase personalization

Retailers and brands will be able to deliver a more personalized omnichannel shopping experiences for consumers using data on areas such as demographics, brand engagement, category trends and purchase spending. In 2019, we expect to see a growing number of startups focusing on data collection and data analytics on each stage of customer’s shopping journey.

For brick-and-mortar retailers, many have found that working with a start up is more cost-effective.

Source: Coresight Research[/caption]

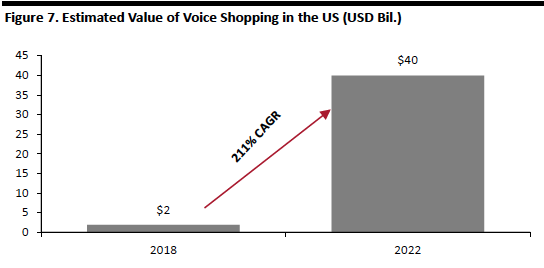

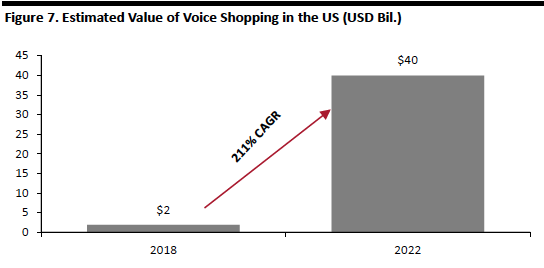

7. Voice search will become more commonplace

We expect to see more consumers purchase and use voice-enabled devices in their homes and for an increasing number of tasks. Voice search capabilities are becoming more refined every day, and large companies are incorporating the technology into any applicable device, from bathroom mirrors to microwaves. Amazon announced that it will build microwaves integrated with Alexa.

In September 2018, Amazon announced a dozen new Alexa-enabled products. Google, on the other hand, announced that its Google Assistant is compatatible with 10,000 smart devices across 1,000 brands, and it revealed several new products in October 2018.

However, voice shopping is not limited to devices specifically designed as personal assistants. According to a survey by Voicebot and Voysis in 2018, more than 50% of voice shopping is done through smartphones. Almost every smartphone can manage voice search and shopping, so the total voice shopping market in the U.S. has a base of well over half the country’s total population. According to OC&C Strategy Consultants, voice shopping generated an estimated $2 billion in revenue in the US in 2018, and this is estimated to grow at a 211% CAGR to $40 billion by 2022.

[caption id="attachment_64876" align="aligncenter" width="544"]

Source: Coresight Research[/caption]

7. Voice search will become more commonplace

We expect to see more consumers purchase and use voice-enabled devices in their homes and for an increasing number of tasks. Voice search capabilities are becoming more refined every day, and large companies are incorporating the technology into any applicable device, from bathroom mirrors to microwaves. Amazon announced that it will build microwaves integrated with Alexa.

In September 2018, Amazon announced a dozen new Alexa-enabled products. Google, on the other hand, announced that its Google Assistant is compatatible with 10,000 smart devices across 1,000 brands, and it revealed several new products in October 2018.

However, voice shopping is not limited to devices specifically designed as personal assistants. According to a survey by Voicebot and Voysis in 2018, more than 50% of voice shopping is done through smartphones. Almost every smartphone can manage voice search and shopping, so the total voice shopping market in the U.S. has a base of well over half the country’s total population. According to OC&C Strategy Consultants, voice shopping generated an estimated $2 billion in revenue in the US in 2018, and this is estimated to grow at a 211% CAGR to $40 billion by 2022.

[caption id="attachment_64876" align="aligncenter" width="544"] Source: OC&C Strategy Consultants/Coresight Research[/caption]

According to a recent Gartner study, roughly 50% of households currently have a voice enabled device, and the percentage is expected to reach 75% in 2020. The study also found that roughly 28% of US consumers use voice to shop currently, and that more than half of US teens use voice search daily. Some 83% of voice-assistant owners believe that using voice enabled technology makes it easier to find products.

Consumers will likely continue to use voice shopping most prominently for apparel, basic goods and entertainment, which will emphasize top recommended items, including private labels. We also expect more voice-based technology startups to enter the space. Some notable existing startups include:

Source: OC&C Strategy Consultants/Coresight Research[/caption]

According to a recent Gartner study, roughly 50% of households currently have a voice enabled device, and the percentage is expected to reach 75% in 2020. The study also found that roughly 28% of US consumers use voice to shop currently, and that more than half of US teens use voice search daily. Some 83% of voice-assistant owners believe that using voice enabled technology makes it easier to find products.

Consumers will likely continue to use voice shopping most prominently for apparel, basic goods and entertainment, which will emphasize top recommended items, including private labels. We also expect more voice-based technology startups to enter the space. Some notable existing startups include:

Source: Amazon[/caption]

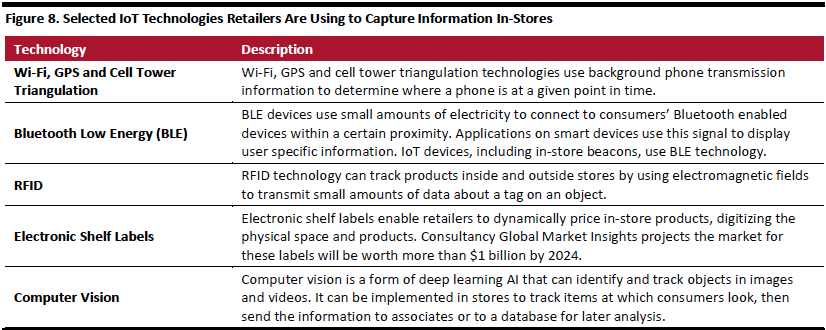

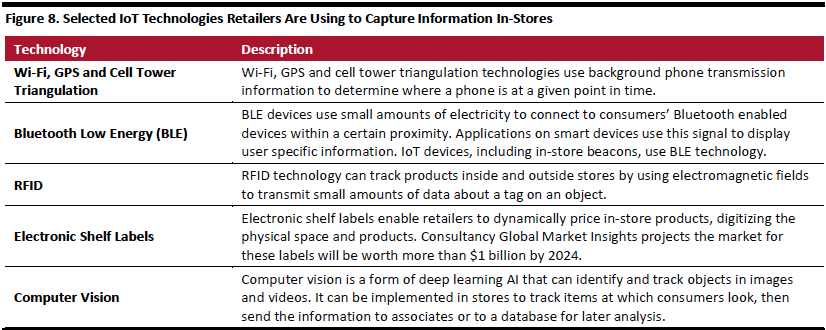

8. Companies will adopt more IoT technology to gather better in-store data

We expect to see a growing number of relatively large retailers partnering with or acquiring Internet of Things (IoT) focused startups. With an inlfux of sensor-based technology, we also expect to see medium and small retailers implement various IoT technologies in stores. Small format stores, including popups, will likely showcase more innovative IoT systems, but larger format stores will likely use the most scalable and intuitive products, including beacons, RFID-enabled products and electronic shelf labels with computer vision tracking.

Most estimates reveal that IoT will grow in the next few years as companies integrate it into their physical strategies. Transparency Market Research estimates that sales of the hardware and software relating to connected retail was valued at $19.5 billion in 2017, and could reach $82.3 billion by the end of 2025. And, according to an International Data Corporation (IDC) Tech Brief from IDC Retail Insights, more than 60% of retailers report having an IoT platform in place, and 85% reported that they would have one in the next 18 months

Source: Amazon[/caption]

8. Companies will adopt more IoT technology to gather better in-store data

We expect to see a growing number of relatively large retailers partnering with or acquiring Internet of Things (IoT) focused startups. With an inlfux of sensor-based technology, we also expect to see medium and small retailers implement various IoT technologies in stores. Small format stores, including popups, will likely showcase more innovative IoT systems, but larger format stores will likely use the most scalable and intuitive products, including beacons, RFID-enabled products and electronic shelf labels with computer vision tracking.

Most estimates reveal that IoT will grow in the next few years as companies integrate it into their physical strategies. Transparency Market Research estimates that sales of the hardware and software relating to connected retail was valued at $19.5 billion in 2017, and could reach $82.3 billion by the end of 2025. And, according to an International Data Corporation (IDC) Tech Brief from IDC Retail Insights, more than 60% of retailers report having an IoT platform in place, and 85% reported that they would have one in the next 18 months

Source: Coresight Research[/caption]

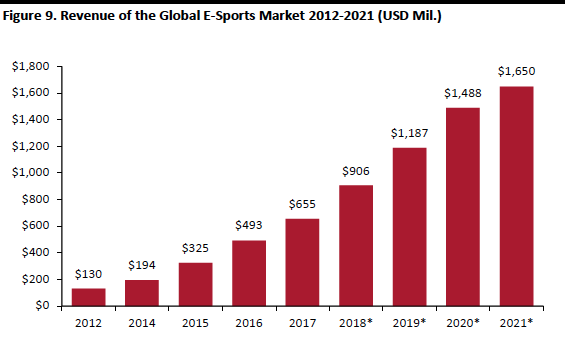

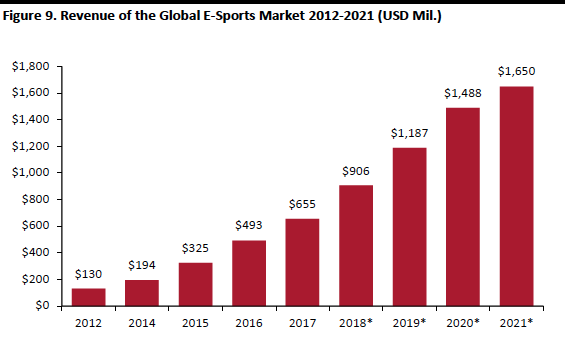

9. E-sport startups will get more funding

Worldwide, e-sports market revenue has increased nearly sevenfold between 2012 and 2018, and is estimated to reach $1.65 billion by 2021, according to market intelligence firm Newzoo. The U.S., Korea and China lead the way. Similarly, the global e-sports audience is expected to quadruple to approximately $550 million by 2021. Despite big players such as Tencent Gaming, Sony, and Blizzard Activision capturing the vast majority of the market, funding for e-sports startups continues to gain momentum.

Source: Coresight Research[/caption]

9. E-sport startups will get more funding

Worldwide, e-sports market revenue has increased nearly sevenfold between 2012 and 2018, and is estimated to reach $1.65 billion by 2021, according to market intelligence firm Newzoo. The U.S., Korea and China lead the way. Similarly, the global e-sports audience is expected to quadruple to approximately $550 million by 2021. Despite big players such as Tencent Gaming, Sony, and Blizzard Activision capturing the vast majority of the market, funding for e-sports startups continues to gain momentum.

Note: *Estimated

Note: *Estimated

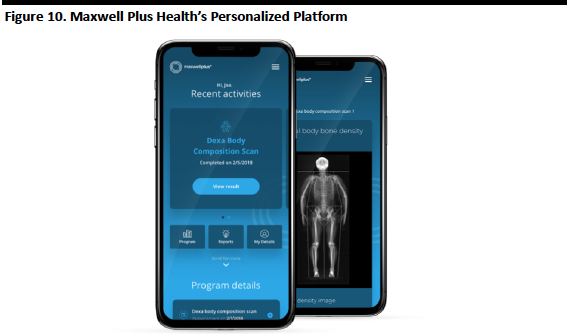

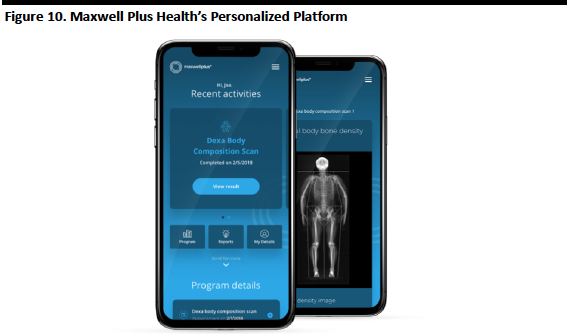

Source: Newzoo/esportsbets.com[/caption] 10. Healthtech will transform the consumer landscape AI may be deliver the greatest impact in healthcare, and healthcare is one of the most popular AI startup investment categories in terms of volume and total funding. Source: Maxwell Plus Health[/caption]

Source: Maxwell Plus Health[/caption]

- Grabit, a San Francisco Bay Area startup, is developing a technology that uses electroadhesion to handle fabrics. Using a technology that channels static cling and acts as a magnet to enable autonomous handling, the company built an auto-layering robot capable of handling textiles, automating and speeding production. Grabit is collaborating with sportswear giant Nike and Hong Kong textile firm Esquel Group.

- Softwear Automation developed Sewbot, a fully autonomous workline that can complete a t-shirt in half of the time required by manual sewing. Sourcing giant Li & Fung and Chinese apparel manufacturer Tianyun Garments are working with the U.S. tech firm to automate an apparel production line.

- Jeanologica, an apparel technology company based in Spain, is partnering with Levi Strauss to test a laser technology to automate the finishing phase in jeans production. Jenealogica’s technology cuts lead times and speeds the finishing phase of jeans manufacturing.

Source: Coresight Research[/caption]

2. We’ll see an increase in blockchain in supply chain, e-commerce and CRM

In 2019, we expect blockchain technology to have a real impact on retailers’ operations, including supply chain and logistics, product provenance, e-commerce operations, payments, loyalty programs and customer data management. Retailers are already working on blockchain platforms, often in collaboration with technology firms. Some examples to watch include:

Source: Coresight Research[/caption]

2. We’ll see an increase in blockchain in supply chain, e-commerce and CRM

In 2019, we expect blockchain technology to have a real impact on retailers’ operations, including supply chain and logistics, product provenance, e-commerce operations, payments, loyalty programs and customer data management. Retailers are already working on blockchain platforms, often in collaboration with technology firms. Some examples to watch include:

- Walmart has been working with IBM on a food-safety blockchain solution, seeking new ways improve food safety. The retailer announced that all leafy green vegetable suppliers must upload data to the blockchain starting September 2019.

- IBM is collaborating with other retailers including grocer Kroger to implement blockchain-based platforms for food supply chain tracking.

- Alibaba is using blockchain technology to track shipment information in cross-border operations, provenance of goods and to fight counterfeit products. Alibaba also provides Blockchain as a Service (BaaS) B2B platforms.

- Provenance enables retailers to provide transparency to shoppers by enabling them to access information — stored on a blockchain platform — about the provenance and the supply chain of products.

- Shopin works with retailers to give consumers ownership and control of their data through the blockchain.

- Loyyal gives retailers a blockchain-based platform that helps manage customers’ rewards and loyalty programs.

Source: Coresight Research[/caption]

3. Last-mile delivery will proliferate as consumer expectations rise

Consumers have come to expect rapid and convenient service, and shipping costs and delivery times are an important factor in purchasing decisions. Retailers and logistics providers, vying for market share and looking to minimize costs, have responded by investing in last-mile innovation and infrastructure.

In 2019, we expect big retailers and brands to continue acquisitions, developing new technology in-house, while startups continue entering the space looking for partnerships. New models for flexible workers and advances in automation, particularly drone and robotics technology, are shaping the future of last-mile delivery.

Amazon, for example, reported shipping costs as a percentage of net sales increased from 10.7% in 2015 to 12.2% in 2017, and have grown significantly on an absolute basis as the company has scaled from $11.5 billion in 2015 to $21.7 billion in 2017. Much of these costs can be attributed to last mile delivery. The company aims to innovate at the tail end of the supply chain, in part by experimenting with bringing last-mile logistics in-house.

Source: Coresight Research[/caption]

3. Last-mile delivery will proliferate as consumer expectations rise

Consumers have come to expect rapid and convenient service, and shipping costs and delivery times are an important factor in purchasing decisions. Retailers and logistics providers, vying for market share and looking to minimize costs, have responded by investing in last-mile innovation and infrastructure.

In 2019, we expect big retailers and brands to continue acquisitions, developing new technology in-house, while startups continue entering the space looking for partnerships. New models for flexible workers and advances in automation, particularly drone and robotics technology, are shaping the future of last-mile delivery.

Amazon, for example, reported shipping costs as a percentage of net sales increased from 10.7% in 2015 to 12.2% in 2017, and have grown significantly on an absolute basis as the company has scaled from $11.5 billion in 2015 to $21.7 billion in 2017. Much of these costs can be attributed to last mile delivery. The company aims to innovate at the tail end of the supply chain, in part by experimenting with bringing last-mile logistics in-house.

- Amazon Flex was launched in 2015 and now operates in more than 50 cities.

- More recently, the company launched Amazon Delivery Service Partners to support entrepreneurs launch businesses to deliver Amazon packages.

- Deliv provides a same-day delivery solution to retailers and businesses and solves issues of irregular demand and capacity by emlpoying workers willing to work unpredictable schedules. The company aims to make deliveries in as fast as an hour, relying on a network of individual couriers. Clients include Macy’s, Bloomingdales, Bloom That, Best Buy, Office Depot and PetSmart, along with others.

- Hitch is building a crowdsourced solution for same-day delivery. The company operates an app that connects shippers with travelers who are already headed along a package’s intended route.

- Starship Technologies aims to enhance delivery through a combination of mobile technology, robots and a local hub system. The robots are roughly half the size of a sidewalk square and are equipped to deliver packages within a two-mile radius. Along with its most recent funding round of $25 million competed in June 2018 (totalling $42.5 million), the company appointed former AirBNB executive Lex Bayer as CEO.

- Nuro makes a self-driving vehicle for local goods. In late 2018, Kroger announced a partnership with Nuro under which the R1 delivery robot, an on-road vehicle that can carry 12 large grocery bags, to deliver groceries to customers in Scottsdale, Arizona. Customers can pay a $5.95 flat rate for same-day or next-day delivery.

- The company already partnered with Kroger on one delivery pilot. The company has raised $92 million in funding.

- Through its logistics arm Cainiao, in May 2018 Alibaba launched the G Plus, a road delivery robot that uses laser technology for navigation.

- JD.com began testing robot delivery in Beijing in June 2018, primarily to cut labor costs for last-mile delivery.

- JD.com operates an innovation lab in China called JDX, which focuses largely on last-mile logistics technology, including drones.

- Google parent company Alphabet is taking a macro approach to drone technology through Project Wing, run through its innovation arm, X. The program seeks to enable a high volume of drones from different operators to share the skies.

Source: Company reports/Coresight Research[/caption]

4. Reality technology will become more commonplace — and a disruptor

In 2019, XR-reality technology will change the way consumers interact with their favorite brands. The three types of reality technology are used to digitally simulate the user’s environment. AR enhances physical objects with digital content, VR simulates a completely virtual 3D environment, while MR combines the two by creating a VR environment in which physical objects are a part.

AR, VR and 3D technology will help both in-store and online retailers to enrich the research and discovery process in a consumer’s shopping journey. By partnering with the right technology providers, retailers can create innovative and immersive shopping experiences that will increase traffic as well as appeal to the digital-first millennial shopper.

We saw collaborations between tech companies and brands and retailers, and we expect this to intensify in 2019:

Source: Company reports/Coresight Research[/caption]

4. Reality technology will become more commonplace — and a disruptor

In 2019, XR-reality technology will change the way consumers interact with their favorite brands. The three types of reality technology are used to digitally simulate the user’s environment. AR enhances physical objects with digital content, VR simulates a completely virtual 3D environment, while MR combines the two by creating a VR environment in which physical objects are a part.

AR, VR and 3D technology will help both in-store and online retailers to enrich the research and discovery process in a consumer’s shopping journey. By partnering with the right technology providers, retailers can create innovative and immersive shopping experiences that will increase traffic as well as appeal to the digital-first millennial shopper.

We saw collaborations between tech companies and brands and retailers, and we expect this to intensify in 2019:

- Macy’s implemented VR in the furniture departments at 60 of its 650 stores. The brand’s VR experience — powered by Marxent’s 3D Cloud — allows customers to virtually design and view the interiors of rooms.

- Lowe's Vision app, partnered with Google and Lenovo, enables customers to easily measure any room in their home with the touch of a finger, and style it with virtual Lowe's products in real-time through AR.

Lowe's Vision app

Lowe's Vision appSource: Lowe’s YouTube channel[/caption] Startups will continue to disrupt the industry with innovative approaches to retail operations, including:

- Avametric enables brands to build virutal dressing rooms, enabling customers to “try on” clothes at home. Shoppers enter body measurement into the app and it projects a 3D model of their body with the clothes. Avametric has built virtual dressing rooms for big retail brands such as Gap, Ann Taylor and Alternative Apparel. In October 2018, industry-leading software and automation company Gerber Technologies acquired Acametric.

- Augment is a mobile app that enable users to visualize the retailer’s online catalogue through AR, in real time and in their actual size and environment. The company has worked with Microsoft, Coca Cola, Unilever and others.

- Magic Leap, which now has received almost $2 billion in funding and has a reported valuation of $6 billion, is building AR hardware. In 2018, AT&T announced a strategic investment in Magic Leap, which already includes backers such as Google, Alibaba and Axel Springer.

- Sephora and Estée Lauder partnered with AR beauty tech startup Modiface to create a custom AR beauty app. The AR feature allows users to upload a selfie to virtually try on various products that can then be purchased. Similarly, beauty giant L'Oréal purchased AR beauty tech startup Modiface in 2018 to luanch a tool that allows consumers to virtually try on makeup.

Note: *Estimated

Note: *EstimatedSource: World Economic Forum/Gartner[/caption] 5. Computer vision will be used more to improve e-commerce Computer vision has seen rapid growth in the last few years while AI is emerging as the preeminent new technology in retail. We expect to see more startups focus on computer vision in 2019, which can boost retail’s e-commerce business. Computer vision technology enables the faster identification of similar items that are in stock on a retailer’s website.This eliminates many of the problems inherent in keyword searches and offers results that are six times more accurate than Google text searches. It also lets retailers organize products better than they can by manually tagging with keywords. Since the products surfaced are directly related to the actual images searched, the items shown are more likely to interest shoppers. Tech giants such as Google, Microsoft and Amazon are already leveraging the power of computer vision technology in their services.

- Google’s Lens technology and Microsoft’s Bing Intelligent Search enable smartphone cameras to identify and search for objects based on how they look.

- Amazon has implemented computer vision in its apparel and accessories division. In addition, imaged-focused websites such as Pinterest and Shutterstock have also developed computer vision applications.

- In 2017, Target partnered with Pinterest, which uses its Lens Technology to add a visual search tool to Target’s app and website.

- In 2018, IKEA integrated visual search capability into its shopping app powered by Grokstyle, a startup focusing on visual AI for retail.

Source: Coresight Research[/caption]

In 2019, we expect to see more retailers and brands adopt computer vision through collaborations with startups. Some companies to watch include:

Source: Coresight Research[/caption]

In 2019, we expect to see more retailers and brands adopt computer vision through collaborations with startups. Some companies to watch include:

- Slyce, a visual recognition company, which has partnered with at least 50 companies to date, including Tommy Hilfiger.

- Markable.ai, which provides computer vision-based visual-recognition application programming interfaces (APIs) and software development kits (SDKs) to brands and retailers.

- Screenshop, which offers a new solution to shop exact and similar looks from a social media feed by turning screenshots into custom catalogs of products.

- Syte.ai develops visual search solutions for retailers, publishers, influencers and consumers with a focus on fashion products.

- Cortexica provides AI-based visual search, video analytics and image recognition to retailers, pharma and manufacturing.

Source: Markable.ai[/caption]

6. Retailers will use more data-driven models to increase personalization

Retailers and brands will be able to deliver a more personalized omnichannel shopping experiences for consumers using data on areas such as demographics, brand engagement, category trends and purchase spending. In 2019, we expect to see a growing number of startups focusing on data collection and data analytics on each stage of customer’s shopping journey.

For brick-and-mortar retailers, many have found that working with a start up is more cost-effective.

Source: Markable.ai[/caption]

6. Retailers will use more data-driven models to increase personalization

Retailers and brands will be able to deliver a more personalized omnichannel shopping experiences for consumers using data on areas such as demographics, brand engagement, category trends and purchase spending. In 2019, we expect to see a growing number of startups focusing on data collection and data analytics on each stage of customer’s shopping journey.

For brick-and-mortar retailers, many have found that working with a start up is more cost-effective.

- For in-store shopping, retailers such as Saks Fifth Avenue, Kate Spade and Coach, worked with Tulip, an in-store informational data provider, to deliver personalized shopping experiences and improved customer service by collecting detailed data on products, customer information and shopping habits.

- For post-purchase, Tommy Hilfiger launched a new line called XPLORE with Awear Solutions, which develops smart chips embedded in the clothes. The XPLORE allows wearers to earn rewards points as they navigate to different locations and collect Hilfiger icons. At the same time, the chips enable retailers to collect data points by tracking the product after it leaves the store.

- Radius8 has created a platform that empowers retailers to dynamically merchandise online using data on physical stores and local market intelligence to provide contextual discovery for shoppers.

- Spring Marketplace tracks point-of-sale (POS) data from customers’ credit card shopping, then analyzes the data to offer personalized rewards and promotions to each customer.

- Adrich collects post purchase use information through it’s smart packaging hardware. It helps retailers and brands personalize services, supporting consumer retention, sales and loyalty.

- Personali enables retailers to target shoppers with intelligent, personalized incentives that impact purchasing decisions through a machine learning algorithm based on behavior economics.

- Monetate helps retailers and brands launch personalized marketing campaigns, choosing content and products in real-time.

Source: Coresight Research[/caption]

7. Voice search will become more commonplace

We expect to see more consumers purchase and use voice-enabled devices in their homes and for an increasing number of tasks. Voice search capabilities are becoming more refined every day, and large companies are incorporating the technology into any applicable device, from bathroom mirrors to microwaves. Amazon announced that it will build microwaves integrated with Alexa.

In September 2018, Amazon announced a dozen new Alexa-enabled products. Google, on the other hand, announced that its Google Assistant is compatatible with 10,000 smart devices across 1,000 brands, and it revealed several new products in October 2018.

However, voice shopping is not limited to devices specifically designed as personal assistants. According to a survey by Voicebot and Voysis in 2018, more than 50% of voice shopping is done through smartphones. Almost every smartphone can manage voice search and shopping, so the total voice shopping market in the U.S. has a base of well over half the country’s total population. According to OC&C Strategy Consultants, voice shopping generated an estimated $2 billion in revenue in the US in 2018, and this is estimated to grow at a 211% CAGR to $40 billion by 2022.

[caption id="attachment_64876" align="aligncenter" width="544"]

Source: Coresight Research[/caption]

7. Voice search will become more commonplace

We expect to see more consumers purchase and use voice-enabled devices in their homes and for an increasing number of tasks. Voice search capabilities are becoming more refined every day, and large companies are incorporating the technology into any applicable device, from bathroom mirrors to microwaves. Amazon announced that it will build microwaves integrated with Alexa.

In September 2018, Amazon announced a dozen new Alexa-enabled products. Google, on the other hand, announced that its Google Assistant is compatatible with 10,000 smart devices across 1,000 brands, and it revealed several new products in October 2018.

However, voice shopping is not limited to devices specifically designed as personal assistants. According to a survey by Voicebot and Voysis in 2018, more than 50% of voice shopping is done through smartphones. Almost every smartphone can manage voice search and shopping, so the total voice shopping market in the U.S. has a base of well over half the country’s total population. According to OC&C Strategy Consultants, voice shopping generated an estimated $2 billion in revenue in the US in 2018, and this is estimated to grow at a 211% CAGR to $40 billion by 2022.

[caption id="attachment_64876" align="aligncenter" width="544"] Source: OC&C Strategy Consultants/Coresight Research[/caption]

According to a recent Gartner study, roughly 50% of households currently have a voice enabled device, and the percentage is expected to reach 75% in 2020. The study also found that roughly 28% of US consumers use voice to shop currently, and that more than half of US teens use voice search daily. Some 83% of voice-assistant owners believe that using voice enabled technology makes it easier to find products.

Consumers will likely continue to use voice shopping most prominently for apparel, basic goods and entertainment, which will emphasize top recommended items, including private labels. We also expect more voice-based technology startups to enter the space. Some notable existing startups include:

Source: OC&C Strategy Consultants/Coresight Research[/caption]

According to a recent Gartner study, roughly 50% of households currently have a voice enabled device, and the percentage is expected to reach 75% in 2020. The study also found that roughly 28% of US consumers use voice to shop currently, and that more than half of US teens use voice search daily. Some 83% of voice-assistant owners believe that using voice enabled technology makes it easier to find products.

Consumers will likely continue to use voice shopping most prominently for apparel, basic goods and entertainment, which will emphasize top recommended items, including private labels. We also expect more voice-based technology startups to enter the space. Some notable existing startups include:

- Voysisis a voice AI platform startup based in Ireland that hopes to become the default company to help third party companies integrate voice technology. The company claims to have shrunk the amount of processing power needed for Wavenets, a type of text-to-speech technology that closely mimics human speaking patterns.

- The Alexa Acceleratorstartups that are specifically focused on utilizing Amazon’s Alexa Skills Kit (ASK), Alexa Voice Services (AVS), Amazon Web Services (AWS) and Amazon Launchpad. Techstars powers the accelerator, and the group is a partnership with Amazon’s Alexa Fund.

Source: Amazon[/caption]

8. Companies will adopt more IoT technology to gather better in-store data

We expect to see a growing number of relatively large retailers partnering with or acquiring Internet of Things (IoT) focused startups. With an inlfux of sensor-based technology, we also expect to see medium and small retailers implement various IoT technologies in stores. Small format stores, including popups, will likely showcase more innovative IoT systems, but larger format stores will likely use the most scalable and intuitive products, including beacons, RFID-enabled products and electronic shelf labels with computer vision tracking.

Most estimates reveal that IoT will grow in the next few years as companies integrate it into their physical strategies. Transparency Market Research estimates that sales of the hardware and software relating to connected retail was valued at $19.5 billion in 2017, and could reach $82.3 billion by the end of 2025. And, according to an International Data Corporation (IDC) Tech Brief from IDC Retail Insights, more than 60% of retailers report having an IoT platform in place, and 85% reported that they would have one in the next 18 months

Source: Amazon[/caption]

8. Companies will adopt more IoT technology to gather better in-store data

We expect to see a growing number of relatively large retailers partnering with or acquiring Internet of Things (IoT) focused startups. With an inlfux of sensor-based technology, we also expect to see medium and small retailers implement various IoT technologies in stores. Small format stores, including popups, will likely showcase more innovative IoT systems, but larger format stores will likely use the most scalable and intuitive products, including beacons, RFID-enabled products and electronic shelf labels with computer vision tracking.

Most estimates reveal that IoT will grow in the next few years as companies integrate it into their physical strategies. Transparency Market Research estimates that sales of the hardware and software relating to connected retail was valued at $19.5 billion in 2017, and could reach $82.3 billion by the end of 2025. And, according to an International Data Corporation (IDC) Tech Brief from IDC Retail Insights, more than 60% of retailers report having an IoT platform in place, and 85% reported that they would have one in the next 18 months

- Walmart reportedly deployed IoT sensors in 5,000 of its stores in the U.S. in 2017, and the company signed a five-year strategic agreement with Microsoft to use Azure cloud computing, in part, for its growing IoT network.

- Target, Lululemon and Levi Strauss have reported IoT-related improvements in inventory, accuracy and fulfillment in their store processes, according to the Journal of Retail Analytics from Northwestern University’s Retail Analytics Council.

- Startups, such as InReality, partner with retailers to install sensors, provide analytics and insights and help implement responsive technology for the retailers. The responsive technologies include digital screens, interactive sound, changes in lighting and sales associate alerts.

Source: Coresight Research[/caption]

9. E-sport startups will get more funding

Worldwide, e-sports market revenue has increased nearly sevenfold between 2012 and 2018, and is estimated to reach $1.65 billion by 2021, according to market intelligence firm Newzoo. The U.S., Korea and China lead the way. Similarly, the global e-sports audience is expected to quadruple to approximately $550 million by 2021. Despite big players such as Tencent Gaming, Sony, and Blizzard Activision capturing the vast majority of the market, funding for e-sports startups continues to gain momentum.

Source: Coresight Research[/caption]

9. E-sport startups will get more funding

Worldwide, e-sports market revenue has increased nearly sevenfold between 2012 and 2018, and is estimated to reach $1.65 billion by 2021, according to market intelligence firm Newzoo. The U.S., Korea and China lead the way. Similarly, the global e-sports audience is expected to quadruple to approximately $550 million by 2021. Despite big players such as Tencent Gaming, Sony, and Blizzard Activision capturing the vast majority of the market, funding for e-sports startups continues to gain momentum.

- Mobcrush, a California technology and entertainment company, provides a live streaming app and community for gamers, powered by one touch mobile broadcasting. Users can broadcast their gameplay through various online social media platforms, and attract sponsorship opportunities ranging from $15 to $2,500 per hour.

- Matcherino, a U.S.-based company, provides advertising solutions that enhance a brand’s awareness, conversion, customer engagement, and ROI across the most popular gaming titles and tournaments. Instead of brands buying banner ads on e-sports tournaments, Matcherino gives a micro-donation to a tournament of the brand’s choice each time a fan interacts with a brand, and provides sponsorship analysis tools.

- Dojo Madness is an e-sports startup from Berlin that harnesses the power of big data to build tools and services that help players and fans understand and master e-sports games. It provides virtual coaches, personalized guidance and performance analysis, tips, and advanced tactical analytics and data visualizations.

Note: *Estimated

Note: *EstimatedSource: Newzoo/esportsbets.com[/caption] 10. Healthtech will transform the consumer landscape AI may be deliver the greatest impact in healthcare, and healthcare is one of the most popular AI startup investment categories in terms of volume and total funding.

- Propeller Health is a U.S. tech company that has developed smart, digitallyconnected products that can more effectively treat chronic conditions such as asthma and COPD by helping users understand symptoms and triggers, and adhere to medication plans. Propeller Health has received investment from McKesson, 3M and Walgreens, among others.

- FetchMD is an app platform that connects individuals and employers to healthcare professionals to schedule same-day house call appointments for a flat fee of $119 per visit. FetchMD has partnered with H-E-B Pharmacy, and is the first company to match consumers to a network of independent advanced practice clinicians.

- Maxwell Plus Health, an Australian medical technology company that uses AI to combine test results from dexa body composition scans, DNA analysis, blood tests, microbiome tests, and MRIs to generate personalized health profiles and proactive health recommendations. Clinical research partners include GE, Southern Radiology and St. Vincent’s Hospital, among others.

- Applied VR, a Loas Angeles-based company, has created a therapeutic virtual reality platform to alleviate chronic and acute pain, stress and anxiety patients may experience throughout healthcare experiences or during certain procedures. Partners include Boston Children’s Hospital, Hospital For Special Surgery and Cedars-Sinai, among others.

Source: Maxwell Plus Health[/caption]

Source: Maxwell Plus Health[/caption]