albert Chan

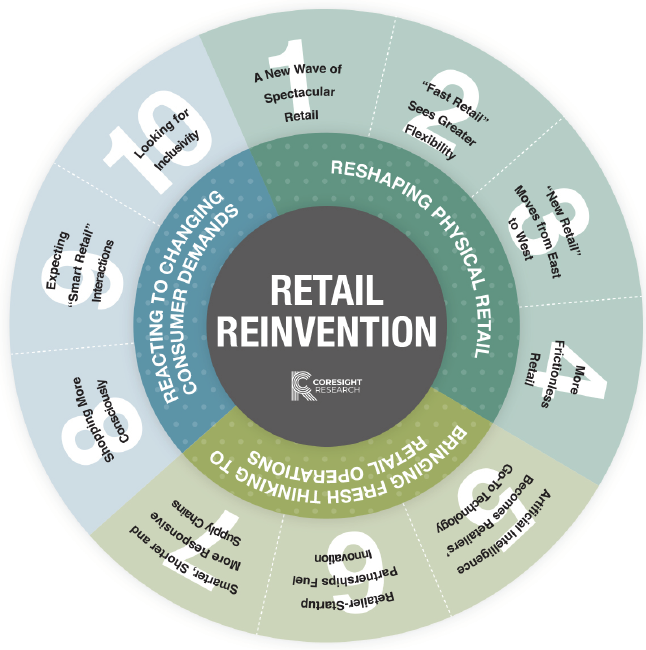

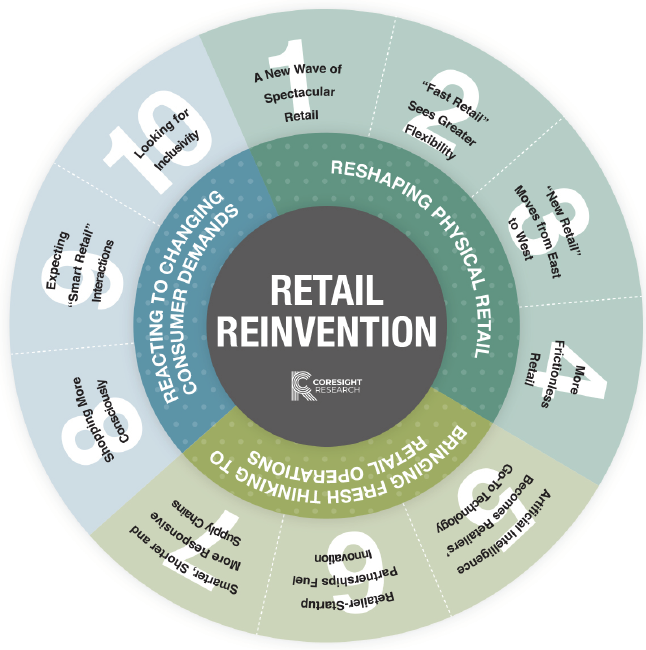

2019: Prepare for a Year of Retail Reinvention

Get ready for better stores and better retailing. We expect 2019 to be a year of reinvention — and not just for the retail sector as a whole, but for physical stores in particular. As we outline over the following pages, we anticipate that the year will be marked by spectacular retail, fast retail and smart retail.

By the end of 2019, we expect to see spectacular new flagships, many more online-to-offline ventures and smarter supply chains. We also anticipate that companies will embed artificial intelligence across retail functions, yielding improved communications and better experiences for customers, while enabling smarter decisions on inventories and pricing. The result will be a global retail sector that is stronger and better equipped to serve rising consumer expectations.

Over the following pages, we outline our 10 retail trends for 2019, sponsored by Prevedere, EnterWorks and Norihiro Kondo’s Silicon Valley New Business Development Center of Panasonic Ventures.

1. Cities Will See More Spectacular Retail

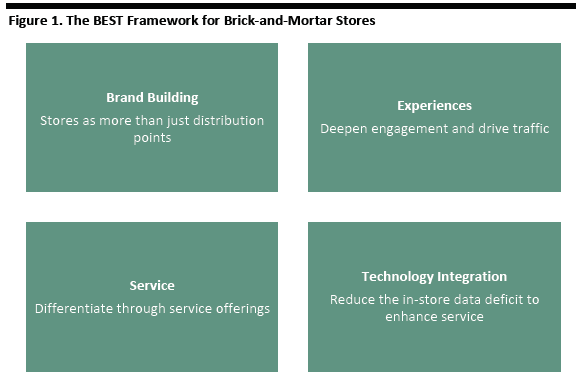

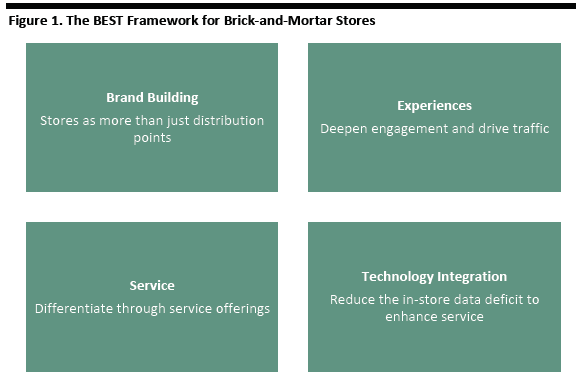

We expect a new wave of investment in physical stores to be core to the reinvention of retail. Already, we are seeing major multibrand retailers such as Walmart and Target freshening portfolios with refurbished environments and new in-store technology. We also expect monobrand retailers will launch a new generation of flagship stores that offer “spectacular retail.”

Urban consumers will enjoy access to these “temples to brands” — experience-rich stores offering a huge choice of product and add-ons such as customization and personalization. The emergence of spectacular retail reflects single-brand retailers’ recognition that stores are as much about building the brand as about generating sales.

What we’ve seen:

1. Cities Will See More Spectacular Retail

We expect a new wave of investment in physical stores to be core to the reinvention of retail. Already, we are seeing major multibrand retailers such as Walmart and Target freshening portfolios with refurbished environments and new in-store technology. We also expect monobrand retailers will launch a new generation of flagship stores that offer “spectacular retail.”

Urban consumers will enjoy access to these “temples to brands” — experience-rich stores offering a huge choice of product and add-ons such as customization and personalization. The emergence of spectacular retail reflects single-brand retailers’ recognition that stores are as much about building the brand as about generating sales.

What we’ve seen:

Source: Coresight Research[/caption]

2. “Fast Retail” Will Have Shorter Leases, More Shared Spaces and More Short-Term Stores

Brick-and-mortar retail will become more flexible and faster-changing than it has traditionally been as retailers and shopping-center owners recognize the need to be more fleet of foot. The physical retail landscape will change at an accelerated pace as shoppers demand newness, brands — including digital-first brands — seek short-term physical touchpoints, and legacy retailers look for greater flexibility.

This “fast retail” trend will manifest as shorter lease terms as retailers seek to avoid being locked amid a quickening pace of change. We’ll see more pop-up stores — including from digital brands. We’ll also see greater collaboration between retailers, notably in sharing spaces to create traffic-driving synergies, as well as large-store retailers seeking cotenants to repurpose excess space.

The result will be a more appealing proposition for consumers and an enhanced ability to adapt to changing consumer behavior. Just as fast fashion keeps shoppers coming back to see what’s new, fast retail will support traffic and shopper excitement for physical retail.

What we’ve seen so far:

Source: Coresight Research[/caption]

2. “Fast Retail” Will Have Shorter Leases, More Shared Spaces and More Short-Term Stores

Brick-and-mortar retail will become more flexible and faster-changing than it has traditionally been as retailers and shopping-center owners recognize the need to be more fleet of foot. The physical retail landscape will change at an accelerated pace as shoppers demand newness, brands — including digital-first brands — seek short-term physical touchpoints, and legacy retailers look for greater flexibility.

This “fast retail” trend will manifest as shorter lease terms as retailers seek to avoid being locked amid a quickening pace of change. We’ll see more pop-up stores — including from digital brands. We’ll also see greater collaboration between retailers, notably in sharing spaces to create traffic-driving synergies, as well as large-store retailers seeking cotenants to repurpose excess space.

The result will be a more appealing proposition for consumers and an enhanced ability to adapt to changing consumer behavior. Just as fast fashion keeps shoppers coming back to see what’s new, fast retail will support traffic and shopper excitement for physical retail.

What we’ve seen so far:

FOMO space by Brookfield Properties Retail Group

FOMO space by Brookfield Properties Retail Group

Source: Brookfield Properties Retail Group[/caption] 3. Western Retailers Will Borrow from “New Retail” with Data-Driven Online-to-Offline Ventures The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures. These will resemble “New Retail,” Alibaba Group’s model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. In 2019, we expect to see Western digital retailers adapt this model with variations of online-to-offline migration and cross-channel integration — what we term an “Alibaba-fication” of online retailing. Already, Amazon is moving toward more physical stores and experiences, both permanent or temporary. In 2019, we expect online retailers to offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We also expect further moves into permanent retail formats, with online data driving decisions about format, product range and location. This is not only about Amazon: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations. What we’ve seen so far: Amazon 4-star Store Soho

Amazon 4-star Store Soho

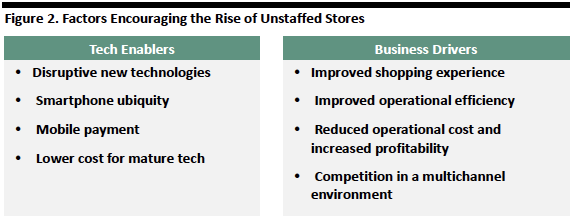

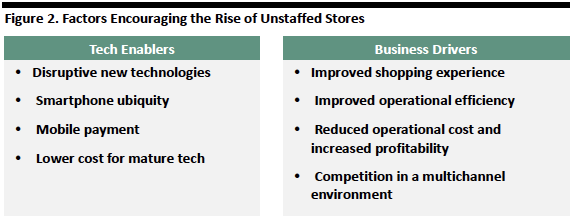

Source: Amazon[/caption] 4. Technology Will Strip Friction from Brick-and-Mortar Retail Aiming for frictionless in-store transactions, retailers will turn to technologies that remove the traditional pain points of brick-and-mortar retail. At the vanguard of this shift will be the burgeoning segment of automated, checkout-free convenience stores. AmazonGo is the flagbearer for this trend in the US, and its ventures so far may just be a hint of what is to come: In late 2018, the Wall Street Journal reported that Amazon is testing its checkout-free technology in larger stores — which could point to an eventual roll-out to Amazon’s Whole Foods chain. Reuters reported that Amazon was looking at bringing its AmazonGo checkout-free stores to airports. A number of players have already emerged in Asia, including Auchan Minute and BingoBox. In China, checkout-free stores dovetail with the ubiquity of apps such as WeChat, which enable both shopper identification and payment. The time-pressured nature of convenience stores makes them natural choices for unstaffed formats, but in 2019 we expect just-walk-out stores to extend more fully into nongrocery sectors in which speed and convenience are important to shoppers. What we’ve seen so far: Source: Coresight Research[/caption]

5. AI Will Become Retailers’ Go-To Technology

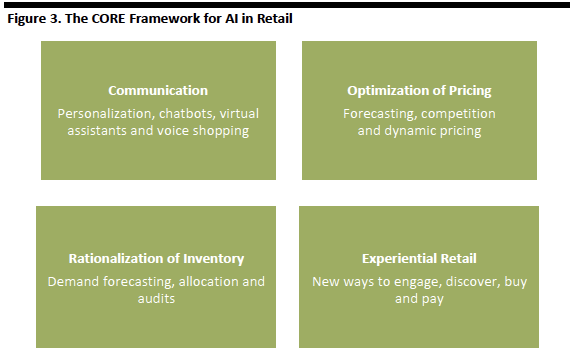

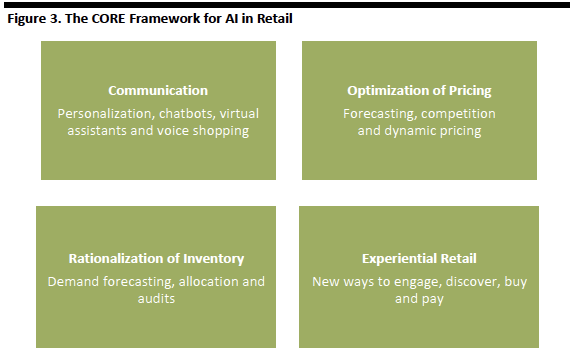

AI will cement its position as the preeminent new technology and the leading technological enabler in the industry. More retailers will turn to AI — and vendors of services based on AI — to make better decisions on inventory and pricing, communicate more efficiently and more effectively with their customers, and personalize offerings. This is not simply about improving customer interactions and data management: AI offers real opportunities to increase operational efficiency through inventory management and price optimization.

In our proprietary CORE framework, we identify four major areas of opportunity for retailers to use AI: Communication (which includes personalization), Optimization of pricing, Rationalization of inventory and Experiential retail.

[caption id="attachment_60191" align="aligncenter" width="574"]

Source: Coresight Research[/caption]

5. AI Will Become Retailers’ Go-To Technology

AI will cement its position as the preeminent new technology and the leading technological enabler in the industry. More retailers will turn to AI — and vendors of services based on AI — to make better decisions on inventory and pricing, communicate more efficiently and more effectively with their customers, and personalize offerings. This is not simply about improving customer interactions and data management: AI offers real opportunities to increase operational efficiency through inventory management and price optimization.

In our proprietary CORE framework, we identify four major areas of opportunity for retailers to use AI: Communication (which includes personalization), Optimization of pricing, Rationalization of inventory and Experiential retail.

[caption id="attachment_60191" align="aligncenter" width="574"] Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

8. Consumers Will Look for Environmentally and Socially Engaged Brands and Retailers

Consumers will shop more consciously, looking for ethical, sustainable and values-driven brands and retailers. The recent past has seen a whirl of conscious consumption trends, from the rise of veganism to outsized growth in organic food sales to fightbacks against single-use plastics. This trend will not go away, and in fact will expand into more retail sectors in 2019.

Demand for more sustainable models will push shoppers toward alternative models of acquisition. Recommerce (resale) platforms such as ThredUP and The RealReal and rental services such as Rent the Runway will benefit from the trend of consumers wanting to reduce the environmental impact of their shopping. Brands will increasingly recognize recommerce and rental as acquisition channels, serving as entry points for first-time luxury shoppers.

This trend encompasses more than just environmental impact. Political and social values will influence consumer behaviors, too. A growing proportion of consumers — many of them younger consumers — will turn away from brands whose values do not align with their own and toward firms whose values do align with their own.

The gradual but sustained shift toward more conscious shopping, whether driven by environmental or social concerns, are likely to fuel further collaboration as retailers and brands look for fresh thinking and endorsements from influential figures, and, in turn, the cachet of being seen to respond to shoppers’ concerns.

What we’ve seen so far:

Source: Coresight Research[/caption]

8. Consumers Will Look for Environmentally and Socially Engaged Brands and Retailers

Consumers will shop more consciously, looking for ethical, sustainable and values-driven brands and retailers. The recent past has seen a whirl of conscious consumption trends, from the rise of veganism to outsized growth in organic food sales to fightbacks against single-use plastics. This trend will not go away, and in fact will expand into more retail sectors in 2019.

Demand for more sustainable models will push shoppers toward alternative models of acquisition. Recommerce (resale) platforms such as ThredUP and The RealReal and rental services such as Rent the Runway will benefit from the trend of consumers wanting to reduce the environmental impact of their shopping. Brands will increasingly recognize recommerce and rental as acquisition channels, serving as entry points for first-time luxury shoppers.

This trend encompasses more than just environmental impact. Political and social values will influence consumer behaviors, too. A growing proportion of consumers — many of them younger consumers — will turn away from brands whose values do not align with their own and toward firms whose values do align with their own.

The gradual but sustained shift toward more conscious shopping, whether driven by environmental or social concerns, are likely to fuel further collaboration as retailers and brands look for fresh thinking and endorsements from influential figures, and, in turn, the cachet of being seen to respond to shoppers’ concerns.

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

10. Shoppers Will Seek More Inclusive Offerings

Inclusivity and equality of access will trump exclusivity and aspiration in 2019. This will be most evident in the apparel industry.

Increasingly, brands and retailers will look to traditionally marginalized fashion customers, most notably plus-size shoppers and those with disabilities looking for adaptive fashion. Midmarket retailers such as department stores — searching for every pocket of opportunity — will broaden offerings with niche sizing and adaptive ranges. Aspirational brands will seek to showcase their inclusive credentials through engagement with nontraditional, “body-positive” influencers and celebrities.

At the high end, we will continue to see a democratizing trend, with demand for streetwear, sneakers and casual styles eroding the traditional hierarchies of luxury. Meanwhile, younger, values-led shoppers will seek out brands that inspire and stand for something more than exclusivity and craftsmanship. Established luxury brands will have to collaborate with atypical influencers, artists and cultural leaders to tap these demands.

What we’ve seen so far:

10. Shoppers Will Seek More Inclusive Offerings

Inclusivity and equality of access will trump exclusivity and aspiration in 2019. This will be most evident in the apparel industry.

Increasingly, brands and retailers will look to traditionally marginalized fashion customers, most notably plus-size shoppers and those with disabilities looking for adaptive fashion. Midmarket retailers such as department stores — searching for every pocket of opportunity — will broaden offerings with niche sizing and adaptive ranges. Aspirational brands will seek to showcase their inclusive credentials through engagement with nontraditional, “body-positive” influencers and celebrities.

At the high end, we will continue to see a democratizing trend, with demand for streetwear, sneakers and casual styles eroding the traditional hierarchies of luxury. Meanwhile, younger, values-led shoppers will seek out brands that inspire and stand for something more than exclusivity and craftsmanship. Established luxury brands will have to collaborate with atypical influencers, artists and cultural leaders to tap these demands.

What we’ve seen so far:

1. Cities Will See More Spectacular Retail

We expect a new wave of investment in physical stores to be core to the reinvention of retail. Already, we are seeing major multibrand retailers such as Walmart and Target freshening portfolios with refurbished environments and new in-store technology. We also expect monobrand retailers will launch a new generation of flagship stores that offer “spectacular retail.”

Urban consumers will enjoy access to these “temples to brands” — experience-rich stores offering a huge choice of product and add-ons such as customization and personalization. The emergence of spectacular retail reflects single-brand retailers’ recognition that stores are as much about building the brand as about generating sales.

What we’ve seen:

1. Cities Will See More Spectacular Retail

We expect a new wave of investment in physical stores to be core to the reinvention of retail. Already, we are seeing major multibrand retailers such as Walmart and Target freshening portfolios with refurbished environments and new in-store technology. We also expect monobrand retailers will launch a new generation of flagship stores that offer “spectacular retail.”

Urban consumers will enjoy access to these “temples to brands” — experience-rich stores offering a huge choice of product and add-ons such as customization and personalization. The emergence of spectacular retail reflects single-brand retailers’ recognition that stores are as much about building the brand as about generating sales.

What we’ve seen:

- RH (formerly Restoration Hardware) recently opened a new flagship store in New York City. RH CEO Gary Friedman said he expects the flagship store to turn over $100 million once sales densities reach maturity.

- Nike’s New York City flagship, opened in November 2018, aims to provide an immersive experience on six floors. The store includes a Speed Shop that uses data to localize ranges, offers two customization studios and incorporates mobile integration across reserving, trying on and paying for products.

- Tiffany will spend $250 million to renovate its flagship store on New York’s Fifth Avenue. Such is the scale of the renovation that it is expected to be completed only in late 2021.

Source: Coresight Research[/caption]

2. “Fast Retail” Will Have Shorter Leases, More Shared Spaces and More Short-Term Stores

Brick-and-mortar retail will become more flexible and faster-changing than it has traditionally been as retailers and shopping-center owners recognize the need to be more fleet of foot. The physical retail landscape will change at an accelerated pace as shoppers demand newness, brands — including digital-first brands — seek short-term physical touchpoints, and legacy retailers look for greater flexibility.

This “fast retail” trend will manifest as shorter lease terms as retailers seek to avoid being locked amid a quickening pace of change. We’ll see more pop-up stores — including from digital brands. We’ll also see greater collaboration between retailers, notably in sharing spaces to create traffic-driving synergies, as well as large-store retailers seeking cotenants to repurpose excess space.

The result will be a more appealing proposition for consumers and an enhanced ability to adapt to changing consumer behavior. Just as fast fashion keeps shoppers coming back to see what’s new, fast retail will support traffic and shopper excitement for physical retail.

What we’ve seen so far:

Source: Coresight Research[/caption]

2. “Fast Retail” Will Have Shorter Leases, More Shared Spaces and More Short-Term Stores

Brick-and-mortar retail will become more flexible and faster-changing than it has traditionally been as retailers and shopping-center owners recognize the need to be more fleet of foot. The physical retail landscape will change at an accelerated pace as shoppers demand newness, brands — including digital-first brands — seek short-term physical touchpoints, and legacy retailers look for greater flexibility.

This “fast retail” trend will manifest as shorter lease terms as retailers seek to avoid being locked amid a quickening pace of change. We’ll see more pop-up stores — including from digital brands. We’ll also see greater collaboration between retailers, notably in sharing spaces to create traffic-driving synergies, as well as large-store retailers seeking cotenants to repurpose excess space.

The result will be a more appealing proposition for consumers and an enhanced ability to adapt to changing consumer behavior. Just as fast fashion keeps shoppers coming back to see what’s new, fast retail will support traffic and shopper excitement for physical retail.

What we’ve seen so far:

- In the UK, the average retail lease length was 20 years in 1992. Today, it is less than five years, according to Appear Here, a marketplace to lease short-term retail space. In the US, retailers are pushing for leases as short as one to two years, down from a previous average of five to 10 years, according to Bloomberg.

- A number of US property owners are carving out space for changing offerings. Simon Property launched The Edit @ Roosevelt Field, a permanent space within which brands and retailers can showcase products. Washington Prime Group launched its Tangible format, which provides space for digital brands and retailers to bring products into its centers. Brookfield Properties Retail Group (formerly GGP) brought the pop-up concept to food service, with its FOMO (“fear of missing out”) space, which features a changing roster of restaurants.

- In the UK, apparel retailer Next has collaborated with complementary retailers, including stationery chain Paperchase and variety store Hema, to open “sub-stores” in its new Oxford Street, London, location. Next is introducing complementary retail partners into other stores, too.

FOMO space by Brookfield Properties Retail Group

FOMO space by Brookfield Properties Retail GroupSource: Brookfield Properties Retail Group[/caption] 3. Western Retailers Will Borrow from “New Retail” with Data-Driven Online-to-Offline Ventures The flow of retail concepts from East to West looks set to accelerate, with more e-commerce players in the US and Europe adopting data-driven online-to-offline ventures. These will resemble “New Retail,” Alibaba Group’s model for integrating online retail, offline retail and logistics across a single value chain powered by data and technology. In 2019, we expect to see Western digital retailers adapt this model with variations of online-to-offline migration and cross-channel integration — what we term an “Alibaba-fication” of online retailing. Already, Amazon is moving toward more physical stores and experiences, both permanent or temporary. In 2019, we expect online retailers to offer more physical experiences around major calendar events such as Black Friday and (in the case of Amazon) Prime Day. We also expect further moves into permanent retail formats, with online data driving decisions about format, product range and location. This is not only about Amazon: We think the biggest names in online platforms, such as eBay, Zalando and Cdiscount, could well move into more physical locations. What we’ve seen so far:

- In later 2018, Amazon opened more pop-up stores in the US and Europe. And, in the US, it opened more checkout-free AmazonGo convenience stores and a new banner called 4-star, which sells nongrocery products rated four or more stars by online customers.

- In the summer of 2018, Amazon brought in a new element of “real-world” experiences for its annual Prime Day.

- In October 2018, Groupe Casino’s online banner Cdiscount opened a product showroom in the group’s new “Le 4 Casino” concept store in Paris.

- In July 2018, Zalando opened a new beauty store in Berlin.

Amazon 4-star Store Soho

Amazon 4-star Store SohoSource: Amazon[/caption] 4. Technology Will Strip Friction from Brick-and-Mortar Retail Aiming for frictionless in-store transactions, retailers will turn to technologies that remove the traditional pain points of brick-and-mortar retail. At the vanguard of this shift will be the burgeoning segment of automated, checkout-free convenience stores. AmazonGo is the flagbearer for this trend in the US, and its ventures so far may just be a hint of what is to come: In late 2018, the Wall Street Journal reported that Amazon is testing its checkout-free technology in larger stores — which could point to an eventual roll-out to Amazon’s Whole Foods chain. Reuters reported that Amazon was looking at bringing its AmazonGo checkout-free stores to airports. A number of players have already emerged in Asia, including Auchan Minute and BingoBox. In China, checkout-free stores dovetail with the ubiquity of apps such as WeChat, which enable both shopper identification and payment. The time-pressured nature of convenience stores makes them natural choices for unstaffed formats, but in 2019 we expect just-walk-out stores to extend more fully into nongrocery sectors in which speed and convenience are important to shoppers. What we’ve seen so far:

- Amazon may be planning to open as many as 3,000 new AmazonGo stores across the US by 2021, according to an unconfirmed Bloomberg report.

- Bingobox expanded its store network in 2018, from 200 units to more than 500 outlets across Mainland China, Taiwan, South Korea and Malaysia.

- In late 2018, Reuters reported that Amazon was testing AmazonGo’s “just walk out” technology for larger store formats.

Source: Coresight Research[/caption]

5. AI Will Become Retailers’ Go-To Technology

AI will cement its position as the preeminent new technology and the leading technological enabler in the industry. More retailers will turn to AI — and vendors of services based on AI — to make better decisions on inventory and pricing, communicate more efficiently and more effectively with their customers, and personalize offerings. This is not simply about improving customer interactions and data management: AI offers real opportunities to increase operational efficiency through inventory management and price optimization.

In our proprietary CORE framework, we identify four major areas of opportunity for retailers to use AI: Communication (which includes personalization), Optimization of pricing, Rationalization of inventory and Experiential retail.

[caption id="attachment_60191" align="aligncenter" width="574"]

Source: Coresight Research[/caption]

5. AI Will Become Retailers’ Go-To Technology

AI will cement its position as the preeminent new technology and the leading technological enabler in the industry. More retailers will turn to AI — and vendors of services based on AI — to make better decisions on inventory and pricing, communicate more efficiently and more effectively with their customers, and personalize offerings. This is not simply about improving customer interactions and data management: AI offers real opportunities to increase operational efficiency through inventory management and price optimization.

In our proprietary CORE framework, we identify four major areas of opportunity for retailers to use AI: Communication (which includes personalization), Optimization of pricing, Rationalization of inventory and Experiential retail.

[caption id="attachment_60191" align="aligncenter" width="574"] Source: Coresight Research[/caption]

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

- Amazon uses AI to make better operational decisions, to create a seamless user experience on its website and app, to communicate with customers through its Alexa personal assistant, in its robotics warehouses and in its unstaffed AmazonGo stores.

- Alibaba deploys AI in its smart speaker assistant Tmall Genie, in its FashionAI digital consultant to give shoppers fashion and dressing tips, in its software E-Commerce Brain which personalizes recommendations, deals and offerings on the company’s online marketplaces and in supply chain and logistics with ASSC and Cainiao.

- Walmart uses AI and machine-learning algorithms to organize inventory data, to price merchandise, optimize routes for delivery and solve other operational problems. The retailer is working on a facial recognition algorithm to recognize customers’ facial expressions to assess their levels of satisfaction.

Source: Coresight Research[/caption]

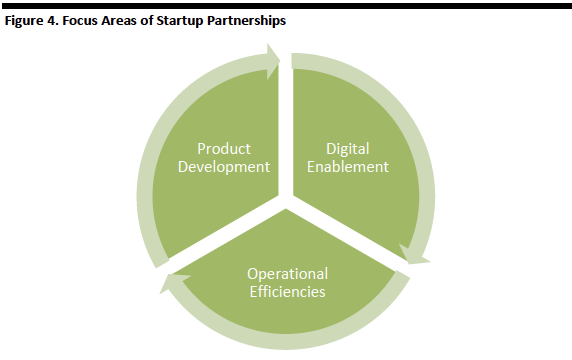

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

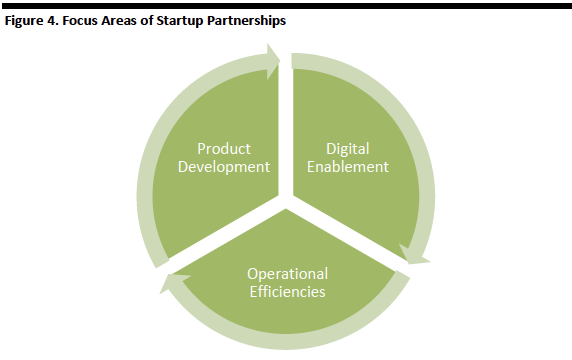

- JD.com announced the launch of a global accelerator program to support startups focusing on AI.

- Farfetch announced the launch of Dream Assembly, a fashion and retail-tech focussed incubator.

- LVMH announced the launch of La Maison des Startups accelerator program at Station F startup campus in Paris.

- Beiersdorf AG launched a beauty accelerator program based in Seoul.

- Ulta Beauty announced a strategic partnership with Iterate, a technology solutions company and an innovation workflow platform that provides access to startups.

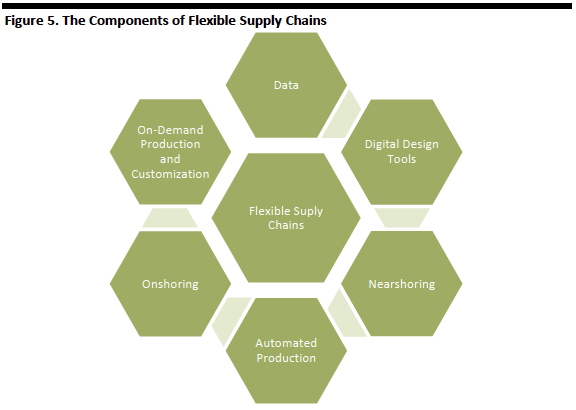

- Adidas is piloting the automation of its product sourcing cycle with SpeedFactory facilities to produce tailored, limited-edition, high-end sneakers. Currently, the company operates two SpeedFactory sites, one in Germany and one in the US.

- H&M is overhauling its supply chain to make it more customer driven. This will include greater speed to market through 3D sampling, closer collaboration with suppliers and prebooking components. It is also deploying advanced analytics in product development and allocation.

- Levi’s is testing laser technology to automate the finishing phase in jeans production, to achieve faster speed to market and greater flexibility to respond to changing consumer demand. The technology will be adopted at full scale in 2020 at the firm’s distribution center in Las Vegas.

Source: Coresight Research[/caption]

8. Consumers Will Look for Environmentally and Socially Engaged Brands and Retailers

Consumers will shop more consciously, looking for ethical, sustainable and values-driven brands and retailers. The recent past has seen a whirl of conscious consumption trends, from the rise of veganism to outsized growth in organic food sales to fightbacks against single-use plastics. This trend will not go away, and in fact will expand into more retail sectors in 2019.

Demand for more sustainable models will push shoppers toward alternative models of acquisition. Recommerce (resale) platforms such as ThredUP and The RealReal and rental services such as Rent the Runway will benefit from the trend of consumers wanting to reduce the environmental impact of their shopping. Brands will increasingly recognize recommerce and rental as acquisition channels, serving as entry points for first-time luxury shoppers.

This trend encompasses more than just environmental impact. Political and social values will influence consumer behaviors, too. A growing proportion of consumers — many of them younger consumers — will turn away from brands whose values do not align with their own and toward firms whose values do align with their own.

The gradual but sustained shift toward more conscious shopping, whether driven by environmental or social concerns, are likely to fuel further collaboration as retailers and brands look for fresh thinking and endorsements from influential figures, and, in turn, the cachet of being seen to respond to shoppers’ concerns.

What we’ve seen so far:

Source: Coresight Research[/caption]

8. Consumers Will Look for Environmentally and Socially Engaged Brands and Retailers

Consumers will shop more consciously, looking for ethical, sustainable and values-driven brands and retailers. The recent past has seen a whirl of conscious consumption trends, from the rise of veganism to outsized growth in organic food sales to fightbacks against single-use plastics. This trend will not go away, and in fact will expand into more retail sectors in 2019.

Demand for more sustainable models will push shoppers toward alternative models of acquisition. Recommerce (resale) platforms such as ThredUP and The RealReal and rental services such as Rent the Runway will benefit from the trend of consumers wanting to reduce the environmental impact of their shopping. Brands will increasingly recognize recommerce and rental as acquisition channels, serving as entry points for first-time luxury shoppers.

This trend encompasses more than just environmental impact. Political and social values will influence consumer behaviors, too. A growing proportion of consumers — many of them younger consumers — will turn away from brands whose values do not align with their own and toward firms whose values do align with their own.

The gradual but sustained shift toward more conscious shopping, whether driven by environmental or social concerns, are likely to fuel further collaboration as retailers and brands look for fresh thinking and endorsements from influential figures, and, in turn, the cachet of being seen to respond to shoppers’ concerns.

What we’ve seen so far:

- H&M’s newly opened experimental store in London includes a Repair and Remake service that allows H&M Club customers to have garments mended free of charge.

- The RealReal and Stella McCartney extended their partnership through 2019. Stella McCartney shoppers who consign with The RealReal receive a $100 store credit to spend at Stella McCartney stores or online.

- Virgil Abloh, Founder of fashion brand Off-White and Creative Director of Louis Vuitton’s men’s line, was appointed Creative Adviser for Sustainable Innovation Design at mineral water company Evian as part of the brand’s intention for its packaging t be “100% circular” by 2025.

- “Buy one give one” firms such as Yoobi in stationery and Bonas in socks tap into the “giving back” trend.

- Nike’s controversial ad campaign featuring Colin Kaepernick in September 2018 yielded a surge in social media likes and followers, according to Wedbush Securities, and it was followed by a boost in the share price.

Source: Coresight Research[/caption]

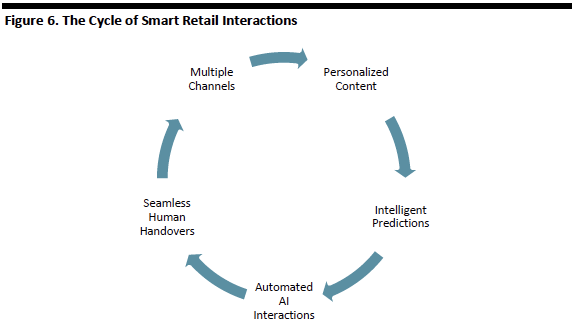

What we’ve seen so far:

Source: Coresight Research[/caption]

What we’ve seen so far:

- US beauty retailer Ulta said its main focus is personalization and connecting online and offline experiences to help consumers navigate the beauty space. Ulta also acquired QM Scientific, an AI startup with capabilities in computer vision, recommendations, natural language processing and visual search.

- Birchbox’s beauty boxes have long been based on personalization. In 2018, the company relaunched its website to offer rich content that aligns with its offline experience. In 2019, the site will offer greater personalization, more closely lining up real world and online experiences.

10. Shoppers Will Seek More Inclusive Offerings

Inclusivity and equality of access will trump exclusivity and aspiration in 2019. This will be most evident in the apparel industry.

Increasingly, brands and retailers will look to traditionally marginalized fashion customers, most notably plus-size shoppers and those with disabilities looking for adaptive fashion. Midmarket retailers such as department stores — searching for every pocket of opportunity — will broaden offerings with niche sizing and adaptive ranges. Aspirational brands will seek to showcase their inclusive credentials through engagement with nontraditional, “body-positive” influencers and celebrities.

At the high end, we will continue to see a democratizing trend, with demand for streetwear, sneakers and casual styles eroding the traditional hierarchies of luxury. Meanwhile, younger, values-led shoppers will seek out brands that inspire and stand for something more than exclusivity and craftsmanship. Established luxury brands will have to collaborate with atypical influencers, artists and cultural leaders to tap these demands.

What we’ve seen so far:

10. Shoppers Will Seek More Inclusive Offerings

Inclusivity and equality of access will trump exclusivity and aspiration in 2019. This will be most evident in the apparel industry.

Increasingly, brands and retailers will look to traditionally marginalized fashion customers, most notably plus-size shoppers and those with disabilities looking for adaptive fashion. Midmarket retailers such as department stores — searching for every pocket of opportunity — will broaden offerings with niche sizing and adaptive ranges. Aspirational brands will seek to showcase their inclusive credentials through engagement with nontraditional, “body-positive” influencers and celebrities.

At the high end, we will continue to see a democratizing trend, with demand for streetwear, sneakers and casual styles eroding the traditional hierarchies of luxury. Meanwhile, younger, values-led shoppers will seek out brands that inspire and stand for something more than exclusivity and craftsmanship. Established luxury brands will have to collaborate with atypical influencers, artists and cultural leaders to tap these demands.

What we’ve seen so far:

- In the UK, ASOS and Marks & Spencer launched adaptive clothing ranges for consumers with disabilities in 2018.

- In 2018, Walmart acquired plus-size apparel brand and retailer Eloquii.

- Kohl’s announced it will launch a new plus-size private label, EVRI, in spring 2019.